Title: Mecklenburg, North Carolina Notice of Public Sale of Collateral (Consumer Goods) on Default Introduction: Mecklenburg, an affluent county located in the beautiful state of North Carolina, often experiences cases of borrowers defaulting on loans secured by consumer goods. In such instances, lenders are obligated to initiate a process known as the Notice of Public Sale of Collateral (Consumer Goods) on Default. This legally regulated action assists lenders in recovering their losses by selling the defaulting borrower's collateral to interested parties in a public sale. This article will provide a detailed description of this process and highlight different types of Mecklenburg, North Carolina Notice of Public Sale of Collateral (Consumer Goods) on Default. 1. Understanding the Notice of Public Sale: The Notice of Public Sale of Collateral (Consumer Goods) on Default is a formal legal document issued by lenders following a borrower's default on a loan secured by consumer goods. It serves as a foreclosure notice informing interested parties about the impending sale of the defaulting borrower's collateral. 2. Purpose of the Notice: The main objective of issuing a Notice of Public Sale in Mecklenburg, North Carolina, is to protect lenders' rights to recover their losses and satisfy outstanding debts. By selling the collateral through a public auction, lenders strive to secure the best value for the assets involved. 3. Process and Legal Requirements: To ensure legality and transparency, Mecklenburg, North Carolina, enforces specific processes and legal requirements for initiating a Notice of Public Sale of Collateral. These may include notifying the defaulting borrower, publishing the notice in local newspapers, providing a detailed description of the collateral, and specifying the date, time, and location of the public sale. 4. Types of Mecklenburg, North Carolina Notice of Public Sale: a) Notice of Public Sale of Vehicles on Default: This type of notice specifically pertains to auto loans secured by vehicles such as cars, motorcycles, or recreational vehicles (RVs). Lenders issue this notice when borrowers default on their loan repayment obligations. b) Notice of Public Sale of Property on Default: If a borrower defaults on a loan secured by real estate or other immovable property, this type of notice is initiated. It announces the sale of the property through a public auction to recover the outstanding debt. c) Notice of Public Sale of Personal Goods on Default: In cases where the collateral involved consists of personal goods, such as electronics, jewelry, or household appliances, this type of notice is issued. The notice provides details of the impending public sale to recover the defaulted loan amount. Conclusion: The Mecklenburg, North Carolina Notice of Public Sale of Collateral (Consumer Goods) on Default is a legal process designed to protect lenders' interests in cases of loan defaults. By naming and describing different types of notices, such as vehicle, property, and personal goods sales, this article highlights the diverse scenarios in which such notices are applied. This process ensures fair and transparent transactions by allowing interested parties to participate in the public sale and lenders to recover their losses.

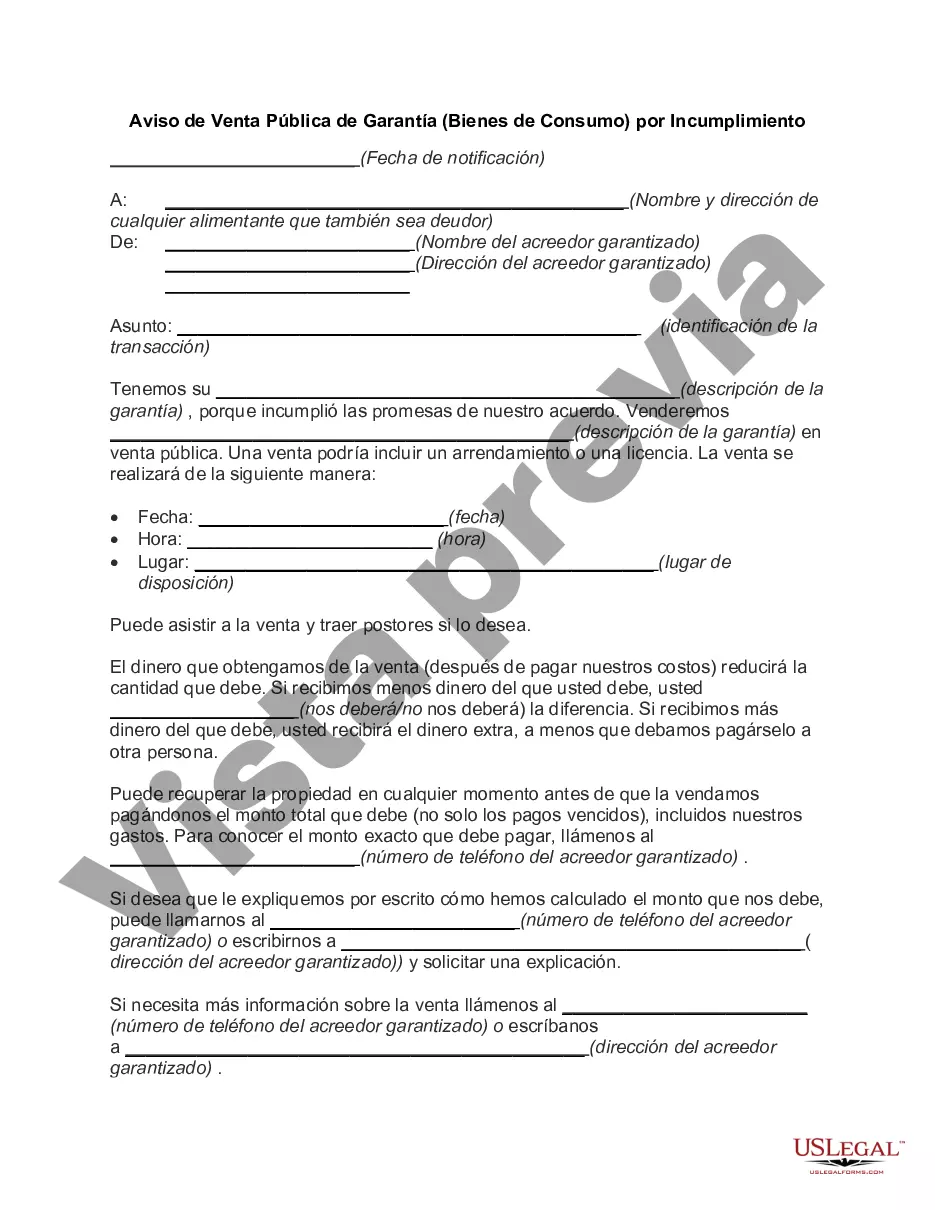

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Aviso de Venta Pública de Garantía (Bienes de Consumo) por Incumplimiento - Notice of Public Sale of Collateral (Consumer Goods) on Default

Description

How to fill out Mecklenburg North Carolina Aviso De Venta Pública De Garantía (Bienes De Consumo) Por Incumplimiento?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and lots of other life situations require you prepare formal documentation that differs from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and download a document for any individual or business purpose utilized in your county, including the Mecklenburg Notice of Public Sale of Collateral (Consumer Goods) on Default.

Locating forms on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the Mecklenburg Notice of Public Sale of Collateral (Consumer Goods) on Default will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guideline to obtain the Mecklenburg Notice of Public Sale of Collateral (Consumer Goods) on Default:

- Ensure you have opened the right page with your regional form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template meets your requirements.

- Search for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Decide on the suitable subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Mecklenburg Notice of Public Sale of Collateral (Consumer Goods) on Default on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!