Fairfax Virginia Notice of Public Sale of Collateral (Consumer Goods) on Default In Fairfax, Virginia, creditors have the right to proceed with a Notice of Public Sale of Collateral on Default, in cases where the consumer fails to fulfill their financial obligations. This notice serves as an official announcement of an upcoming public auction, where the collateral pledged by the consumer will be sold to settle the outstanding debt. The sale aims to recoup the owed amount by liquidating consumer goods that were used as security against the loan or credit agreement. Types of Fairfax Virginia Notice of Public Sale of Collateral (Consumer Goods) on Default: 1. Auto Repossession: In situations where the consumer defaults on an auto loan, the lender may initiate a Notice of Public Sale of Collateral to repossess the vehicle. Once the legally required notifications have been sent, a public auction is scheduled to sell the repossessed vehicle, ensuring a fair market value is achieved. 2. Property Foreclosure: In instances of mortgage or loan default, a creditor can pursue a Notice of Public Sale of Collateral to foreclose on the property securing the loan. This notice provides the community with information about a public auction of the property, enabling interested parties to participate in the bidding process. 3. Personal Property Seizure: When loans or debts are secured by personal property, such as jewelry, electronics, or other valuable assets, creditors have the right to execute a Notice of Public Sale of Collateral on Default. This notice alerts the public to an auction where the pledged personal property will be sold to settle the unpaid debt. 4. Boat or Recreational Vehicle Repossession: Similar to auto repossession, lenders can issue a Notice of Public Sale of Collateral to reclaim boats, RVs, or other recreational vehicles when consumers default on their loan payments. The notice informs the public of the impending auction, allowing interested buyers to participate. Engaging in a Fairfax, Virginia Notice of Public Sale of Collateral on Default provides an opportunity for creditors to recover their losses, while potentially offering consumers a chance to pay off their debt and reclaim their collateral before the auction date. It is crucial for consumers to seek legal advice and understand their rights when faced with such a notice, as state and federal laws offer specific protections to both parties involved.

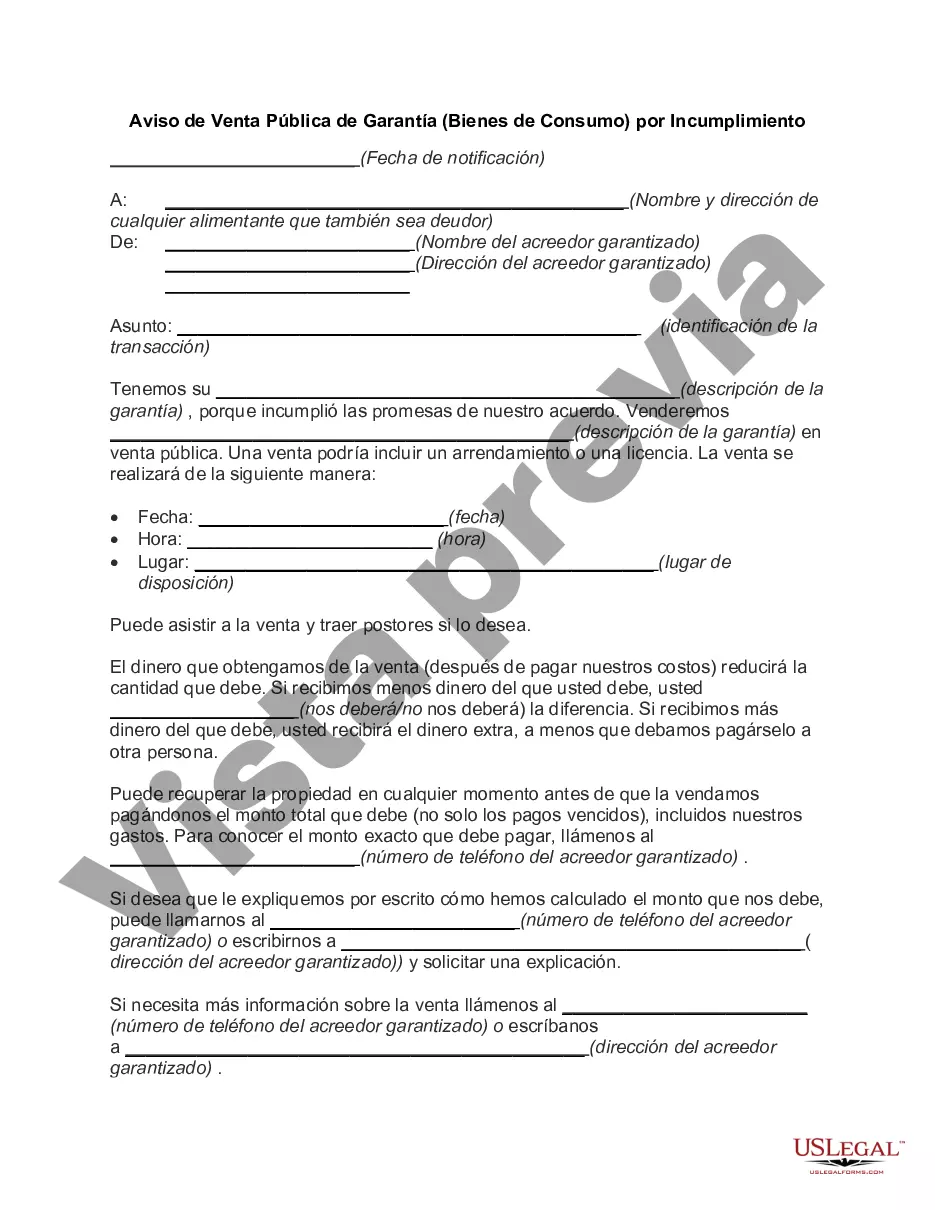

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Aviso de Venta Pública de Garantía (Bienes de Consumo) por Incumplimiento - Notice of Public Sale of Collateral (Consumer Goods) on Default

Description

How to fill out Fairfax Virginia Aviso De Venta Pública De Garantía (Bienes De Consumo) Por Incumplimiento?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare official documentation that varies throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and download a document for any personal or business purpose utilized in your county, including the Fairfax Notice of Public Sale of Collateral (Consumer Goods) on Default.

Locating samples on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Fairfax Notice of Public Sale of Collateral (Consumer Goods) on Default will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guide to obtain the Fairfax Notice of Public Sale of Collateral (Consumer Goods) on Default:

- Ensure you have opened the right page with your localised form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template meets your requirements.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the suitable subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Fairfax Notice of Public Sale of Collateral (Consumer Goods) on Default on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!