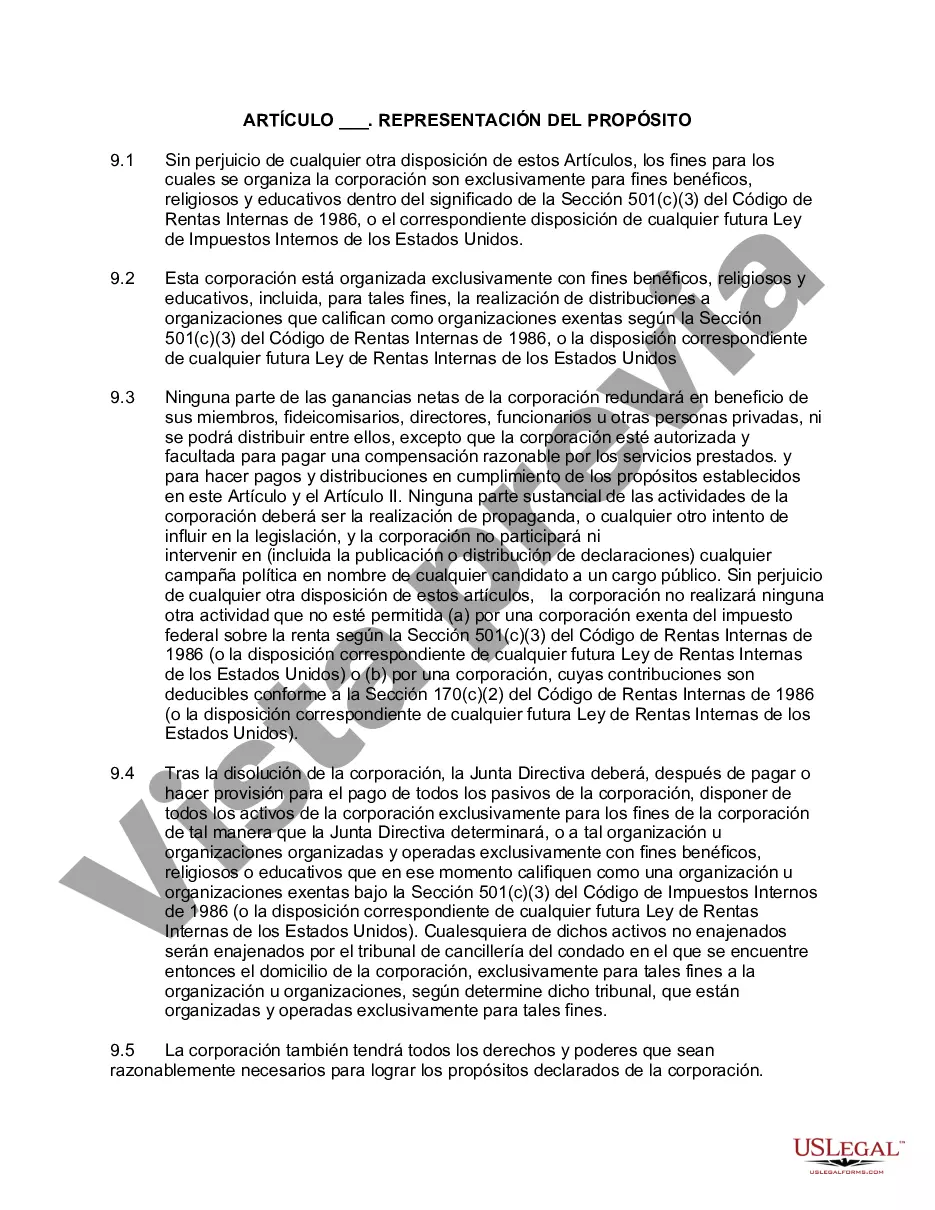

Cuyahoga Ohio Bylaw Provision for Obtaining Federal Nonprofit Status Article Restatement of Purpose is an essential document that outlines the specific regulations and requirements for nonprofit organizations in Cuyahoga County, Ohio, seeking federal recognition as tax-exempt entities. The primary purpose of this article is to elucidate the crucial provisions and procedures that organizations must fulfill to obtain and maintain their nonprofit status under federal law. The Cuyahoga Ohio Bylaw Provision addresses various key aspects related to nonprofit status, aiming to ensure transparency, compliance, and ethical conduct among organizations operating within the county. By adhering to these provisions, nonprofit entities can gain the advantages of tax-exempt status, enabling them to effectively pursue their charitable, educational, religious, or scientific missions, while also benefiting from tax benefits and potential grants. One significant requirement detailed in these bylaws is the necessity for nonprofits to establish their eligibility for federal nonprofit status. This includes meeting the criteria set forth by the Internal Revenue Service (IRS), such as having a charitable purpose, operating for public benefit rather than private gain, and maintaining compliance with pertinent federal tax laws and regulations. Moreover, the Cuyahoga Ohio Bylaw Provision emphasizes the importance of incorporating specific language within nonprofits' articles of incorporation and bylaws to demonstrate their commitment to abide by federal requirements. This language may include provisions related to the organization's charitable purposes and its commitment to comply with IRS regulations, as well as ensuring that its assets will be used solely for exempt purposes and that no part of the organization's net earnings will benefit private individuals or entities. Additionally, the Cuyahoga Ohio Bylaw Provision may encompass other administrative aspects relevant to obtaining federal nonprofit status, such as record-keeping and reporting requirements. Nonprofits are often required to maintain detailed financial records, file annual information returns (Form 990), and provide periodic updates to the IRS regarding any significant changes in their operations or structure. In conclusion, the Cuyahoga Ohio Bylaw Provision for Obtaining Federal Nonprofit Status Article Restatement of Purpose serves as a comprehensive guide for organizations in Cuyahoga County seeking federal recognition as tax-exempt entities. By complying with these provisions, nonprofits can ensure their adherence to the legal requirements necessary for their continued operation as tax-exempt organizations, ultimately enabling them to pursue their mission and make a positive impact in the community. Different types of Cuyahoga Ohio Bylaw Provision for Obtaining Federal Nonprofit Status Article Restatement of Purpose may include sections specific to various categories of nonprofit organizations, such as charitable organizations, educational institutions, religious entities, and scientific research organizations. These sections would likely delve into the unique prerequisites and obligations that each type of nonprofit must fulfill in order to meet federal regulations and maintain their tax-exempt status.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Disposición de los estatutos para obtener el estatus federal de organización sin fines de lucro Artículo Reformulación del propósito - Bylaw Provision For Obtaining Federal Nonprofit Status Article Restatement of Purpose

Description

How to fill out Cuyahoga Ohio Disposición De Los Estatutos Para Obtener El Estatus Federal De Organización Sin Fines De Lucro Artículo Reformulación Del Propósito?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare official paperwork that varies from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any individual or business objective utilized in your county, including the Cuyahoga Bylaw Provision For Obtaining Federal Nonprofit Status Article Restatement of Purpose.

Locating forms on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Cuyahoga Bylaw Provision For Obtaining Federal Nonprofit Status Article Restatement of Purpose will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guide to get the Cuyahoga Bylaw Provision For Obtaining Federal Nonprofit Status Article Restatement of Purpose:

- Make sure you have opened the right page with your local form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template meets your requirements.

- Search for another document using the search option if the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Cuyahoga Bylaw Provision For Obtaining Federal Nonprofit Status Article Restatement of Purpose on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!