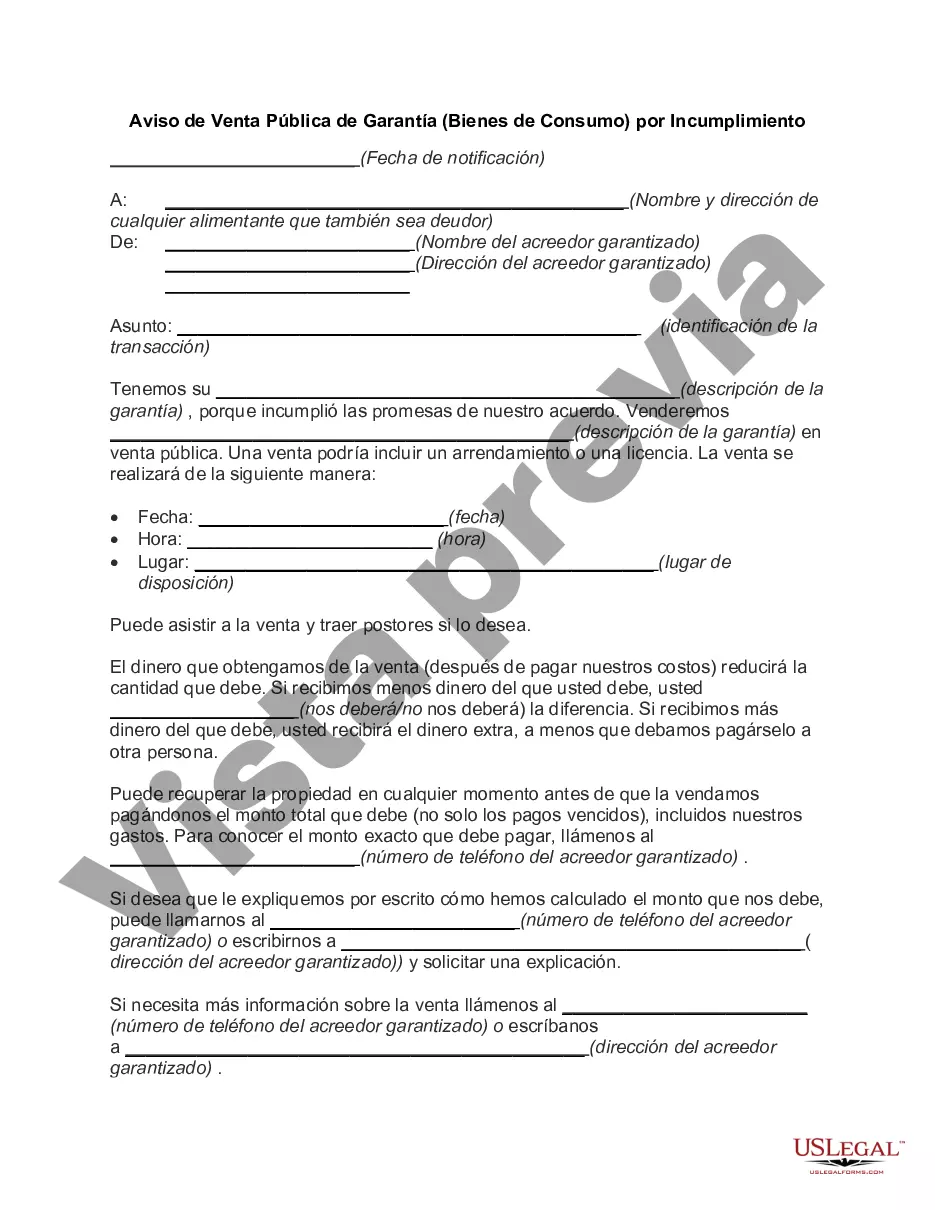

Miami-Dade County, located in the state of Florida, issues notices of public sale of collateral in the event of consumer goods default. These notices are important for various individuals and businesses involved in the lending and financial sector. The purpose of the notice is to inform interested parties about the impending sale of collateral to recover any outstanding debts owed by the defaulting party. Keywords: Miami-Dade County, Florida, consumer goods, public sale, collateral, default, notice Types of Miami-Dade Florida Notice of Public Sale of Collateral (Consumer Goods) on Default: 1. Auto Repossession: This type of notice pertains to the default of an auto loan or lease agreement. When a borrower fails to make timely payments, the lender may repossess the vehicle and proceed with a public sale to recoup their losses. 2. Mortgage Foreclosure: In cases where homeowners default on their mortgage payments, lenders can initiate foreclosure proceedings. The notice of public sale informs interested parties about the auctioning of the property to recover the outstanding loan amount. 3. Personal Property Repossession: When individuals default on loans secured by consumer goods, such as electronics, furniture, or appliances, the lender may repossess these items. The notice of public sale provides information regarding the upcoming auction where the collateral will be sold to satisfy the debt. 4. Business Equipment Repossession: This notice type applies to defaulting businesses that have pledged their equipment or machinery as collateral for loans. Lenders can repossess and sell the business assets to recover the outstanding debt. 5. Boats and Watercraft Repossession: Defaulting on a boat loan or lease agreement can lead to repossession of the vessel. The notice of public sale informs interested parties about an upcoming auction where the boat will be sold to settle the outstanding debt. 6. Recreational Vehicle Repossession: When borrowers default on loans secured by recreational vehicles such as RVs, motor homes, or trailers, lenders may repossess and sell the vehicles to recoup their losses. The notice of public sale provides relevant details about the auction where the collateral will be sold. It's essential for interested parties, such as potential buyers, debtors, and creditors, to review the Miami-Dade Florida Notice of Public Sale of Collateral (Consumer Goods) on Default carefully. These notices outline the date, time, and location of the public auction, enabling parties to participate, bid, or settle outstanding debts promptly.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Aviso de Venta Pública de Garantía (Bienes de Consumo) por Incumplimiento - Notice of Public Sale of Collateral (Consumer Goods) on Default

State:

Multi-State

County:

Miami-Dade

Control #:

US-0591BG

Format:

Word

Instant download

Description

This form is a notice of public sale of collateral on default.

Miami-Dade County, located in the state of Florida, issues notices of public sale of collateral in the event of consumer goods default. These notices are important for various individuals and businesses involved in the lending and financial sector. The purpose of the notice is to inform interested parties about the impending sale of collateral to recover any outstanding debts owed by the defaulting party. Keywords: Miami-Dade County, Florida, consumer goods, public sale, collateral, default, notice Types of Miami-Dade Florida Notice of Public Sale of Collateral (Consumer Goods) on Default: 1. Auto Repossession: This type of notice pertains to the default of an auto loan or lease agreement. When a borrower fails to make timely payments, the lender may repossess the vehicle and proceed with a public sale to recoup their losses. 2. Mortgage Foreclosure: In cases where homeowners default on their mortgage payments, lenders can initiate foreclosure proceedings. The notice of public sale informs interested parties about the auctioning of the property to recover the outstanding loan amount. 3. Personal Property Repossession: When individuals default on loans secured by consumer goods, such as electronics, furniture, or appliances, the lender may repossess these items. The notice of public sale provides information regarding the upcoming auction where the collateral will be sold to satisfy the debt. 4. Business Equipment Repossession: This notice type applies to defaulting businesses that have pledged their equipment or machinery as collateral for loans. Lenders can repossess and sell the business assets to recover the outstanding debt. 5. Boats and Watercraft Repossession: Defaulting on a boat loan or lease agreement can lead to repossession of the vessel. The notice of public sale informs interested parties about an upcoming auction where the boat will be sold to settle the outstanding debt. 6. Recreational Vehicle Repossession: When borrowers default on loans secured by recreational vehicles such as RVs, motor homes, or trailers, lenders may repossess and sell the vehicles to recoup their losses. The notice of public sale provides relevant details about the auction where the collateral will be sold. It's essential for interested parties, such as potential buyers, debtors, and creditors, to review the Miami-Dade Florida Notice of Public Sale of Collateral (Consumer Goods) on Default carefully. These notices outline the date, time, and location of the public auction, enabling parties to participate, bid, or settle outstanding debts promptly.

Free preview