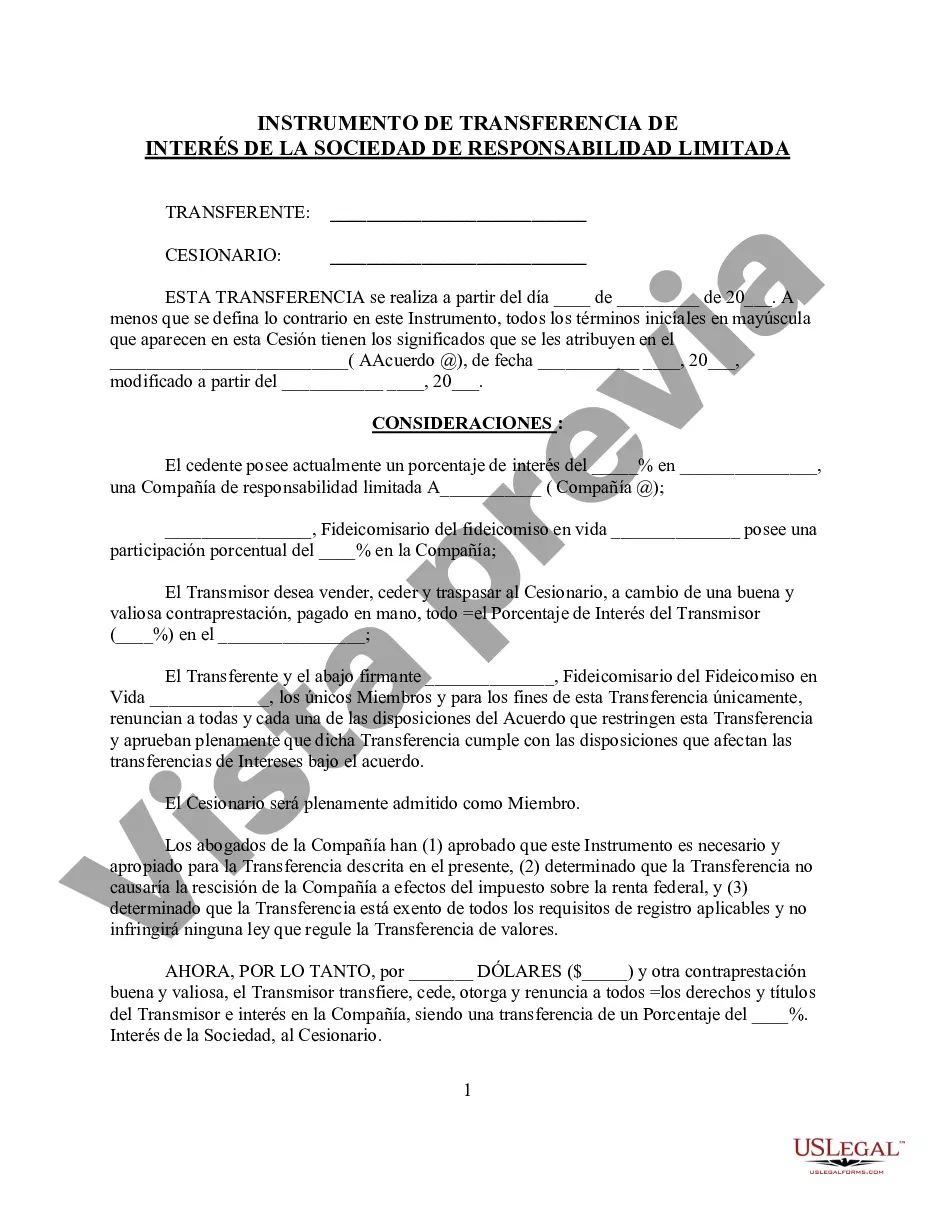

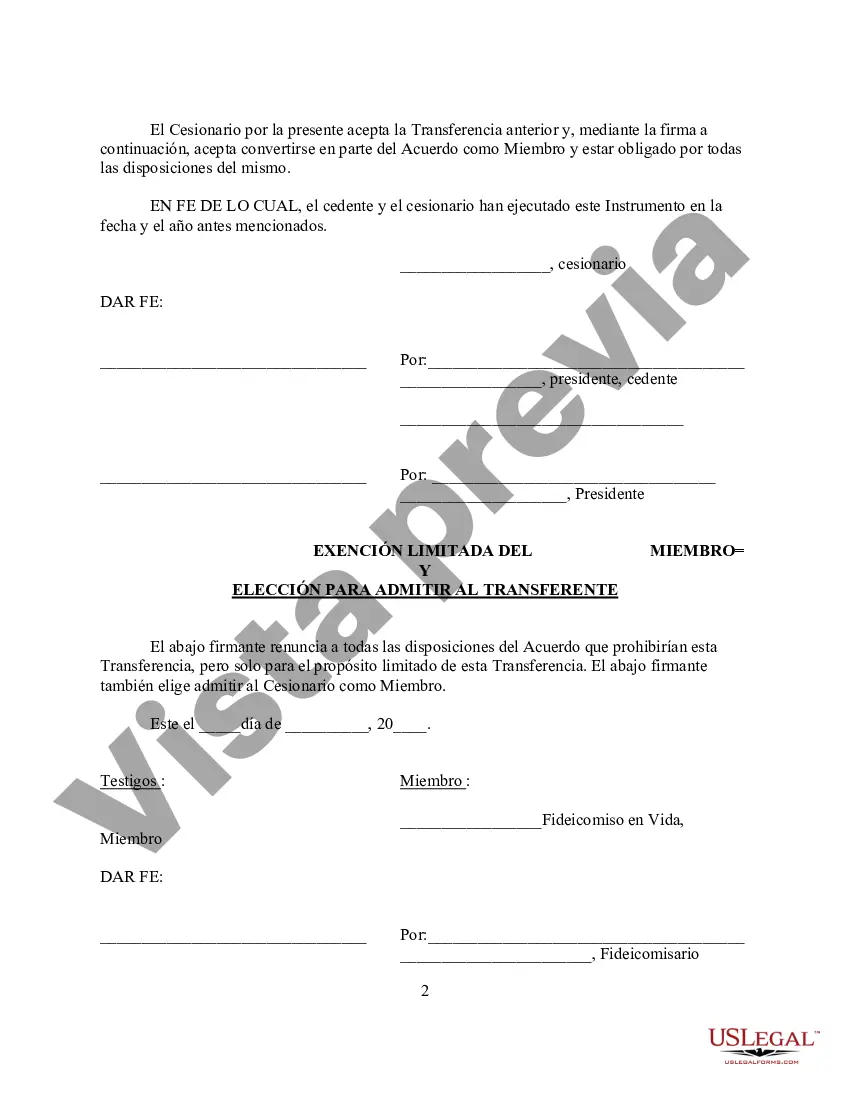

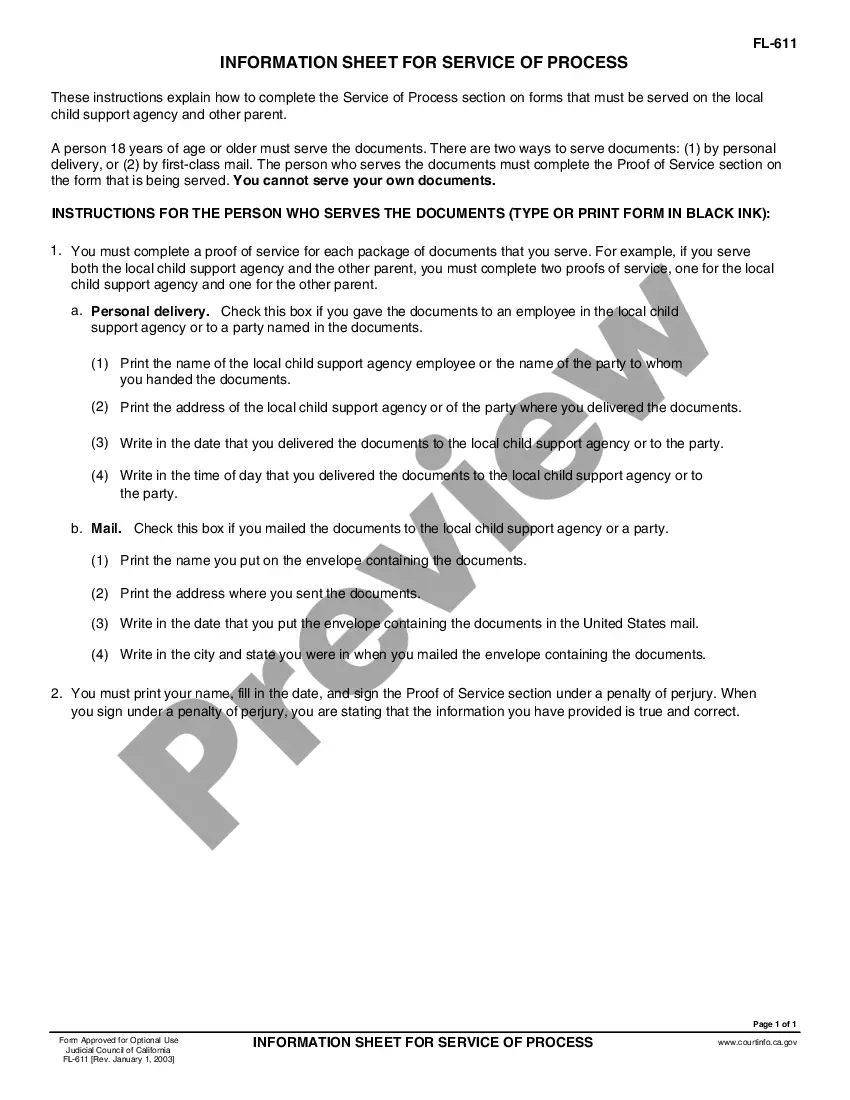

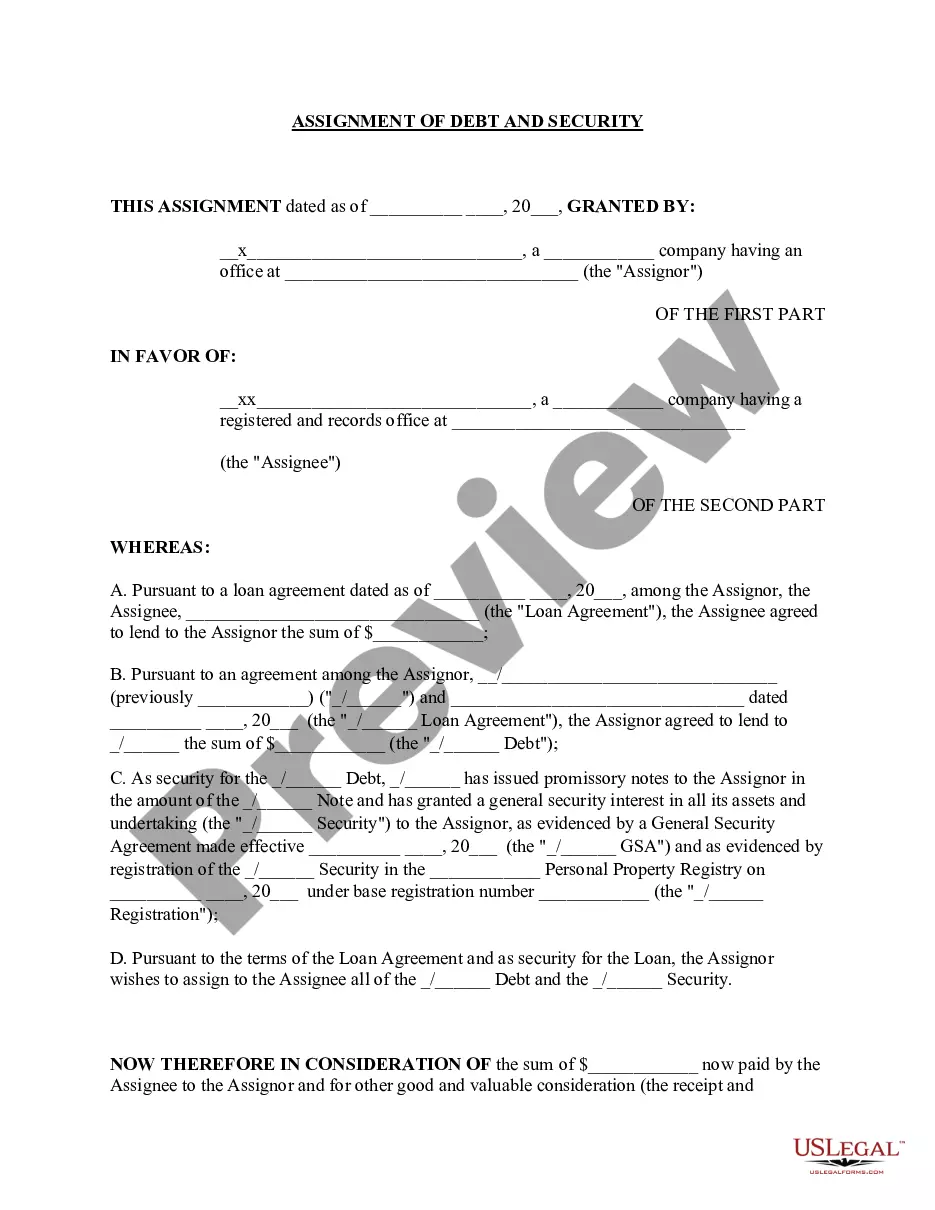

Hillsborough Florida Assignment of LLC Company Interest to Living Trust is a legal process that involves transferring the ownership or interest in a limited liability company (LLC) to a living trust. This type of arrangement is common among individuals who want to ensure smooth transition and management of their business assets in case of incapacitation or death. By transferring LLC interest to a living trust, the assets become part of the trust's estate plan, which typically includes designated beneficiaries and a trustee responsible for managing the assets. In Hillsborough County, Florida, there are several variations of the Assignment of LLC Company Interest to Living Trust, each serving different purposes and accommodating specific needs of the LLC owners. Some of these variations include: 1. Revocable Living Trust Assignment of LLC Company Interest: This type of assignment allows the LLC owner to maintain control and make changes to the living trust during their lifetime. It provides flexibility and permits the owner to revoke or modify the trust agreement if necessary. 2. Irrevocable Living Trust Assignment of LLC Company Interest: Unlike revocable trusts, irrevocable trusts cannot be altered or terminated without the consent of the beneficiaries. Assigning an LLC company interest to an irrevocable living trust offers more long-term asset protection and may have tax advantages, but it comes with less flexibility. 3. Testamentary Assignment of LLC Company Interest through Living Trust: This type of assignment takes effect upon the LLC owner's death. It involves incorporating the assignment into the individual's will, which designates how the LLC interest should be distributed among the trust beneficiaries. The Hillsborough Florida Assignment of LLC Company Interest to Living Trust process typically involves the following steps: 1. Preparation of Assignment Document: This involves drafting a legally binding document that clearly outlines the LLC ownership transfer details, such as the assignor's name, assignee's name (the trust), assessment of the company interest being transferred, and any conditions or restrictions applicable. 2. Reviewing the Operating Agreement: The LLC's operating agreement should be examined to ensure there are no clauses restricting or prohibiting transfers to living trusts. If such restrictions exist, amendments may be required. 3. Execution and Notarization: The assignor must sign the assignment document, and often witnesses are required as well. In some cases, notarization is necessary to validate the assignment's authenticity and make it legally enforceable. 4. Record Keeping: It is crucial to maintain accurate records of the assignment, including copies of all documents involved, for future reference and potential filing requirements. 5. Revise Legal Documents: After the assignment, it is necessary to update all relevant legal documents associated with the LLC, such as the operating agreement and any filings with the Florida Secretary of State's office, to reflect the new ownership structure. 6. Consultation with Professionals: It is highly recommended seeking the assistance of legal and financial professionals experienced in estate planning and business law to ensure compliance with applicable laws and maximize the benefits of the assignment. Assigning an LLC company interest to a living trust in Hillsborough, Florida, provides individuals with control over their business assets during their lifetime and an organized mechanism for transferring ownership after their passing. It is essential to understand the different types of assignments and consult professionals to ascertain which one aligns best with individual goals and circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hillsborough Florida Cesión del interés de la empresa LLC al fideicomiso en vida - Assignment of LLC Company Interest to Living Trust

Description

How to fill out Hillsborough Florida Cesión Del Interés De La Empresa LLC Al Fideicomiso En Vida?

Creating documents, like Hillsborough Assignment of LLC Company Interest to Living Trust, to take care of your legal matters is a tough and time-consumming task. Many situations require an attorney’s participation, which also makes this task not really affordable. However, you can acquire your legal matters into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal documents crafted for various scenarios and life situations. We make sure each document is compliant with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Hillsborough Assignment of LLC Company Interest to Living Trust form. Simply log in to your account, download the template, and customize it to your requirements. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is fairly straightforward! Here’s what you need to do before getting Hillsborough Assignment of LLC Company Interest to Living Trust:

- Ensure that your form is specific to your state/county since the regulations for creating legal paperwork may differ from one state another.

- Learn more about the form by previewing it or reading a quick intro. If the Hillsborough Assignment of LLC Company Interest to Living Trust isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or create an account to start utilizing our service and download the form.

- Everything looks great on your side? Click the Buy now button and choose the subscription option.

- Select the payment gateway and enter your payment information.

- Your form is good to go. You can go ahead and download it.

It’s an easy task to find and purchase the needed document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!