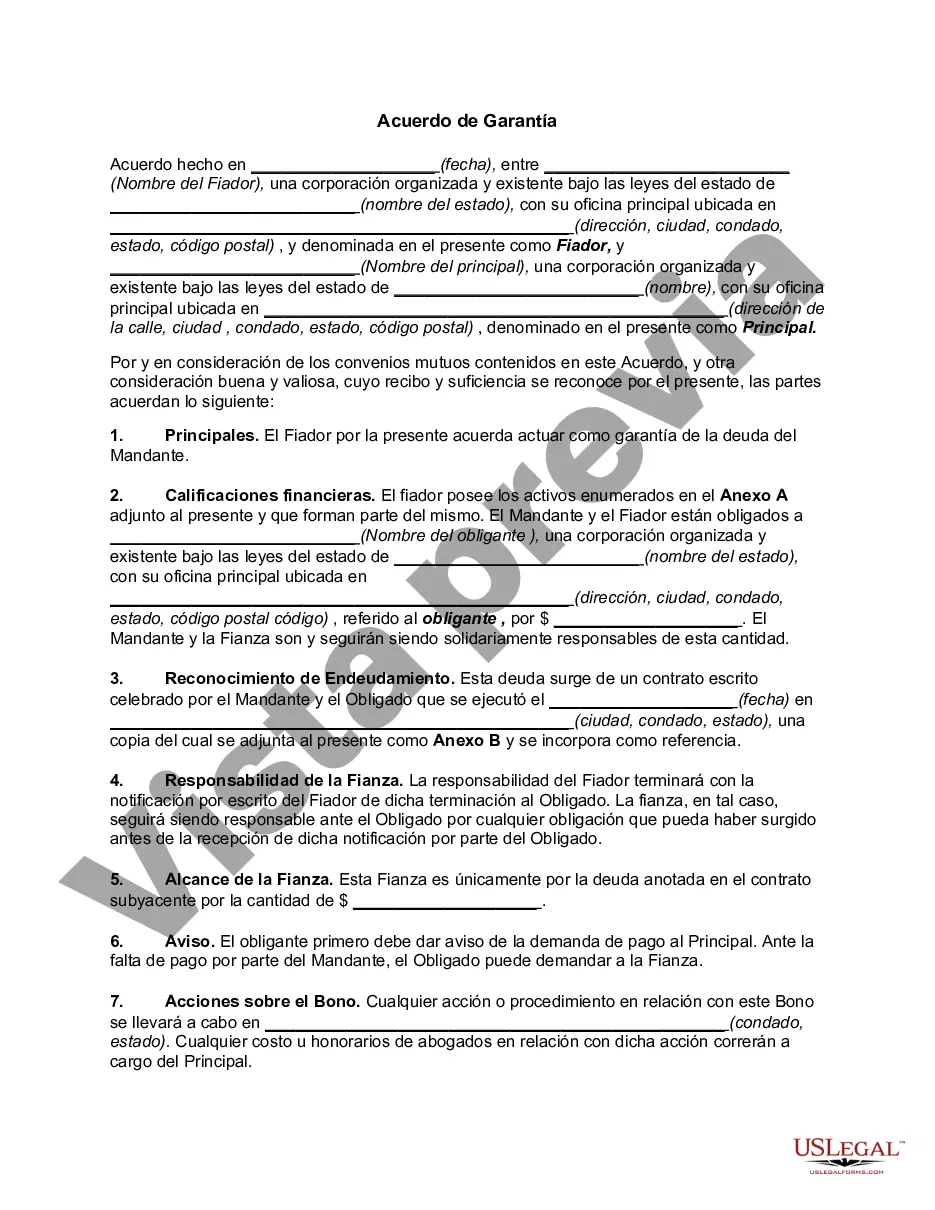

The surety agreement in Nassau, New York, is a legal contract between three parties: the principal, the surety, and the obliged. This agreement ensures that the principal fulfills their obligations as specified in a contract or agreement. In other words, it provides a guarantee to the obliged that the principal will deliver on their promises. The Nassau New York Surety Agreement serves as a financial protection mechanism for the obliged by holding the surety liable for any financial losses incurred if the principal fails to complete the agreed-upon tasks. This agreement is frequently used in various industries, including construction, real estate, and government contracts, where performance and payment guarantees are crucial. Different types of Nassau New York Surety Agreements include: 1. Performance Surety Agreement: This type of surety agreement ensures that the principal will perform their duties as outlined in a contract. It safeguards the obliged against potential losses caused by the principal's failure to complete the project or deliver the promised services. 2. Payment Surety Agreement: This agreement guarantees that the principal will make all necessary payments to contractors, subcontractors, and suppliers involved in a project. It protects the obliged from potential financial risks due to non-payment or delayed payments by the principal. 3. Bid Bond Surety Agreement: A bid bond is a form of surety agreement that guarantees that the principal, if awarded a contract, will enter into the contract and fulfill all necessary obligations. It provides assurance to the project owner that the principal has the financial capacity to complete the project as per the bid. 4. Maintenance Surety Agreement: This type of surety agreement ensures that the principal will provide maintenance or warranty services to the obliged for a specified period after the completion of the project. It safeguards the obliged against any defects or failures during the maintenance period. 5. License and Permit Surety Agreement: These agreements are often required by government agencies to ensure that the principal complies with laws, regulations, and codes related to their licensed activities. It serves as a guarantee that the principal will conduct business in accordance with legal requirements. In Nassau, New York, these different types of surety agreements play a crucial role in various industries, offering financial security and peace of mind to both project owners and other parties involved in contractual agreements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Acuerdo de Garantía - Surety Agreement

Description

How to fill out Nassau New York Acuerdo De Garantía?

Laws and regulations in every area differ throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Nassau Surety Agreement, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the forms can be used multiple times: once you obtain a sample, it remains available in your profile for further use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Nassau Surety Agreement from the My Forms tab.

For new users, it's necessary to make several more steps to get the Nassau Surety Agreement:

- Take a look at the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template once you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!