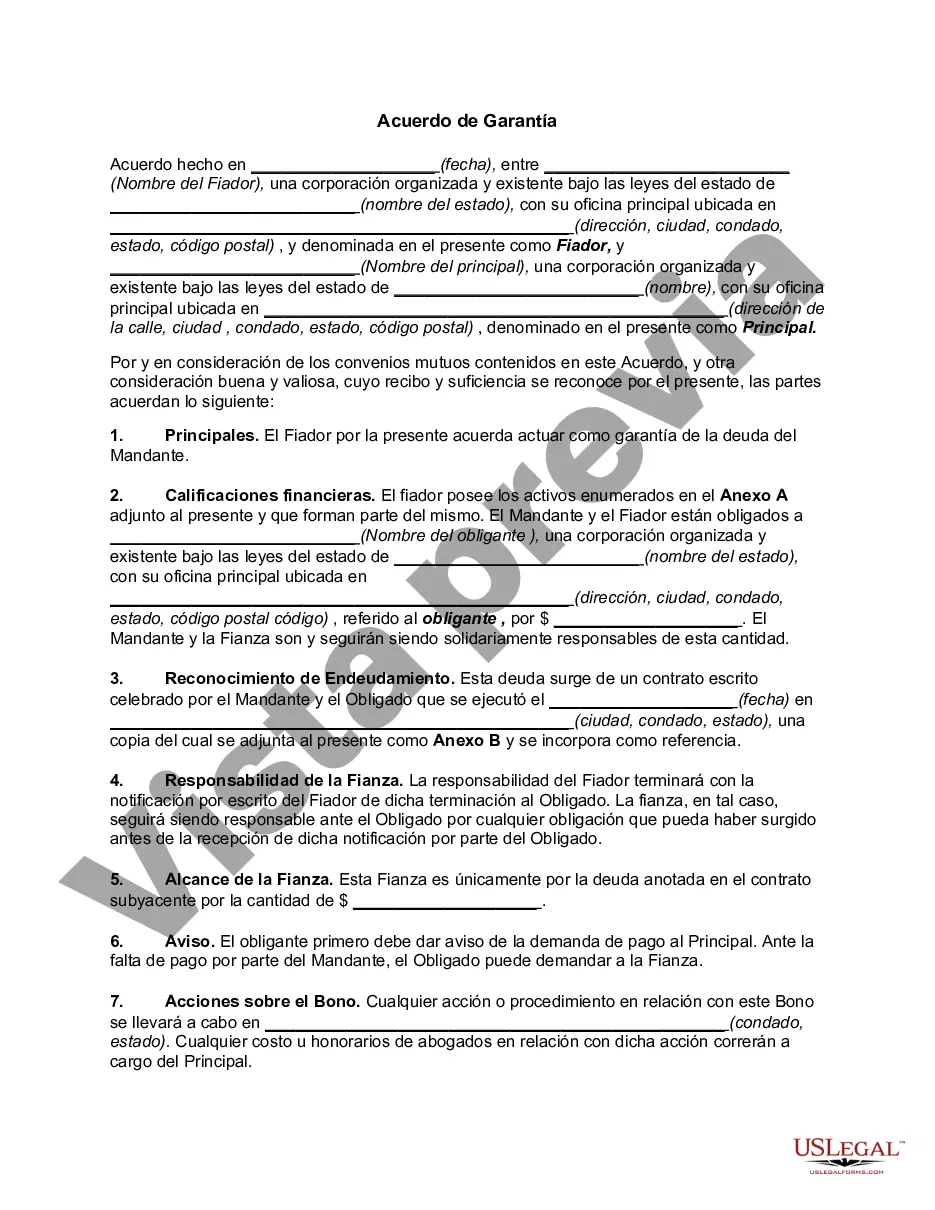

A Chicago Illinois Surety Agreement is a legally binding contract between three parties: the obliged (typically the government or a private entity requiring the agreement), the principal (the party responsible for fulfilling an obligation), and the surety (a third party guaranteeing the principal's performance). It is primarily used to ensure that the principal carries out their obligations as specified in a separate contract or agreement. The purpose of a Chicago Illinois Surety Agreement is to provide financial security and peace of mind to the obliged by guaranteeing that the principal will complete the specified tasks, meet all contractual requirements, and handle any potential liabilities. In case the principal fails to fulfill their obligations, the surety assumes responsibility and compensates the obliged for any losses incurred, up to the agreed-upon amount mentioned in the agreement. There are various types of Chicago Illinois Surety Agreements, each serving different purposes: 1. Performance Surety Agreement: This type of agreement guarantees that the principal will complete a specific project or task as stipulated in a construction or service contract. It protects the obliged from financial loss in case the principal fails to meet the agreed-upon terms and conditions. 2. Payment Surety Agreement: This agreement ensures that the principal will pay subcontractors, suppliers, and laborers involved in a construction project. It safeguards the obliged by assuring that all parties are compensated correctly, minimizing the risk of disputes or non-payment. 3. Bid Surety Agreement: This type of agreement is commonly used in the procurement process. It guarantees that the principal, who is submitting a bid on a project, will enter into a contract and provide the required performance or payment surety if their bid is accepted. 4. License and Permit Surety Agreement: This agreement may be required by government entities to ensure that individuals or businesses comply with regulations, laws, or licensing requirements. It acts as a financial guarantee that the principal will fulfill their obligations and adhere to the applicable rules. 5. Court Surety Agreement: Sometimes referred to as judicial, fiduciary, or probate bonds, this agreement is utilized in legal proceedings. It ensures that the principal will fulfill their responsibilities as ordered by the court, whether it involves acting as an executor, guardian, or trustee. Chicago Illinois Surety Agreements play a crucial role in protecting both the obliged and the principal by mitigating risks associated with contractual obligations. They offer financial security and help maintain trust in business relationships. It is important for all involved parties to carefully review and understand the terms of the agreement before entering into such a commitment.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Acuerdo de Garantía - Surety Agreement

Description

How to fill out Chicago Illinois Acuerdo De Garantía?

Preparing papers for the business or personal needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws and regulations of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to generate Chicago Surety Agreement without professional help.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Chicago Surety Agreement on your own, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary form.

If you still don't have a subscription, follow the step-by-step guideline below to get the Chicago Surety Agreement:

- Examine the page you've opened and verify if it has the document you need.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that satisfies your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any situation with just a few clicks!