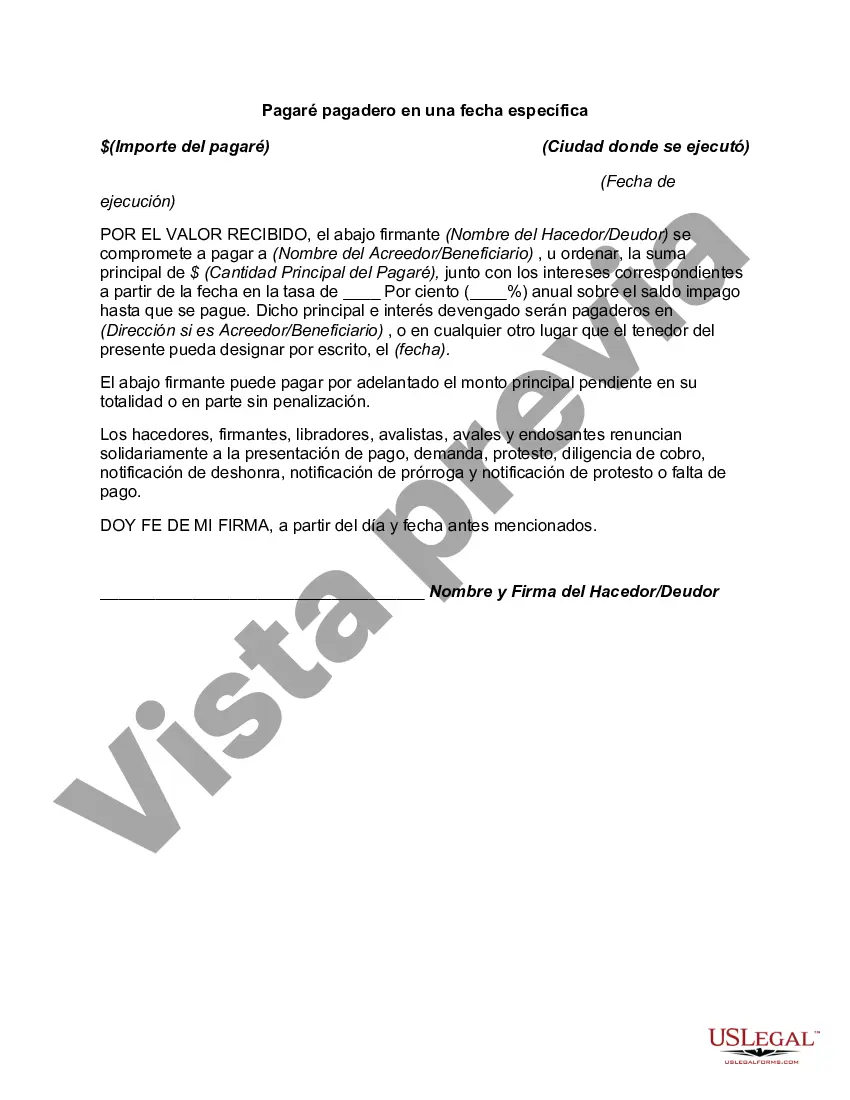

A promissory note payable on a specific date is a legally binding document that outlines a borrower's promise to repay a specific amount of money to a lender by a predetermined date. In the context of San Jose, California, multiple types of promissory notes payable on a specific date exist, each serving unique purposes within the financial landscape of the city. One type of San Jose California promissory note payable on a specific date is a personal promissory note. This document is commonly used between individuals or within families, where the lender lends money to a borrower for personal reasons such as education expenses, medical bills, or automobile purchases. The promissory note sets forth the payment terms, interest rates (if any), and a specific repayment deadline. Another variation is a business promissory note payable on a specific date, which is crucial for commercial transactions in San Jose. Business owners often rely on these notes when securing funding from financial institutions or private investors to meet working capital needs, expand their operations, or invest in equipment or inventory. The terms of this note may include interest rates, collateral requirements, and a specific date of repayment to ensure timely and full reimbursement. Real estate transactions in San Jose also encompass a significant type of promissory note payable on a specific date. Known as a real estate promissory note, this legally binding agreement is found within mortgage loans, land contracts, or installment sales. It provides details regarding the borrowed amount, interest rate, repayment schedule, and maturity date. These notes are vital for homebuyers, property investors, and developers to finance residential or commercial real estate endeavors in San Jose. Furthermore, San Jose California offers various government-backed promissory notes payable on a specific date, designed to facilitate economic growth and support community development projects. For instance, the city may issue municipal bonds to finance public infrastructure improvements, educational facilities, or environmental initiatives. These notes typically have extended repayment periods, interest rates tied to market conditions, and are critical for financing the city's infrastructure needs. In conclusion, San Jose California promotes economic activities through a range of promissory notes payable on a specific date. Whether for personal, business, real estate, or governmental purposes, these arrangements ensure the smooth circulation of funds within the city and contribute to its growth and development.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Pagaré pagadero en una fecha específica - Promissory Note Payable on a Specific Date

Description

How to fill out San Jose California Pagaré Pagadero En Una Fecha Específica?

Drafting paperwork for the business or personal needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to draft San Jose Promissory Note Payable on a Specific Date without professional assistance.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid San Jose Promissory Note Payable on a Specific Date on your own, using the US Legal Forms online library. It is the largest online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed form.

If you still don't have a subscription, follow the step-by-step instruction below to get the San Jose Promissory Note Payable on a Specific Date:

- Examine the page you've opened and check if it has the sample you need.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that satisfies your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal templates for any use case with just a couple of clicks!