Title: Harris, Texas Notice of Public Sale of Collateral (Consumer Goods) on Default — An In-Depth Overview Keywords: Harris, Texas, Notice, Public Sale, Collateral, Consumer Goods, Default Introduction: When a borrower defaults on their loan agreement, it is the lender's right to take appropriate actions to recover their losses. In Harris, Texas, a Notice of Public Sale of Collateral (Consumer Goods) on Default serves as a legal notification given by the lender to inform the borrower and the public about the upcoming sale of collateral to recover the outstanding debt. This article provides a detailed description of the Harris, Texas Notice of Public Sale of Collateral (Consumer Goods) on Default, outlining its purpose, types, and important considerations. 1. Purpose of Harris, Texas Notice of Public Sale of Collateral (Consumer Goods) on Default: The primary purpose of the Harris, Texas Notice of Public Sale of Collateral (Consumer Goods) on Default is to provide information about an impending public auction of consumer goods that were put up as collateral by the borrower against a loan. This notice serves as a legal requirement to inform the borrower, the public, and interested parties about the upcoming sale. 2. Types of Harris, Texas Notice of Public Sale of Collateral (Consumer Goods) on Default: There may be several types of Harris, Texas Notice of Public Sale of Collateral (Consumer Goods) on Default, depending on the lender and the specific situation. Some common types include: a. Vehicle Collateral: This type of notice applies when the collateral in question is a vehicle (such as a car, motorcycle, or boat). It outlines the details of the pending sale, including the make, model, and VIN number of the vehicle. b. Electronic Devices: If the collateral consists of consumer electronics like smartphones, laptops, or gaming consoles, this type of notice will be issued. It includes relevant information about the devices such as brand, specifications, and condition. c. Furniture and Appliances: When consumer goods like furniture, household appliances, or other similar items serve as collateral, this type of notice provides details about the sale. It mentions the specific items, their condition, and any notable features. 3. Key Considerations: a. Timeline: The notice typically includes the date, time, and location of the public sale, allowing interested parties to attend or participate in the auction. b. Debt Settlement: The notice may also highlight the outstanding amount owed by the borrower and provide instructions on how to settle the debt before the sale, including potential options to redeem the collateral. c. Legal Precautions: To protect the lender's interests, the notice may contain legal disclaimers and statements regarding the loan agreement, as well as any applicable laws and regulations. d. Publicity and Advertising: To ensure maximum exposure, the lender may be required to advertise the sale in local newspapers, online platforms, or through other suitable means to attract potential buyers. Conclusion: The Harris, Texas Notice of Public Sale of Collateral (Consumer Goods) on Default serves as a crucial informational document notifying the borrower and the public about the upcoming sale of collateral to recover unpaid debts. It comes in various types, depending on the nature of the collateral involved. By understanding the purpose and considering the key details presented in the notice, interested parties can make informed decisions regarding their involvement in the forthcoming public sale.

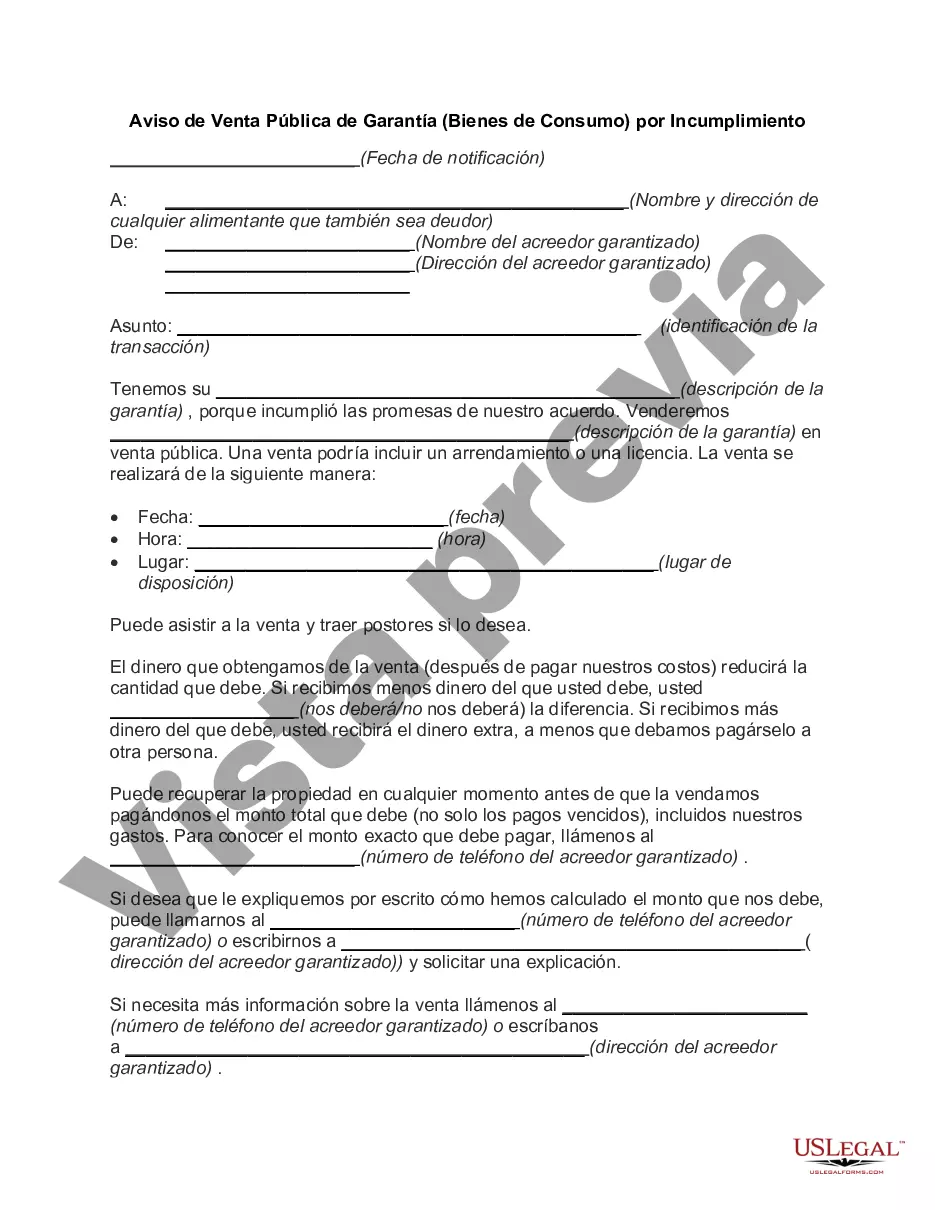

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Aviso de Venta Pública de Garantía (Bienes de Consumo) por Incumplimiento - Notice of Public Sale of Collateral (Consumer Goods) on Default

Description

How to fill out Harris Texas Aviso De Venta Pública De Garantía (Bienes De Consumo) Por Incumplimiento?

Do you need to quickly create a legally-binding Harris Notice of Public Sale of Collateral (Consumer Goods) on Default or maybe any other form to take control of your personal or corporate matters? You can select one of the two options: contact a legal advisor to draft a legal document for you or create it entirely on your own. Luckily, there's an alternative solution - US Legal Forms. It will help you get neatly written legal papers without having to pay unreasonable prices for legal services.

US Legal Forms offers a rich catalog of over 85,000 state-specific form templates, including Harris Notice of Public Sale of Collateral (Consumer Goods) on Default and form packages. We provide templates for a myriad of use cases: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed template without extra troubles.

- To start with, double-check if the Harris Notice of Public Sale of Collateral (Consumer Goods) on Default is tailored to your state's or county's laws.

- If the form comes with a desciption, make sure to check what it's intended for.

- Start the search again if the form isn’t what you were seeking by using the search bar in the header.

- Select the plan that best fits your needs and proceed to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Harris Notice of Public Sale of Collateral (Consumer Goods) on Default template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. Additionally, the paperwork we offer are updated by industry experts, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!