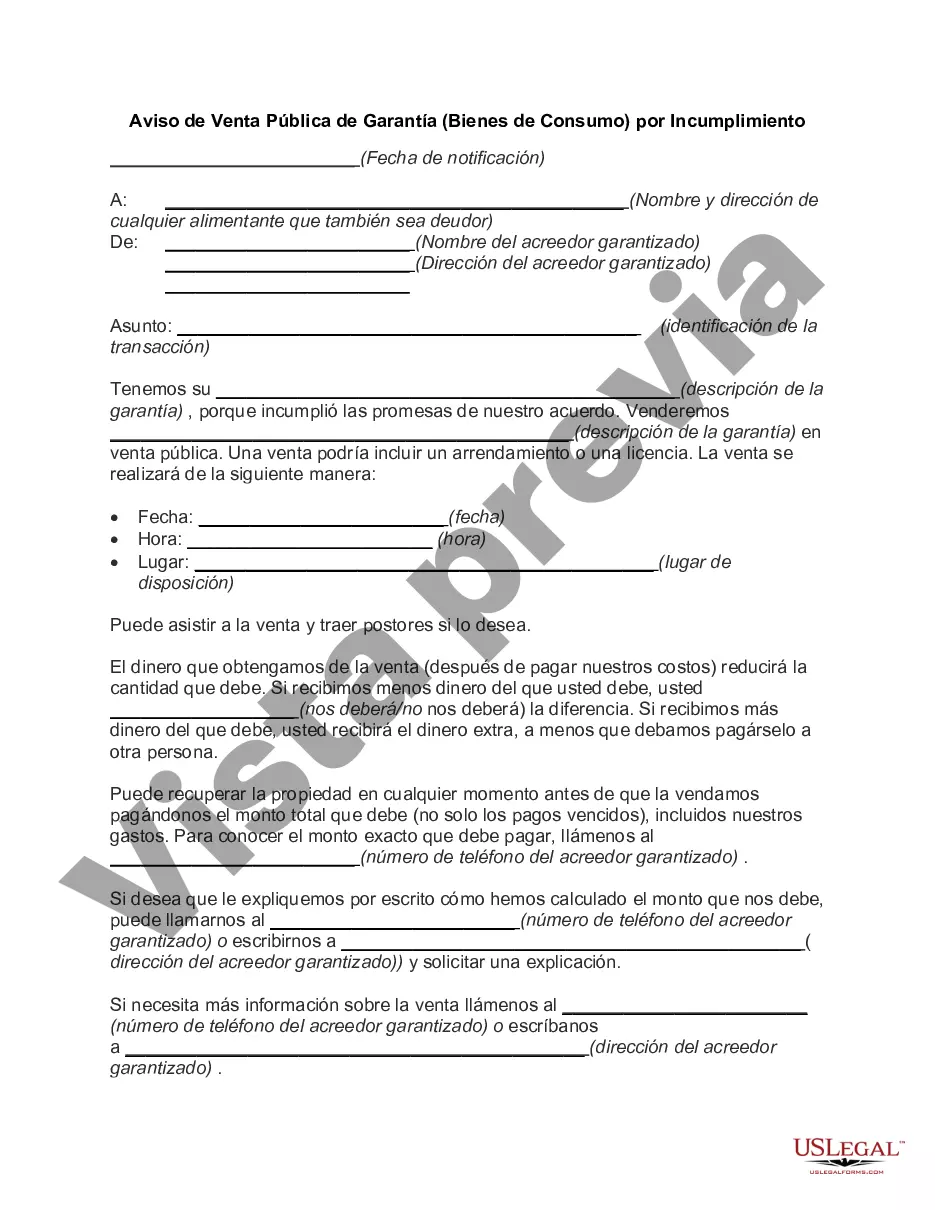

Description: A Wayne Michigan Notice of Public Sale of Collateral (Consumer Goods) on Default is a legal notice issued when a borrower defaults on a loan secured by collateral in the form of consumer goods. This notice serves to inform the public and interested parties that the lender is exercising their right to sell the collateral in order to recoup their losses. The Wayne Michigan Notice of Public Sale of Collateral (Consumer Goods) on Default is a crucial step in the repossession and sale process. It is important for individuals and businesses to understand their rights and obligations when dealing with such situations. There are various types of Wayne Michigan Notice of Public Sale of Collateral (Consumer Goods) on Default, depending on the specific collateral involved. Some common types may include: 1. Wayne Michigan Notice of Public Sale of Collateral (Consumer Goods) on Default for Automobiles: This notice is issued when a borrower defaults on a loan secured by a car or any other type of motor vehicle. The lender has the right to take possession of the vehicle and sell it to recover the outstanding debt. 2. Wayne Michigan Notice of Public Sale of Collateral (Consumer Goods) on Default for Electronics: This notice is relevant when a borrower defaults on a loan secured by electronic devices such as televisions, computers, smartphones, or appliances. The lender may repossess and auction off these items to recover their losses. 3. Wayne Michigan Notice of Public Sale of Collateral (Consumer Goods) on Default for Furniture: This notice is applicable when a borrower defaults on a loan secured by furniture or other household items. The lender can seize and sell these goods to compensate for the unpaid debt. 4. Wayne Michigan Notice of Public Sale of Collateral (Consumer Goods) on Default for Jewelry: This notice is issued when a borrower defaults on a loan secured by jewelry or valuable accessories. The lender has the right to sell the collateral, typically through public auction, to satisfy the outstanding balance. It is important to note that the specific terms and procedures may vary depending on the lender and the loan agreement. Interested parties should carefully review the notice and seek legal advice if necessary to understand their rights and responsibilities. Failure to respond or take action within the specified time frame outlined in the notice may result in the permanent loss of the collateral.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Aviso de Venta Pública de Garantía (Bienes de Consumo) por Incumplimiento - Notice of Public Sale of Collateral (Consumer Goods) on Default

Description

How to fill out Wayne Michigan Aviso De Venta Pública De Garantía (Bienes De Consumo) Por Incumplimiento?

Preparing documents for the business or individual needs is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to create Wayne Notice of Public Sale of Collateral (Consumer Goods) on Default without expert help.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Wayne Notice of Public Sale of Collateral (Consumer Goods) on Default on your own, using the US Legal Forms online library. It is the largest online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary document.

If you still don't have a subscription, adhere to the step-by-step instruction below to get the Wayne Notice of Public Sale of Collateral (Consumer Goods) on Default:

- Examine the page you've opened and verify if it has the sample you need.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that meets your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal templates for any use case with just a few clicks!