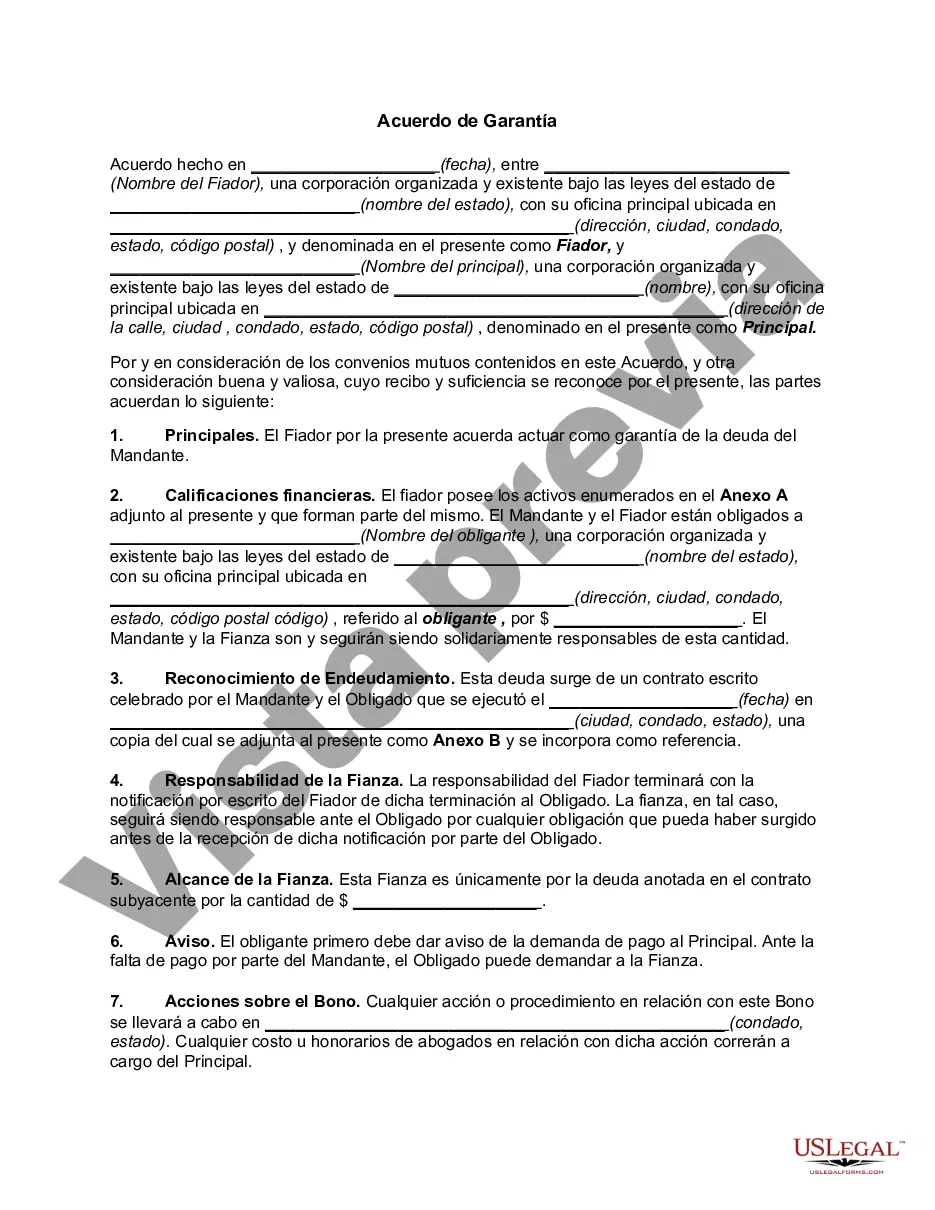

A Phoenix Arizona Surety Agreement is a legally binding contract that provides a guarantee or assurance to the beneficiary (obliged) that a specific party (principal) will fulfill their contractual obligations. This agreement establishes a relationship between the surety (a third party) and the principal, where the surety agrees to be responsible for the obligations if the principal defaults. There are various types of Phoenix Arizona Surety Agreements, each tailored to specific scenarios and industries: 1. Contract Surety Agreement: This type of agreement is commonly used in construction projects to protect project owners and ensure that contractors adhere to the terms and conditions of their contracts. It guarantees that the contractor will perform the work as specified, pay subcontractors and suppliers, and fulfill all obligations stated in the contract. 2. Payment Surety Agreement: Primarily used in the construction industry, this agreement guarantees that contractors will make timely payments to subcontractors, suppliers, and laborers involved in the project. It provides financial security to the beneficiaries, ensuring they receive proper compensation for their services. 3. Performance Surety Agreement: This agreement assures project owners that the contractor will complete the project according to the specifications, within the defined timeframe, and meet all quality standards. It provides financial protection to the beneficiary in case of non-performance or default by the contractor. 4. License or Permit Surety Agreement: Certain professions or businesses in Phoenix Arizona require licenses or permits operating legally. This agreement ensures compliance with applicable laws and regulations by guaranteeing that licensees or permit holders will fulfill their obligations and meet their financial responsibilities. 5. Court Surety Agreement: In legal proceedings, this type of agreement acts as a guarantee for individuals involved in civil cases, ensuring that the required payments or obligations set by the court are fulfilled. It provides financial security to the court and opposing parties. 6. Judicial Surety Agreement: This agreement is used to secure bail bonds. It guarantees that the defendant will appear in court for all scheduled hearings and comply with any conditions imposed by the court, thereby ensuring judicial process integrity. In conclusion, a Phoenix Arizona Surety Agreement is a versatile legal contract that facilitates various industries and scenarios in ensuring contractual obligations, financial security, and compliance. Its different types cater to specific needs, such as construction projects, professional licenses, legal proceedings, and bail bonds.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Acuerdo de Garantía - Surety Agreement

Description

How to fill out Phoenix Arizona Acuerdo De Garantía?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and many other life situations require you prepare official documentation that differs from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any personal or business objective utilized in your region, including the Phoenix Surety Agreement.

Locating forms on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Phoenix Surety Agreement will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guide to obtain the Phoenix Surety Agreement:

- Ensure you have opened the right page with your regional form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template meets your needs.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Phoenix Surety Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!