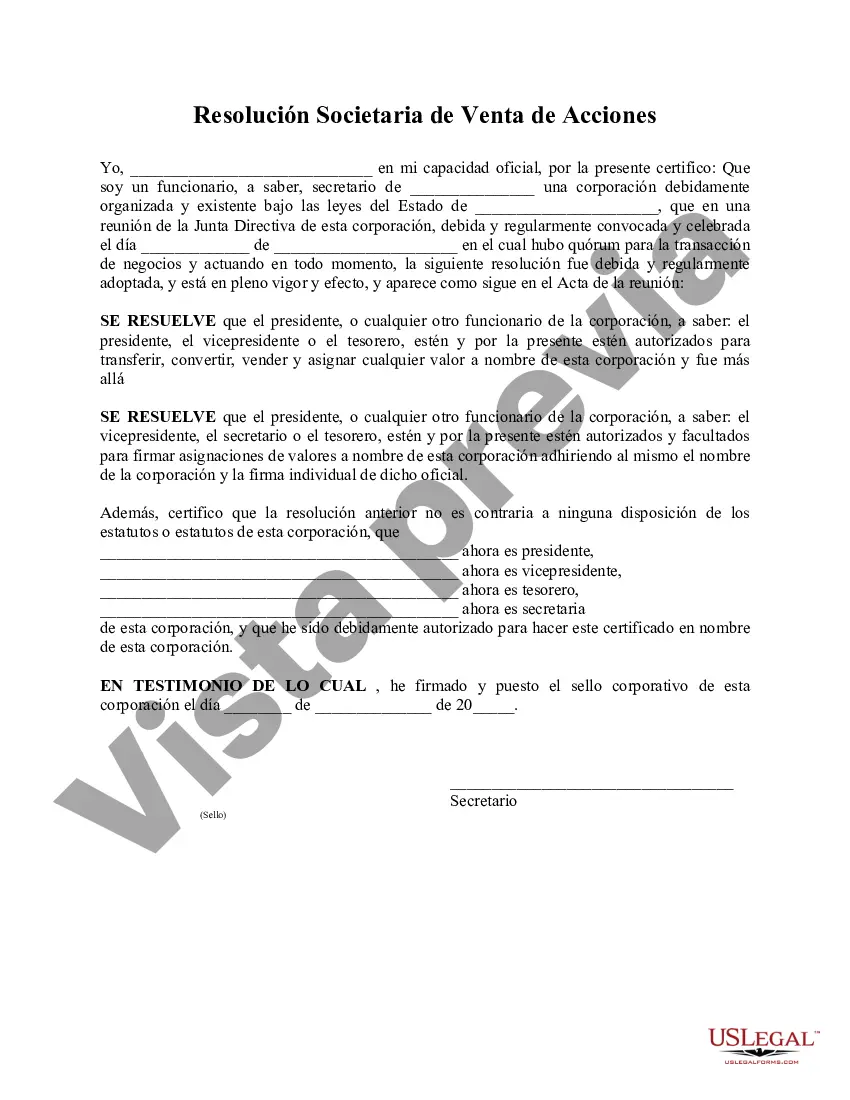

Miami-Dade Florida Corporate Resolution For Sale of Stock is a legal document that outlines the formal decision made by a corporation's board of directors to authorize the sale of stock. This resolution is an important process for corporations looking to generate capital through the sale of shares in the company. A Miami-Dade Florida Corporate Resolution For Sale of Stock typically includes key elements such as: 1. Identification: The resolution starts by clearly identifying the corporation, including its official name, registered address, and relevant identifying details such as a Federal Tax Identification Number. 2. Purpose: The resolution states the reason for the sale of stock, which could include raising funds for business expansion, financing acquisitions or projects, or paying off debts. 3. Authorization of Sale: The resolution authorizes the corporation to sell a specific number of shares and specifies the type and class of stock to be sold (common, preferred, etc.). The resolution also sets guidelines on the minimum and maximum price at which the stock can be sold. 4. Designation of Officers: The resolution designates officers or individuals within the corporation (typically the president, treasurer, or CEO) who are authorized to execute the sale on behalf of the corporation. It may further outline the necessary steps to be taken for the completion of the sale, such as obtaining necessary legal approvals. 5. Reporting: The resolution may require the officers authorized to execute the sale to report back to the board of directors or shareholders on the progress and outcome of the stock sale. Different types of Miami-Dade Florida Corporate Resolution For Sale of Stock may include variations based on the specific needs of the corporation, such as: 1. Ordinary Stock Sale Resolution: This type of resolution authorizes the corporation to sell ordinary shares, which typically grant shareholders voting rights and may be subject to specific restrictions or conditions. 2. Preferred Stock Sale Resolution: If a corporation wishes to sell preferred shares, which offer specific advantages over ordinary shares (e.g., priority in dividend payments or liquidation preferences), a preferred stock sale resolution is necessary. 3. Secondary Offering Resolution: In cases where a corporation has previously sold shares to the public through an initial public offering (IPO) or direct listing, a secondary offering resolution authorizes the sale of additional shares by existing shareholders. It is crucial for corporations to consult legal professionals or experts to ensure compliance with local regulations and guidelines, as the specifics of the resolution may vary depending on the jurisdiction and corporate structure.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Resolución Societaria de Venta de Acciones - Corporate Resolution For Sale of Stock

State:

Multi-State

County:

Miami-Dade

Control #:

US-0606-WG

Format:

Word

Instant download

Description

Authorization to purchase corporation's outstanding common stock

Miami-Dade Florida Corporate Resolution For Sale of Stock is a legal document that outlines the formal decision made by a corporation's board of directors to authorize the sale of stock. This resolution is an important process for corporations looking to generate capital through the sale of shares in the company. A Miami-Dade Florida Corporate Resolution For Sale of Stock typically includes key elements such as: 1. Identification: The resolution starts by clearly identifying the corporation, including its official name, registered address, and relevant identifying details such as a Federal Tax Identification Number. 2. Purpose: The resolution states the reason for the sale of stock, which could include raising funds for business expansion, financing acquisitions or projects, or paying off debts. 3. Authorization of Sale: The resolution authorizes the corporation to sell a specific number of shares and specifies the type and class of stock to be sold (common, preferred, etc.). The resolution also sets guidelines on the minimum and maximum price at which the stock can be sold. 4. Designation of Officers: The resolution designates officers or individuals within the corporation (typically the president, treasurer, or CEO) who are authorized to execute the sale on behalf of the corporation. It may further outline the necessary steps to be taken for the completion of the sale, such as obtaining necessary legal approvals. 5. Reporting: The resolution may require the officers authorized to execute the sale to report back to the board of directors or shareholders on the progress and outcome of the stock sale. Different types of Miami-Dade Florida Corporate Resolution For Sale of Stock may include variations based on the specific needs of the corporation, such as: 1. Ordinary Stock Sale Resolution: This type of resolution authorizes the corporation to sell ordinary shares, which typically grant shareholders voting rights and may be subject to specific restrictions or conditions. 2. Preferred Stock Sale Resolution: If a corporation wishes to sell preferred shares, which offer specific advantages over ordinary shares (e.g., priority in dividend payments or liquidation preferences), a preferred stock sale resolution is necessary. 3. Secondary Offering Resolution: In cases where a corporation has previously sold shares to the public through an initial public offering (IPO) or direct listing, a secondary offering resolution authorizes the sale of additional shares by existing shareholders. It is crucial for corporations to consult legal professionals or experts to ensure compliance with local regulations and guidelines, as the specifics of the resolution may vary depending on the jurisdiction and corporate structure.