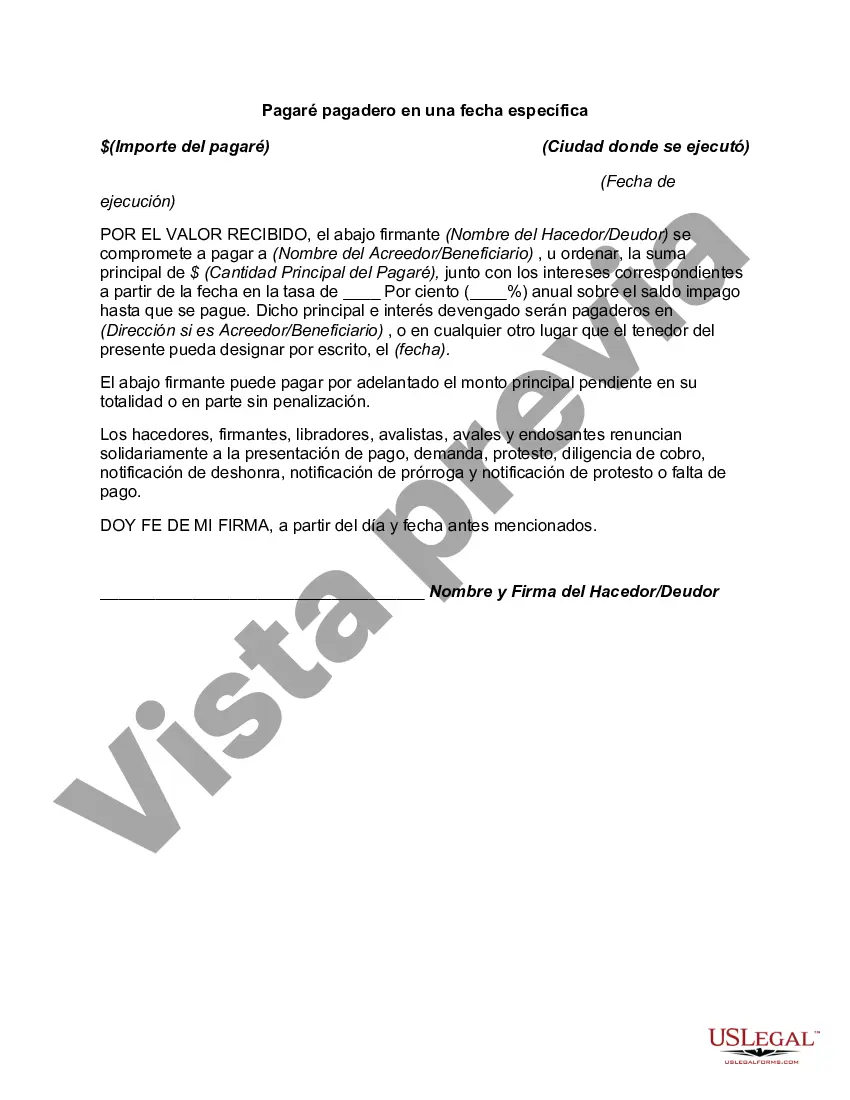

Middlesex Massachusetts Promissory Note Payable on a Specific Date is a legally binding document that outlines the terms and conditions of a loan between a lender and a borrower residing in Middlesex County, Massachusetts. This note specifies the repayment terms, including the principal amount borrowed, the interest rate, and the specific date by which the borrower must repay the loan. The Middlesex Massachusetts Promissory Note Payable on a Specific Date serves as a written evidence of debt and establishes the borrower's obligation to repay the borrowed funds according to the agreed-upon terms. It provides protection for both the lender and the borrower, ensuring clarity and transparency in the loan transaction. Key components of a Middlesex Massachusetts Promissory Note Payable on a Specific Date include: 1. Parties involved: The note identifies the lender and the borrower by stating their full legal names and addresses. 2. Principal amount: This specifies the initial sum of money borrowed by the borrower, often referred to as the principal. 3. Interest rate: The note states the interest rate that will be applied to the outstanding balance of the loan. The interest can be fixed or variable, depending on the agreement between the parties. 4. Repayment terms: It outlines the date by which the borrower must repay the loan, including any specified installments or payment schedule. 5. Late payment penalties: The note may include penalties or fees for late or missed payments, specifying the repercussions of non-compliance. 6. Collateral: In some cases, the note may involve collateral provided by the borrower to secure the loan. This could be a property, vehicle, or any other valuable asset. 7. Governing law: The note will typically state that it is governed by the laws of Massachusetts and specifically Middlesex County. Different types of Middlesex Massachusetts Promissory Note Payable on a Specific Date may include variations based on the loan purpose, repayment terms, or specific clauses agreed upon by the parties. Variations could include loans for personal use, business loans, student loans, or mortgages, each tailored to cater to specific needs and circumstances. Overall, the Middlesex Massachusetts Promissory Note Payable on a Specific Date is a crucial legal instrument providing a framework for lending relationships. It offers protection for both lenders and borrowers, promoting transparency and accountability throughout the loan process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Middlesex Massachusetts Pagaré pagadero en una fecha específica - Promissory Note Payable on a Specific Date

Description

How to fill out Middlesex Massachusetts Pagaré Pagadero En Una Fecha Específica?

Whether you intend to open your business, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare specific paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any personal or business occurrence. All files are collected by state and area of use, so picking a copy like Middlesex Promissory Note Payable on a Specific Date is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few additional steps to get the Middlesex Promissory Note Payable on a Specific Date. Adhere to the instructions below:

- Make sure the sample fulfills your individual needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the sample when you find the proper one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Middlesex Promissory Note Payable on a Specific Date in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!