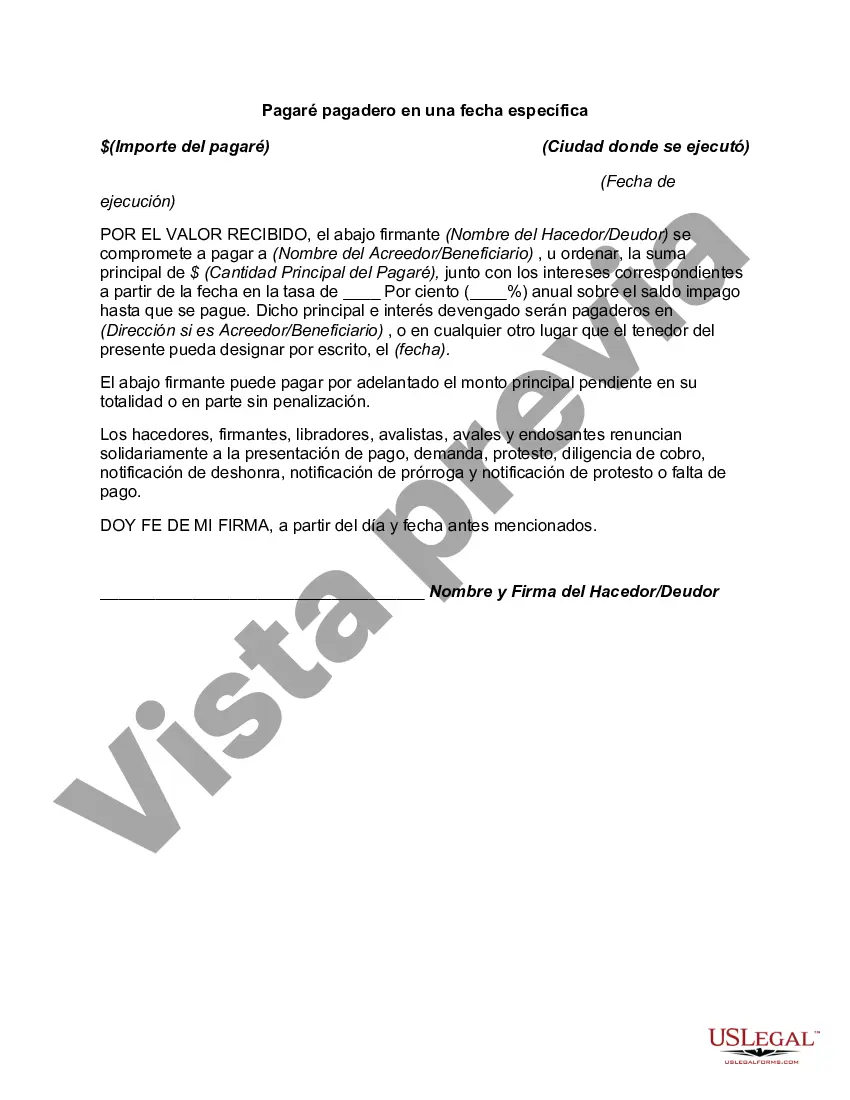

Allegheny Pennsylvania Promissory Note Payable on a Specific Date is a legally binding document that outlines the terms and conditions of a loan between a lender and a borrower in the state of Pennsylvania. This note serves as a written agreement that the borrower will repay the borrowed amount on a specified date. Keywords: Allegheny Pennsylvania, promissory note, payable, specific date, loan agreement, borrower, lender, terms and conditions. There are different types of Allegheny Pennsylvania Promissory Note Payable on a Specific Date. Some of these include: 1. Secured Promissory Note: This type of promissory note includes collateral, which is a valuable asset pledged by the borrower to secure the loan. If the borrower fails to repay the loan, the lender has the right to seize the collateral to recover their funds. 2. Unsecured Promissory Note: Unlike a secured promissory note, this type of note does not require any collateral. The borrower's promise to repay the loan is solely based on their creditworthiness and reputation. 3. Installment Promissory Note: This note divides the total loan amount into equal installments, which the borrower pays back over a specified period. Each installment includes a portion of the principal amount and accrued interest. 4. Demand Promissory Note: This note allows the lender to demand repayment of the loan at any time. The borrower needs to repay the outstanding amount promptly once the lender makes the demand. 5. Balloon Promissory Note: This note requires the borrower to make regular interest payments over the loan term, with a large final payment consisting of the remaining principal and accrued interest due at the end. It is important for both the lender and the borrower to carefully read, understand, and comply with the terms and conditions stated in the Allegheny Pennsylvania Promissory Note Payable on a Specific Date. This note ensures the protection of both parties' rights and serves as evidence of the loan agreement. For any legal implications or disputes, it is advisable to consult with a qualified attorney well-versed in Pennsylvania's loan and promissory note regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Pagaré pagadero en una fecha específica - Promissory Note Payable on a Specific Date

Description

How to fill out Allegheny Pennsylvania Pagaré Pagadero En Una Fecha Específica?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and many other life situations demand you prepare official documentation that differs from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any individual or business purpose utilized in your region, including the Allegheny Promissory Note Payable on a Specific Date.

Locating forms on the platform is amazingly straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Allegheny Promissory Note Payable on a Specific Date will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guide to get the Allegheny Promissory Note Payable on a Specific Date:

- Make sure you have opened the correct page with your localised form.

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form meets your requirements.

- Look for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Allegheny Promissory Note Payable on a Specific Date on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!