A Salt Lake Utah Surety Agreement is a legal contract that involves three parties: the obliged, the principal, and the surety. This agreement is designed to provide a guarantee to the obliged (typically a project owner or a government agency) that the principal (usually a contractor or a business owner) will fulfill their contractual obligations as stated in a specific project or agreement. The surety, usually an insurance or bonding company, becomes responsible for the debts, defaults, or non-performance of the principal if they fail to meet their obligations. There are various types of Salt Lake Utah Surety Agreements, each catering to specific needs and obligations. Some common types include: 1. Bid bonds: These ensure that the principal will honor the terms of their bid if awarded the contract. It guarantees that the principal will enter into a contract and provide the required performance and payment bonds. 2. Performance bonds: This type of surety agreement ensures that the principal will complete the project according to the contract's specifications. It provides financial protection to the obliged if the principal fails to meet their responsibilities. 3. Payment bonds: These bonds guarantee that the principal will pay subcontractors, laborers, and suppliers involved in the project. It protects the obliged from potential liens or claims for unpaid bills by ensuring timely payments. 4. Maintenance bonds: These bonds cover defects in workmanship or materials after the completion of a construction project. They provide financial protection to the obliged during the specified maintenance period. 5. License and permit bonds: These bonds are often required by government agencies to ensure that the principal will comply with specific laws, regulations, or ordinances. They protect the public and the government from potential financial losses caused by non-compliance or violations. 6. Subdivision bonds: These bonds are typically required by municipalities or counties for real estate developers. They ensure that developers will complete specified infrastructure improvements, such as roads, utilities, and parks, within a subdivision. In Salt Lake Utah, Surety Agreements play a vital role in various industries, especially in construction and public projects. These agreements provide assurance to project owners, governments, and subcontractors that contractual obligations will be fulfilled. Properly executed Surety Agreements protect all parties involved and promote trust and accountability in business dealings.

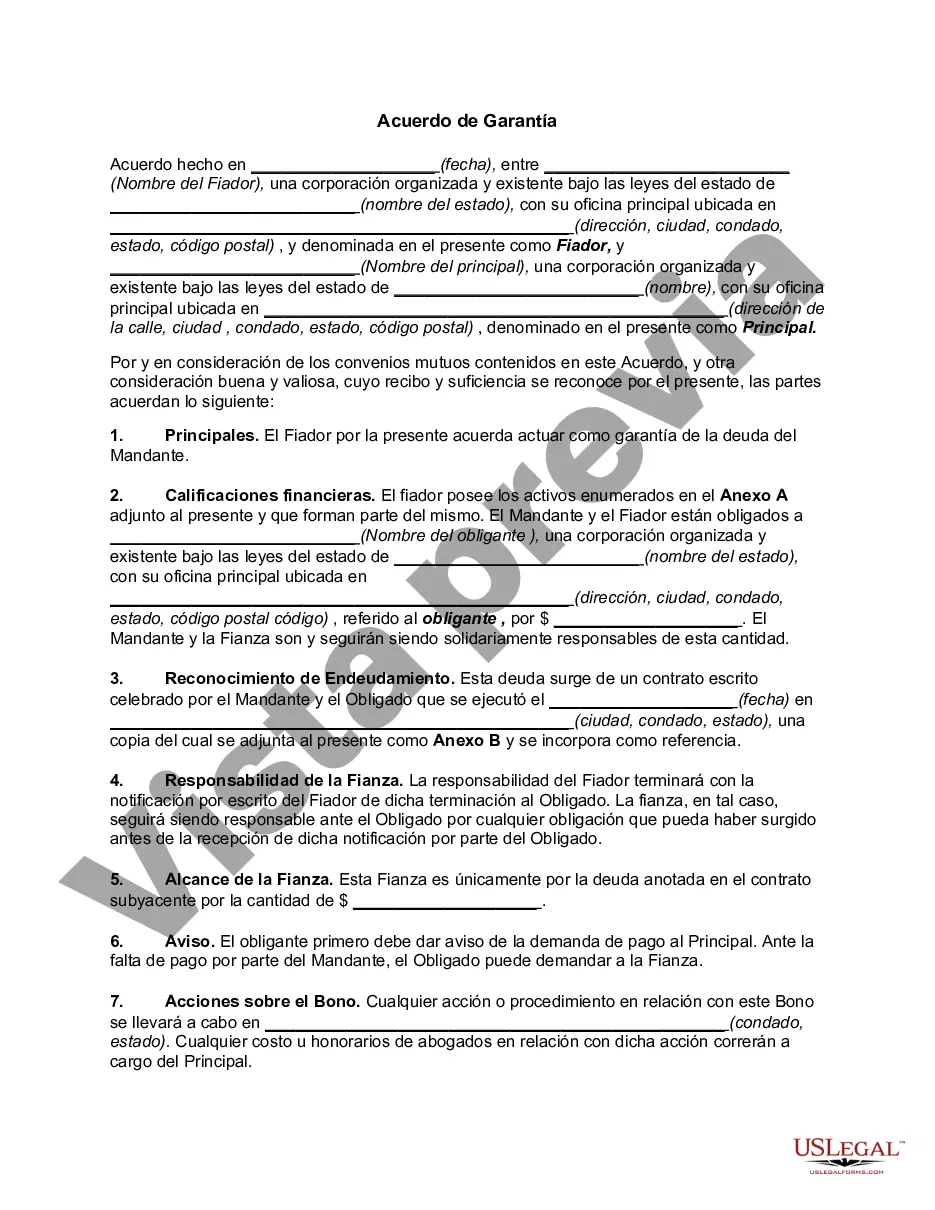

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Acuerdo de Garantía - Surety Agreement

Description

How to fill out Salt Lake Utah Acuerdo De Garantía?

Laws and regulations in every area differ around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Salt Lake Surety Agreement, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals looking for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you pick a sample, it remains accessible in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Salt Lake Surety Agreement from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Salt Lake Surety Agreement:

- Analyze the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template when you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!