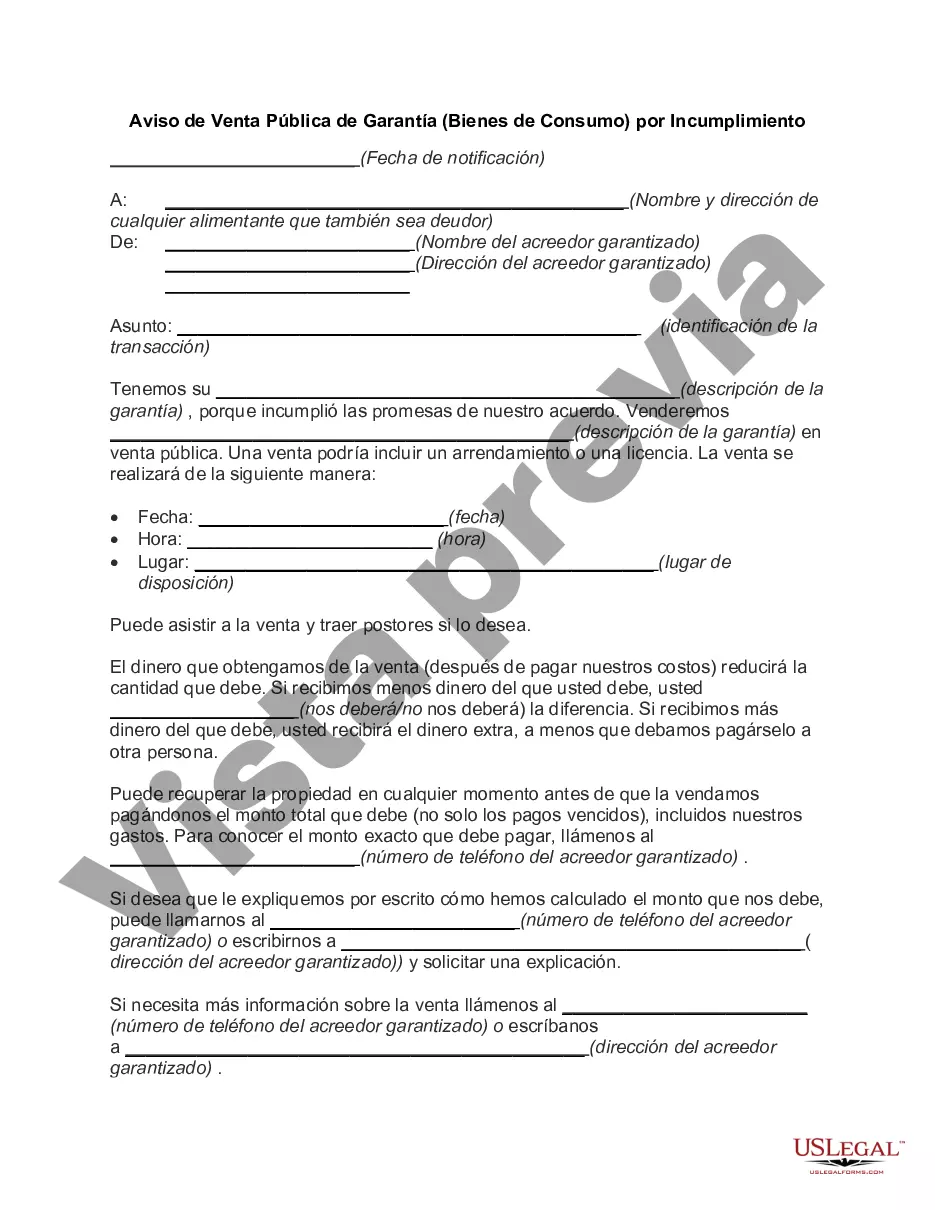

Cuyahoga Ohio Notice of Public Sale of Collateral (Consumer Goods) on Default is a legal document issued when a borrower defaults on a loan secured by consumer goods in the Cuyahoga County region of Ohio. The notice serves to notify the public about the scheduled sale of the collateral to recover the outstanding debt. In Cuyahoga County, there are several types of Notice of Public Sale of Collateral (Consumer Goods) on Default, including: 1. Auto Loan Default: When a borrower fails to make payments on a car loan, the lender may initiate a public sale of the vehicle to recoup the unpaid debt. 2. Mortgage Default: If a homeowner fails to make mortgage payments, the lender can issue a notice to sell the property at a public auction to recover the outstanding loan balance. 3. Personal Loan Default: In the case of default on a personal loan, such as a credit card debt or personal line of credit, the lender can proceed with a public sale of the borrower's personal assets or goods which were pledged as collateral. 4. Electronics Loan Default: This type of notice may involve the sale of consumer electronics, such as laptops, smartphones, or gaming consoles, when a borrower defaults on a loan specifically taken to finance these items. 5. Jewelry Loan Default: When a borrower fails to repay a loan secured by valuable jewelry items, the lender may initiate a public sale to recuperate their losses. It is important for borrowers to be aware that if they default on their loan obligations, their collateral may be sold through a public sales process. This allows the lender to recover their investment but may have significant financial and legal consequences for the borrower. It is advisable to seek legal advice to understand the specific implications and explore potential alternatives to defaulting on a loan.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Aviso de Venta Pública de Garantía (Bienes de Consumo) por Incumplimiento - Notice of Public Sale of Collateral (Consumer Goods) on Default

Description

How to fill out Cuyahoga Ohio Aviso De Venta Pública De Garantía (Bienes De Consumo) Por Incumplimiento?

Whether you plan to open your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare specific paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business occasion. All files are collected by state and area of use, so opting for a copy like Cuyahoga Notice of Public Sale of Collateral (Consumer Goods) on Default is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few more steps to obtain the Cuyahoga Notice of Public Sale of Collateral (Consumer Goods) on Default. Adhere to the guide below:

- Make certain the sample meets your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file when you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Cuyahoga Notice of Public Sale of Collateral (Consumer Goods) on Default in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you are able to access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!