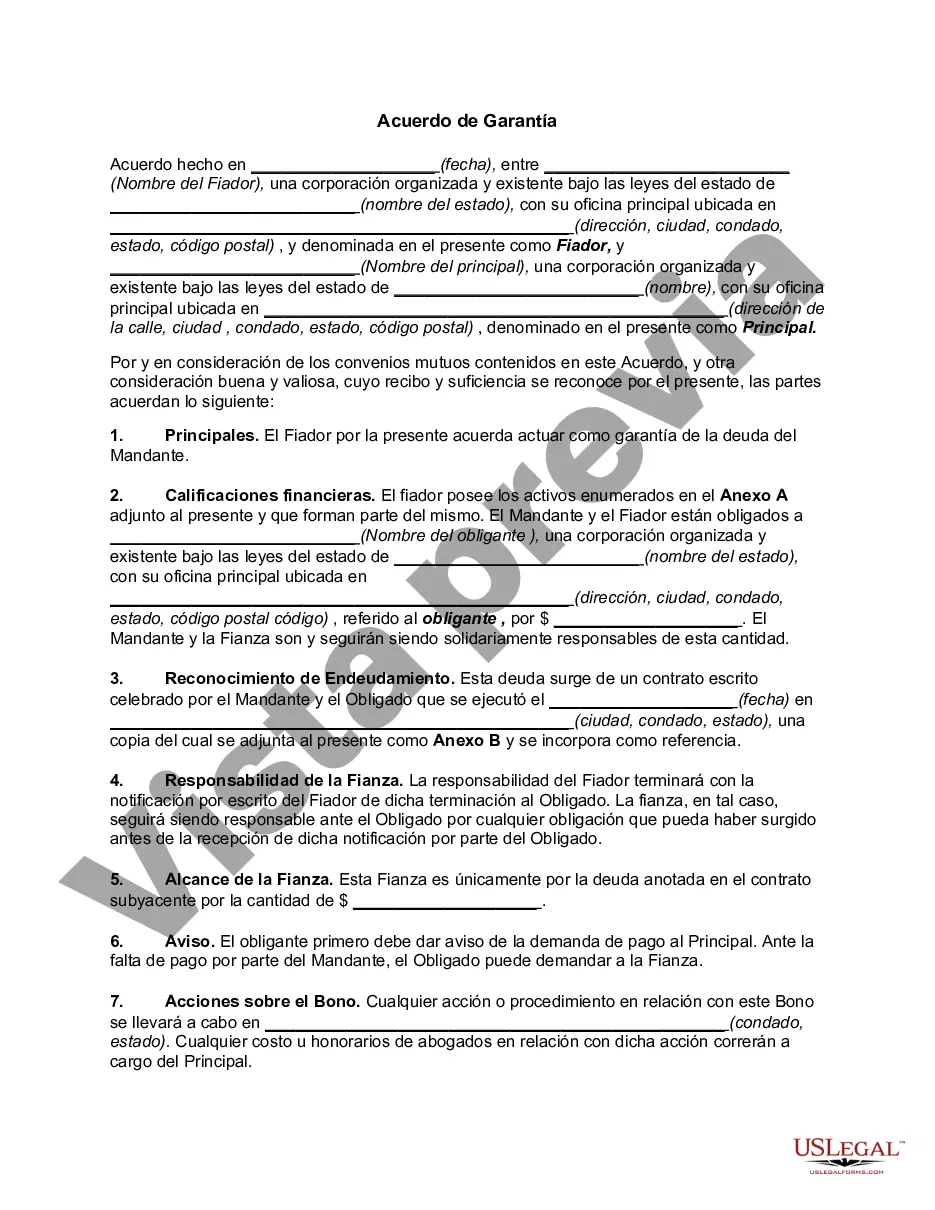

A Suffolk New York Surety Agreement, also referred to as a surety bond, is a legally binding contract between three parties; the principal, the obliged, and the surety company. The purpose of this agreement is to provide financial protection and assurance to the obliged in case the principal fails to fulfill their contractual obligations, such as meeting project deadlines, making payments, or complying with legal requirements. In Suffolk County, New York, various types of surety agreements may be applicable, depending on the specific industry or situation. Some common types include: 1. Construction Surety Agreement: This type of surety agreement is commonly used in construction projects to ensure that contractors, subcontractors, and suppliers adhere to contractual obligations, complete the project as specified, and pay their bills on time. It protects project owners and investors from possible financial losses caused by defaults or inadequate performance. 2. Performance Surety Agreement: This agreement guarantees that a principal will perform their duties, services, or obligations according to the agreed-upon terms and conditions outlined in a contract. It acts as an assurance to the obliged that the principal will complete the task satisfactorily. 3. Payment Surety Agreement: A payment surety agreement ensures that all subcontractors and suppliers involved in a project will receive timely payments from the principal. It helps to prevent non-payment or delayed payment issues, which can cause financial strain or termination of services. 4. License and Permit Surety Agreement: This type of surety agreement is primarily used to verify that individuals or businesses have obtained the necessary licenses, permits, or certifications required by government authorities or regulatory bodies. It ensures that the principal abides by all legal and regulatory obligations. 5. Bail Surety Agreement: In criminal cases, a bail surety agreement is often employed. The surety company, acting as a guarantor, assures the court that the defendant will appear for their hearings and comply with all legal requirements. If the defendant fails to meet their obligations, the surety company may be obligated to pay the bail amount. It is essential for individuals and businesses in Suffolk County, New York, to understand the specific type of surety agreement that best suits their needs. Working with a reputable surety company or consulting with legal professionals can help ensure the appropriate agreement is chosen and executed correctly to provide the necessary protection for all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Acuerdo de Garantía - Surety Agreement

Description

How to fill out Suffolk New York Acuerdo De Garantía?

Draftwing documents, like Suffolk Surety Agreement, to take care of your legal affairs is a difficult and time-consumming task. Many cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can take your legal matters into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms created for various cases and life circumstances. We make sure each document is in adherence with the laws of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Suffolk Surety Agreement template. Simply log in to your account, download the form, and personalize it to your requirements. Have you lost your document? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is just as easy! Here’s what you need to do before downloading Suffolk Surety Agreement:

- Make sure that your template is specific to your state/county since the rules for creating legal papers may vary from one state another.

- Discover more information about the form by previewing it or going through a quick intro. If the Suffolk Surety Agreement isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to start using our website and get the form.

- Everything looks great on your side? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your form is good to go. You can go ahead and download it.

It’s an easy task to locate and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Sign up for it now if you want to check what other perks you can get with US Legal Forms!