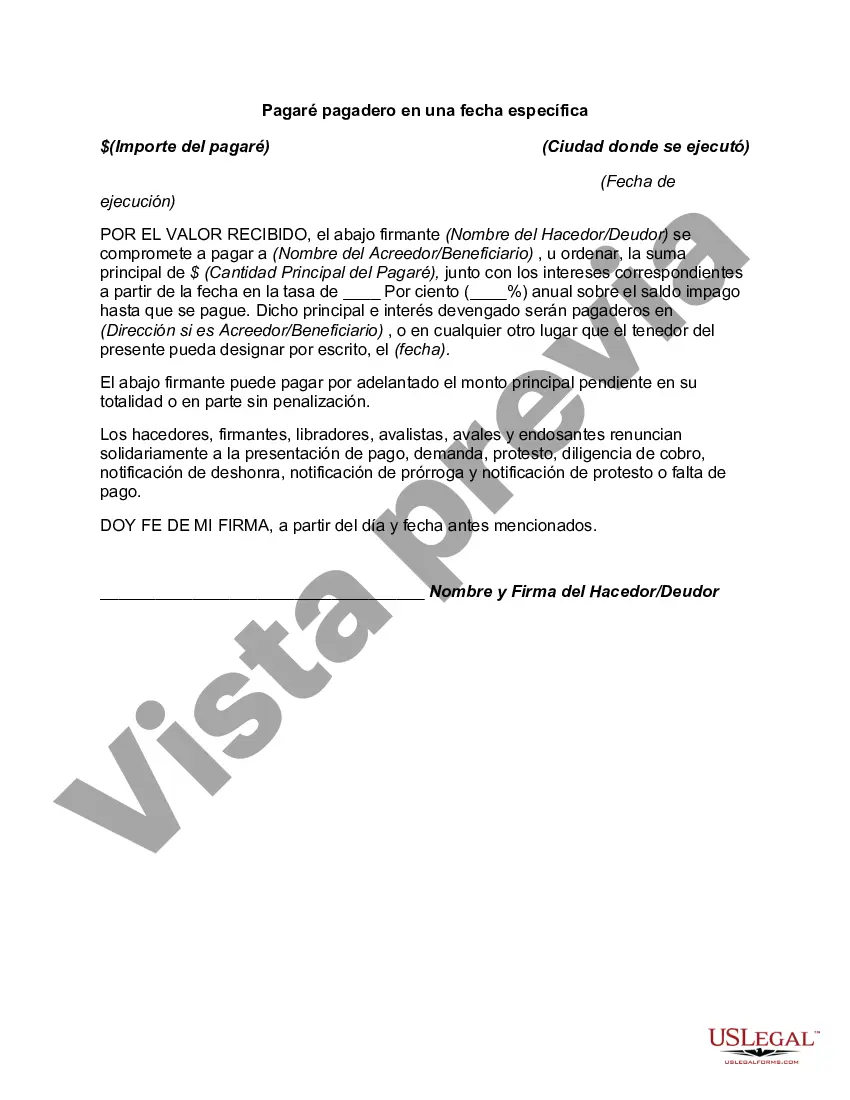

Maricopa, Arizona Promissory Note Payable on a Specific Date: A Detailed Description A promissory note is a legal instrument that outlines the borrower's promise to repay a specific amount of money to a lender by a designated due date. In Maricopa, Arizona, promissory notes payable on a specific date serve as a popular financial tool for individuals and businesses seeking to formalize loan agreements. These promissory notes stipulate that the borrower will repay the principal amount borrowed, along with any accrued interest, on a predetermined date. The lender, on the other hand, agrees to lend the funds and holds the right to enforce the repayment terms if the borrower fails to fulfill their obligation. Different Types of Maricopa, Arizona Promissory Notes Payable on a Specific Date: 1. Personal Promissory Note: This type of promissory note typically arises between individuals, friends, or family members. It outlines the agreement between the borrower and lender regarding a specific loan amount, interest rate (if applicable), repayment duration, and the due date for the complete repayment of the loan. 2. Business Promissory Note: In this case, the promissory note is used for commercial purposes, often involving entrepreneurs or small business owners in Maricopa, Arizona. These notes serve as a legally binding contract, providing a clear outline of the loan amount, interest rates, repayment schedule, and consequences of failing to repay as agreed. 3. Real Estate Promissory Note: This type of promissory note arises when a property sale involves financing from the seller rather than a traditional mortgage lender. The note will include the loan details, such as the amount, interest rate, repayment schedule, and property specifics, ensuring a smooth and orderly transaction between the parties involved. 4. Student Loan Promissory Note: This type of promissory note is prevalent among students seeking financial assistance for higher education. These notes outline the terms and conditions of the loan, including the borrowed amount, adjusted interest rates, repayment start date, and duration. They are typically issued by private lenders or educational institutions. Maricopa, Arizona Promissory Notes Payable on a Specific Date help to establish transparency, protects both parties, and ensure the loan agreement is legally enforceable. Borrowers and lenders alike benefit from the clarity provided by these notes, as all relevant terms and conditions are clearly stated. It is crucial for all parties involved to carefully review and understand the terms before entering into such agreements to avoid any potential misunderstandings or disputes in the future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Pagaré pagadero en una fecha específica - Promissory Note Payable on a Specific Date

Description

How to fill out Maricopa Arizona Pagaré Pagadero En Una Fecha Específica?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to create some of them from scratch, including Maricopa Promissory Note Payable on a Specific Date, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in various categories varying from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching process less challenging. You can also find information materials and tutorials on the website to make any tasks related to paperwork execution simple.

Here's how to locate and download Maricopa Promissory Note Payable on a Specific Date.

- Take a look at the document's preview and description (if provided) to get a basic information on what you’ll get after getting the document.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can affect the validity of some records.

- Examine the similar document templates or start the search over to find the right file.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the option, then a suitable payment method, and buy Maricopa Promissory Note Payable on a Specific Date.

- Select to save the form template in any offered format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Maricopa Promissory Note Payable on a Specific Date, log in to your account, and download it. Of course, our website can’t replace a lawyer entirely. If you need to deal with an extremely difficult case, we recommend using the services of a lawyer to review your form before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Become one of them today and get your state-compliant paperwork effortlessly!