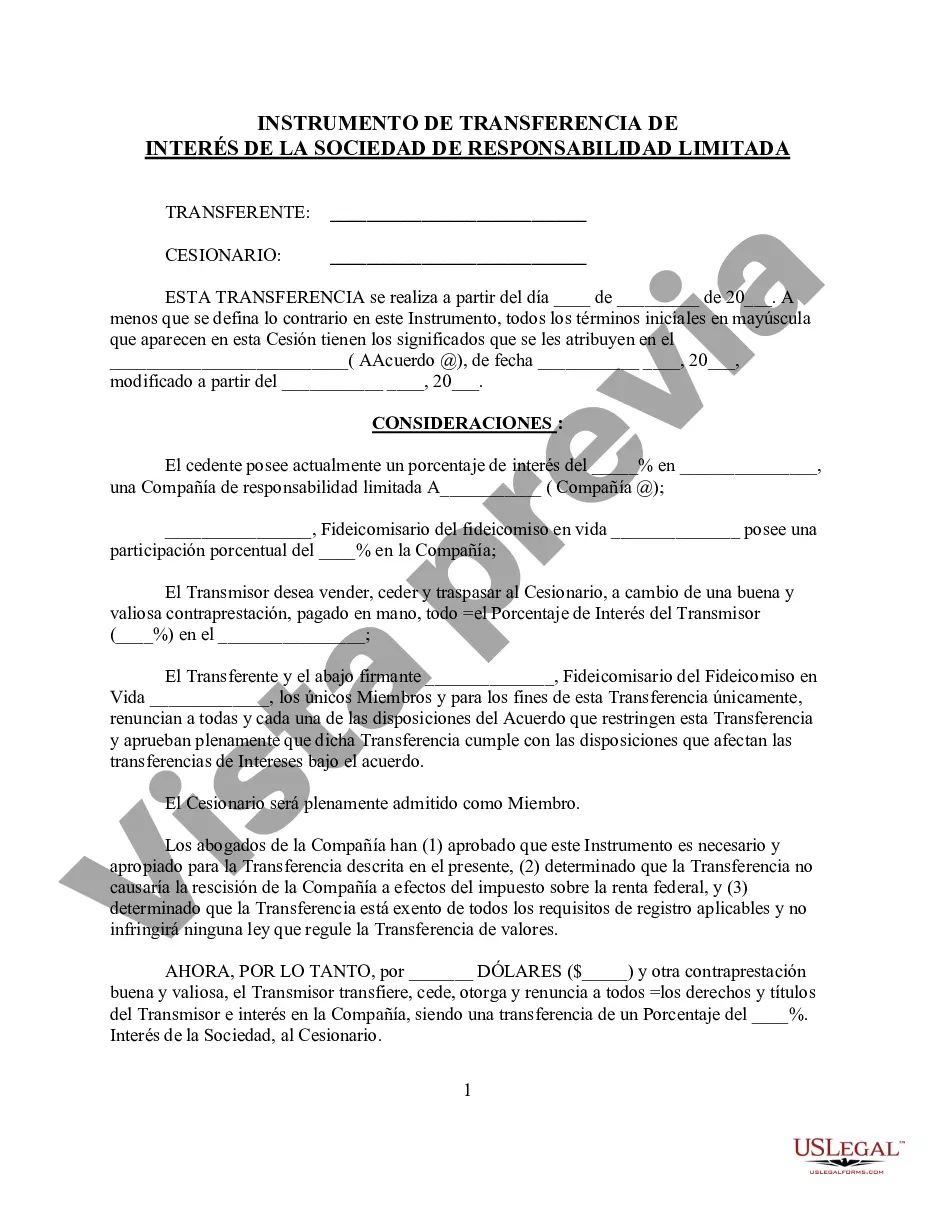

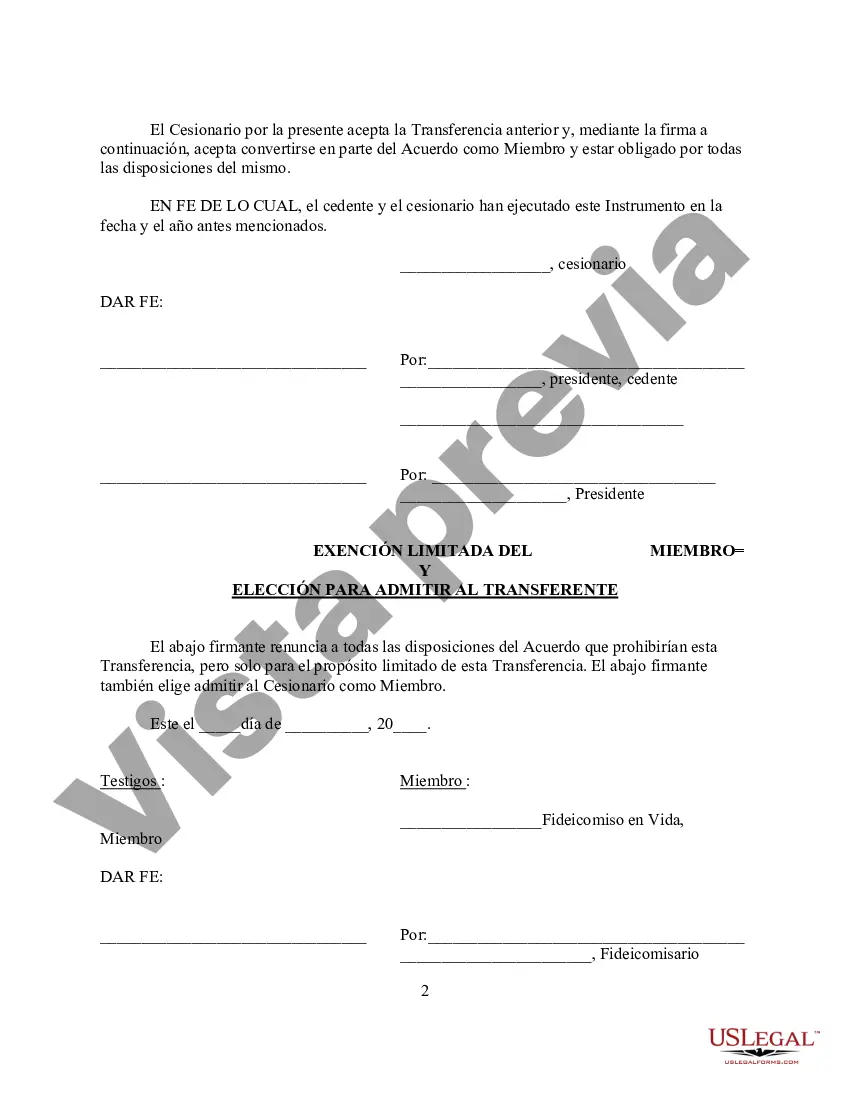

The Clark Nevada Assignment of LLC Company Interest to Living Trust is a legal document that allows an individual to transfer their ownership interest in a Limited Liability Company (LLC) to their living trust based in Clark County, Nevada. This assignment ensures the seamless transfer of the LLC's assets and liabilities into the trust, providing for an organized and efficient estate planning process. By utilizing this assignment, owners can ensure that their LLC company interests will be managed and distributed according to their wishes after their passing. This document is particularly useful for individuals who want to protect their assets, have control over their distributions, and provide for the smooth transfer of ownership without the need for probate or court intervention. The Clark Nevada Assignment of LLC Company Interest to Living Trust involves several key steps. First, the owner must identify their interest in the LLC and specify the percentage or share they want to transfer to the living trust. Additionally, the assignment should include details about the trust, such as the name of the trust, the trustee's name, and any specific provisions related to the management and distribution of the company interest. It is important to note that there are different types of Clark Nevada Assignment of LLC Company Interest to Living Trust documents available, depending on the specific requirements and objectives of the owner. These may include: 1. General Assignment: This is a standard assignment document used to transfer the LLC interest to the living trust. It outlines the essential details of the transfer and establishes the legal relationship between the LLC, the owner, and the living trust. 2. Provisions for Successor Beneficiaries: This type of assignment goes beyond the basic transfer and includes provisions for successor beneficiaries. It allows the owner to specify alternative or contingent beneficiaries who would receive the LLC interest in the event that the primary beneficiary is unable or unwilling to accept it. 3. Specific Distribution Instructions: Some owners may have specific instructions on how they want their LLC interest to be distributed among beneficiaries. In this case, a customized assignment document can be created to ensure those instructions are followed precisely. Overall, the Clark Nevada Assignment of LLC Company Interest to Living Trust provides individuals with a reliable and effective way to safeguard their LLC interests and ensure a seamless transfer of ownership to their living trust. It is a powerful estate planning tool that allows owners to maintain control over their assets even after their passing, making it an essential component of a comprehensive estate plan.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Clark Nevada Cesión del interés de la empresa LLC al fideicomiso en vida - Assignment of LLC Company Interest to Living Trust

Description

How to fill out Clark Nevada Cesión Del Interés De La Empresa LLC Al Fideicomiso En Vida?

How much time does it usually take you to draft a legal document? Because every state has its laws and regulations for every life sphere, finding a Clark Assignment of LLC Company Interest to Living Trust meeting all regional requirements can be tiring, and ordering it from a professional attorney is often costly. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, gathered by states and areas of use. Apart from the Clark Assignment of LLC Company Interest to Living Trust, here you can get any specific document to run your business or personal deeds, complying with your county requirements. Professionals verify all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can pick the file in your profile at any time later on. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Clark Assignment of LLC Company Interest to Living Trust:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Clark Assignment of LLC Company Interest to Living Trust.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!