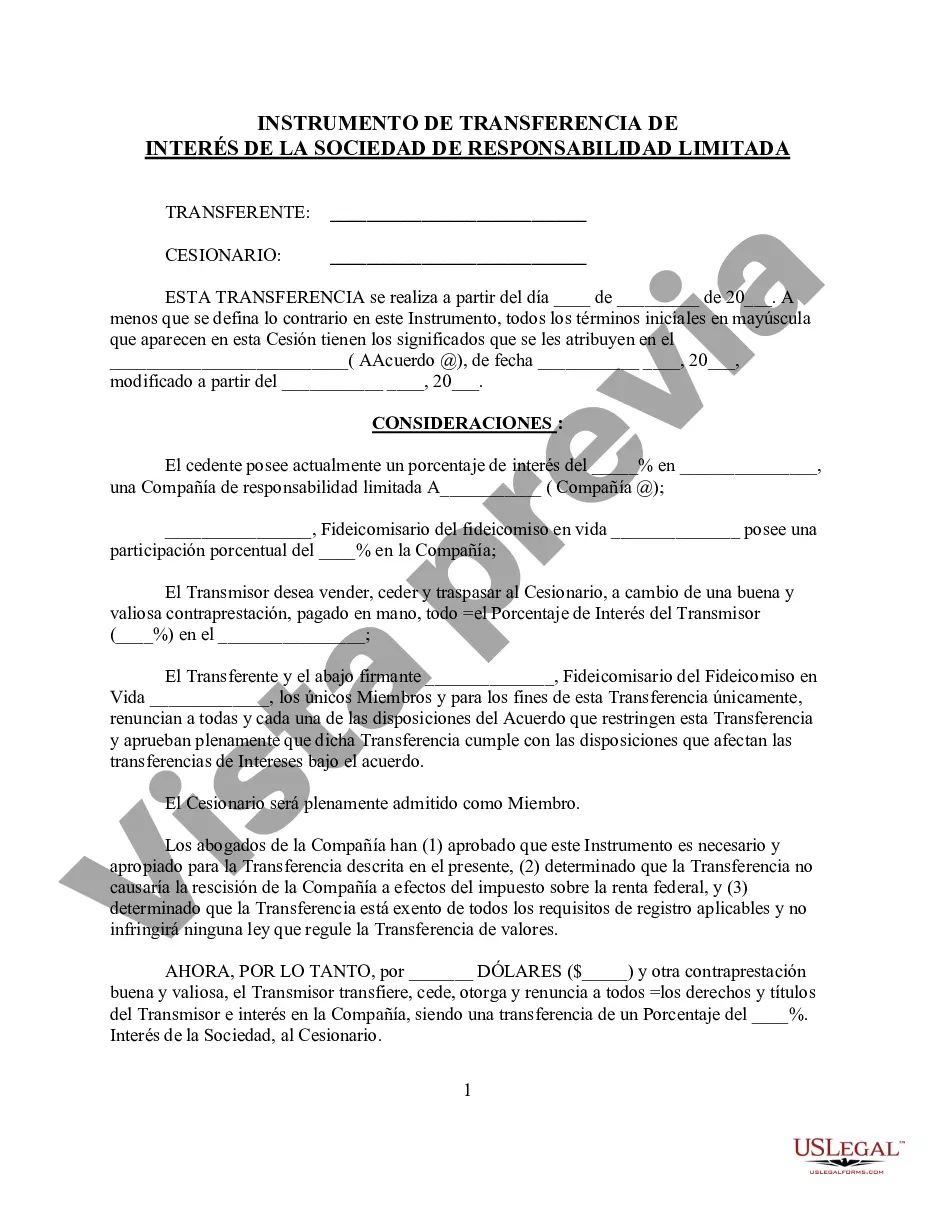

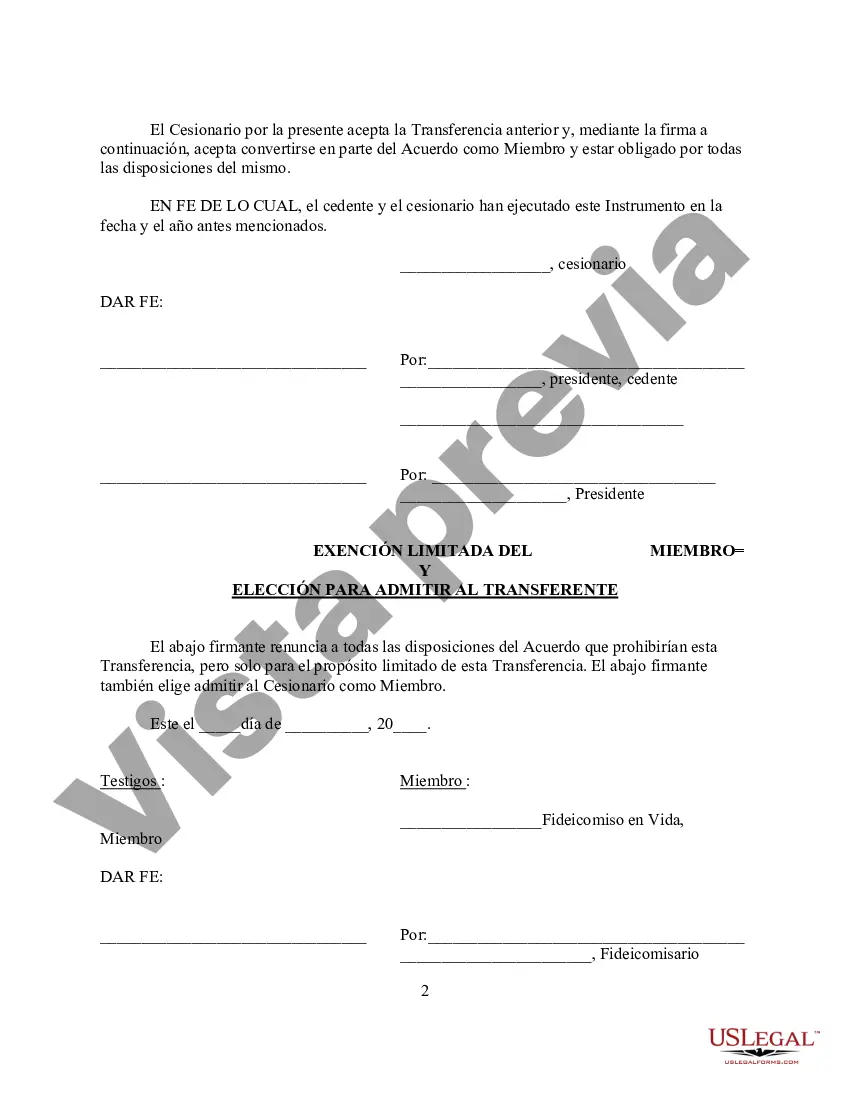

Orange, California is a vibrant city located in Orange County, known for its rich history, beautiful architecture, and bustling downtown. It is home to numerous attractions, including the world-renowned Chapman University and the popular Orange Circle, a historic district filled with charming shops, restaurants, and entertainment venues. When it comes to legal matters, Orange California offers various options to individuals and businesses looking to assign their Limited Liability Company (LLC) company interest to a Living Trust. An Assignment of LLC Company Interest to Living Trust is a legal document that transfers ownership of an LLC company interest from an individual or entity to a living trust. This process allows for seamless management and distribution of assets within the trust, providing numerous benefits like probate avoidance, asset protection, and continuity of management. In Orange California, there are different types of Assignment of LLC Company Interest to Living Trust, each catering to specific circumstances and needs. Some of these specialized assignments include: 1. Single-Member LLC Assignment to Living Trust: This type of assignment is applicable when an individual owns and operates an LLC as the sole member. By assigning the company interest to a living trust, the individual ensures that their assets will be managed and distributed according to their wishes, all while maintaining the limited liability protection provided by the LLC structure. 2. Multi-Member LLC Assignment to Living Trust: In cases where there are multiple members involved in an LLC, this assignment allows for a seamless transition of ownership and management to a living trust. It ensures that the interests of all members are protected and promotes ease of asset transfer and management. 3. LLC Operating Agreement Amendment for Living Trust Inclusion: Instead of a direct assignment, some individuals or businesses may choose to amend their LLC operating agreement to include provisions for the transfer of company interests to a living trust. This type of assignment ensures that all ownership and management rights are clearly defined within the operating agreement, providing a comprehensive legal framework for the trust's involvement in the LLC. Regardless of the type of Assignment of LLC Company Interest to Living Trust chosen, it is crucial to consult with an experienced attorney in Orange California to navigate through the legal requirements and ensure all necessary documentation is properly executed. With the assistance of legal professionals, individuals and businesses can confidently transfer their LLC company interest to a living trust, securing the future of their assets and promoting efficient estate planning.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange California Cesión del interés de la empresa LLC al fideicomiso en vida - Assignment of LLC Company Interest to Living Trust

Description

How to fill out Orange California Cesión Del Interés De La Empresa LLC Al Fideicomiso En Vida?

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Orange Assignment of LLC Company Interest to Living Trust, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you purchase a sample, it remains accessible in your profile for future use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Orange Assignment of LLC Company Interest to Living Trust from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Orange Assignment of LLC Company Interest to Living Trust:

- Analyze the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the document once you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!