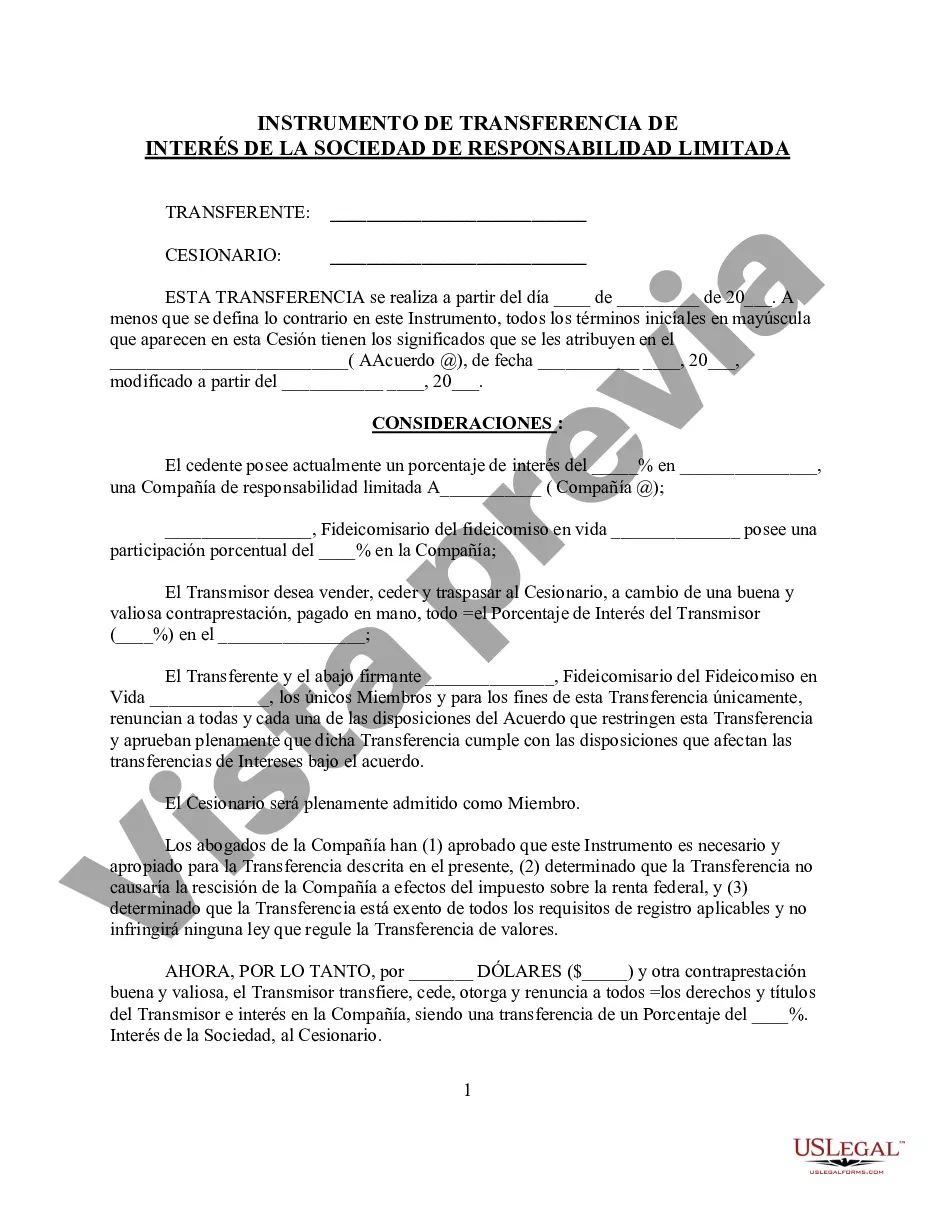

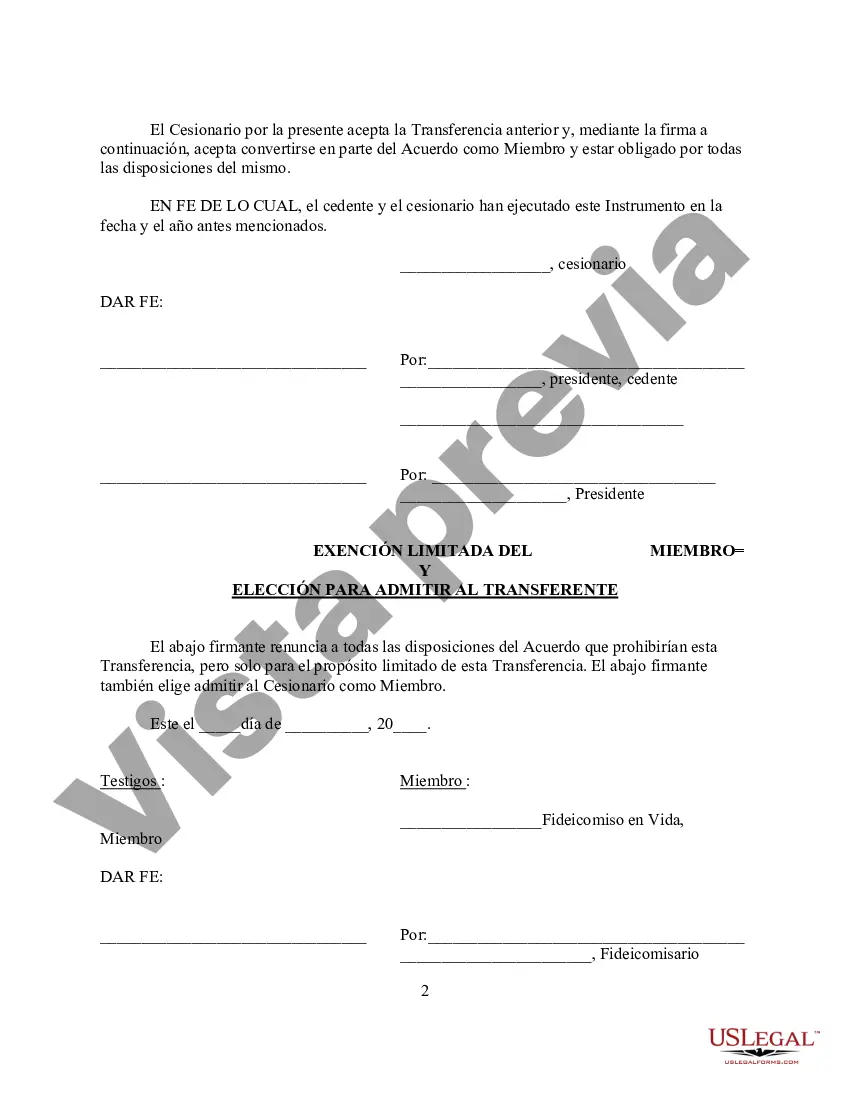

Wayne Michigan Assignment of LLC Company Interest to Living Trust: A Comprehensive Guide If you own a limited liability company (LLC) in Wayne, Michigan, and are looking to streamline your estate planning and asset management, assigning your LLC company interest to a living trust can be a suitable approach. This article aims to provide a detailed understanding of what a Wayne Michigan Assignment of LLC Company Interest to Living Trust entails, its benefits, and the different types available. What is a Wayne Michigan Assignment of LLC Company Interest to Living Trust? A Wayne Michigan Assignment of LLC Company Interest to Living Trust refers to the legal process of transferring ownership of an LLC company interest to a revocable living trust. A living trust is a widely used estate planning tool that allows an individual, known as the granter, to place assets under the management of a trust during their lifetime and dictate their distribution after their demise. By assigning your LLC interest to a living trust, you can ensure seamless transfer of ownership and avoid potential probate complications. Benefits of Assigning LLC Company Interest to Living Trust: 1. Probate Avoidance: Assigning your LLC company interest to a living trust helps bypass the probate process, saving time and potential expenses. 2. Continuity and Effective Management: Assigning the LLC company interest to a living trust ensures a smooth transition of ownership, allowing for ongoing management and operation of the business without disruption. 3. Privacy: Unlike probate proceedings, trust administration maintains confidentiality, as the trust document does not become a matter of public record. 4. Asset Protection: By placing your LLC interest in a trust, you can shield it from potential creditors and lawsuits, ensuring the preservation of valuable assets. 5. Incapacity Planning: A living trust also provides mechanisms for management and disposition of assets during periods of incapacity, avoiding the need for guardianship or conservatorships. Different Types of Wayne Michigan Assignment of LLC Company Interest to Living Trust: 1. Revocable Assignment: This type of assignment allows the granter to retain control and modify the terms of the trust during their lifetime. It offers flexibility and can be modified or revoked as circumstances change. 2. Irrevocable Assignment: With an irrevocable assignment, the granter transfers ownership of the LLC company interest permanently. This type of assignment provides enhanced asset protection but limits the granter's control over the trust and its assets. In conclusion, a Wayne Michigan Assignment of LLC Company Interest to Living Trust serves as a valuable tool for LLC owners seeking efficient estate planning and asset management. By leveraging a living trust, you can bypass probate, maintain privacy, protect assets, and ensure seamless transitions. It is essential to consult with a knowledgeable attorney specializing in estate planning to determine the most suitable type of assignment for your unique circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Cesión del interés de la empresa LLC al fideicomiso en vida - Assignment of LLC Company Interest to Living Trust

Description

How to fill out Wayne Michigan Cesión Del Interés De La Empresa LLC Al Fideicomiso En Vida?

How much time does it usually take you to draft a legal document? Given that every state has its laws and regulations for every life sphere, finding a Wayne Assignment of LLC Company Interest to Living Trust meeting all local requirements can be tiring, and ordering it from a professional attorney is often expensive. Numerous online services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, gathered by states and areas of use. Aside from the Wayne Assignment of LLC Company Interest to Living Trust, here you can find any specific form to run your business or personal affairs, complying with your county requirements. Specialists check all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can retain the document in your profile at any time in the future. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your Wayne Assignment of LLC Company Interest to Living Trust:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Wayne Assignment of LLC Company Interest to Living Trust.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!