King Washington Covenant Not to Sue by Widow of Deceased Stockholder is a legal agreement that provides protection and assurance to the widow of a deceased stockholder from potential lawsuits related to the deceased stockholder's shares and ownership interests. This covenant is designed to safeguard the widow's rights and entitlements in light of any future disputes or claims that may arise. In essence, the King Washington Covenant Not to Sue serves as a legal shield for the surviving spouse of a deceased stockholder, ensuring their peace of mind and safeguarding their financial interests. It establishes an agreement between the widow and other relevant parties, including the company or corporation in which the deceased stockholder held shares. This covenant acts as a legally binding contract, preventing any potential legal actions or lawsuits against the widow in relation to the ownership of the deceased stockholder's shares. It provides assurance that the widow will not be held personally liable for any claims, debts, or liabilities arising from the deceased stockholder's ownership interests. Furthermore, the King Washington Covenant Not to Sue may include various stipulations or clauses pertaining to specific scenarios or contingencies. These may address issues such as disputes over share transfers, stockholder rights, dividends, or potential disagreements with other shareholders or third parties. Each covenant may be customized to address the unique circumstances of the deceased stockholder's holdings and the widow's specific needs or concerns. It's important to note that there can be different types or variations of the King Washington Covenant Not to Sue, depending on the specific jurisdiction or legal framework in which it is applied. Some possible types may include: 1. General Covenant Not to Sue: This type of covenant provides a broad protection for the widow against any potential lawsuits related to the deceased stockholder's shares, ownership, or involvement in the company. 2. Limited Covenant Not to Sue: In certain cases, the covenant may have limitations or exclusions, specifying the particular areas or situations in which the widow is protected from lawsuits. These limitations might be based on certain conditions, specific parties, or defined periods. 3. Specific Issue Covenant Not to Sue: This variant addresses a singular specific issue or concern regarding the deceased stockholder's shares or ownership interests. It provides a targeted and focused protection to the widow, effectively resolving potential disputes related to that particular matter. Overall, the King Washington Covenant Not to Sue by Widow of Deceased Stockholder is a valuable legal instrument that safeguards the rights and interests of the surviving spouse in relation to the deceased stockholder's shares. It provides peace of mind and financial security by shielding the widow from potential lawsuits and liabilities, ensuring a smoother transition and resolution of ownership matters.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.King Washington Pacto de no demandar por viuda de accionista fallecido - Covenant Not to Sue by Widow of Deceased Stockholder

Description

How to fill out King Washington Pacto De No Demandar Por Viuda De Accionista Fallecido?

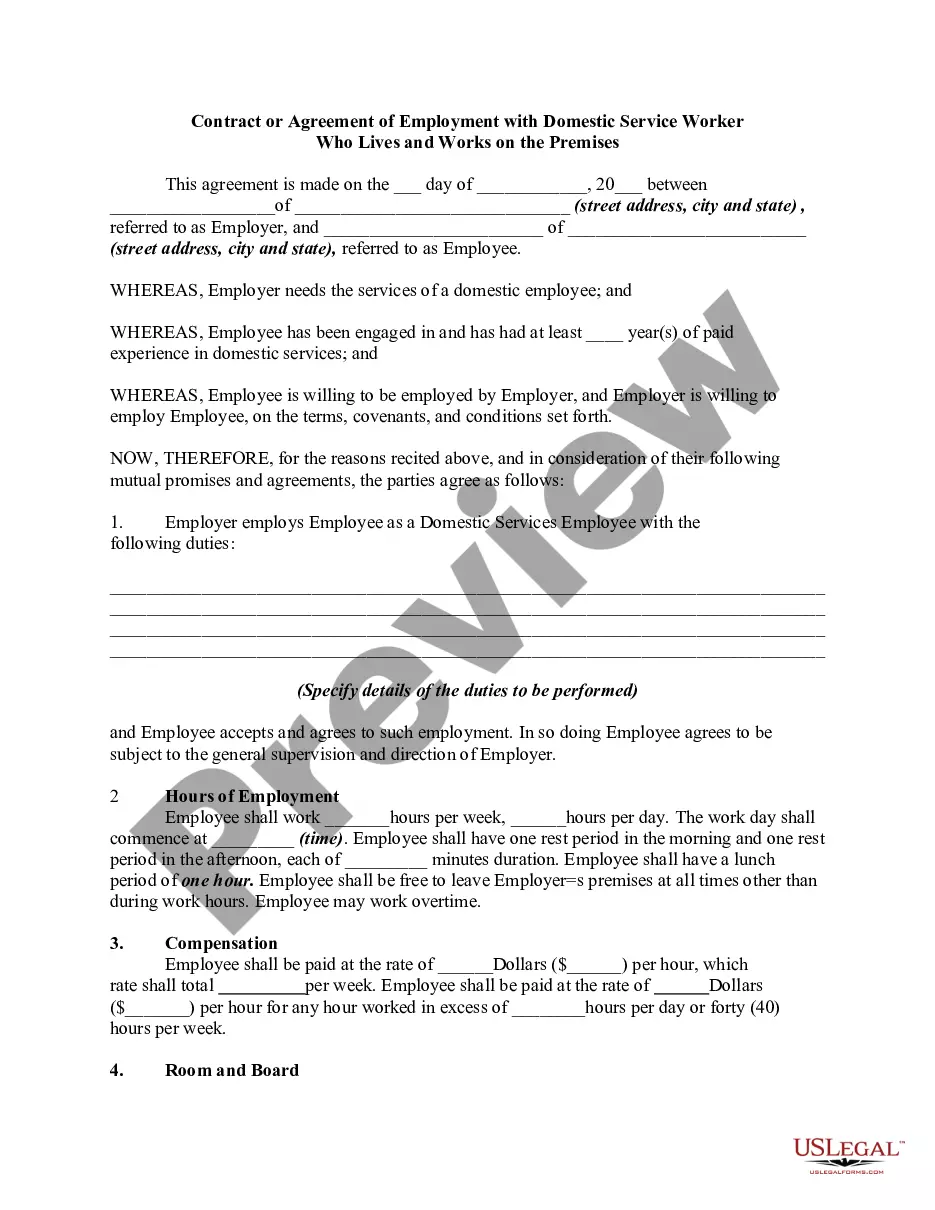

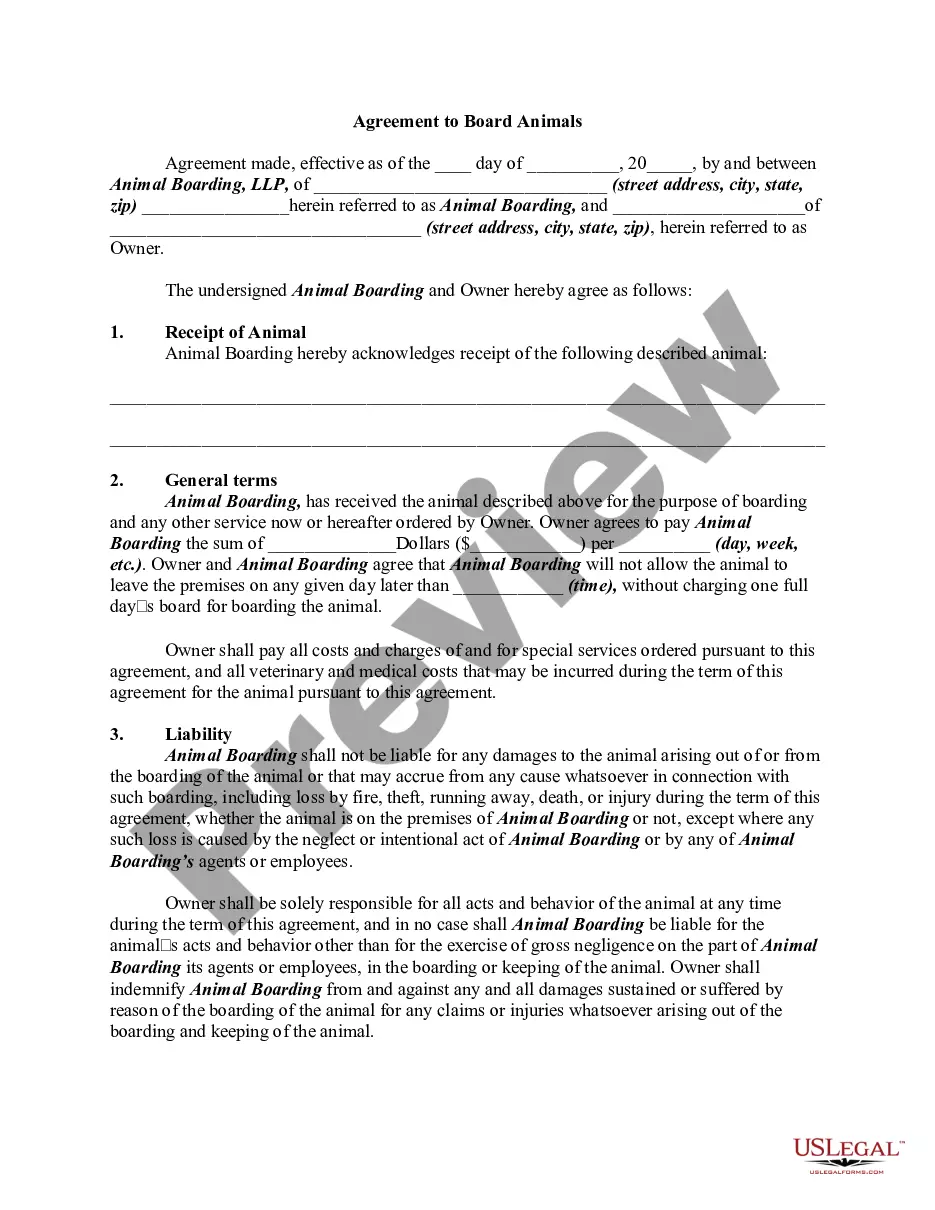

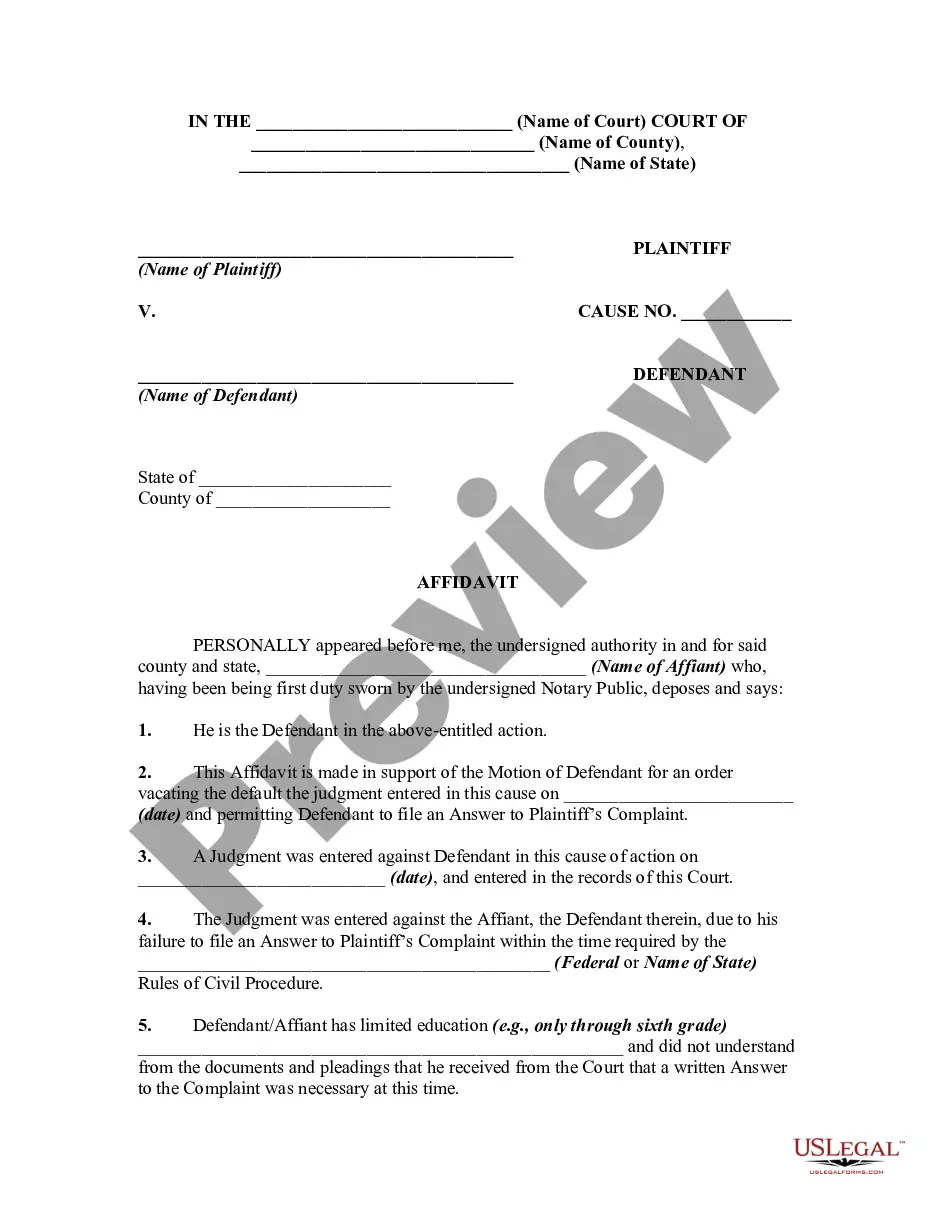

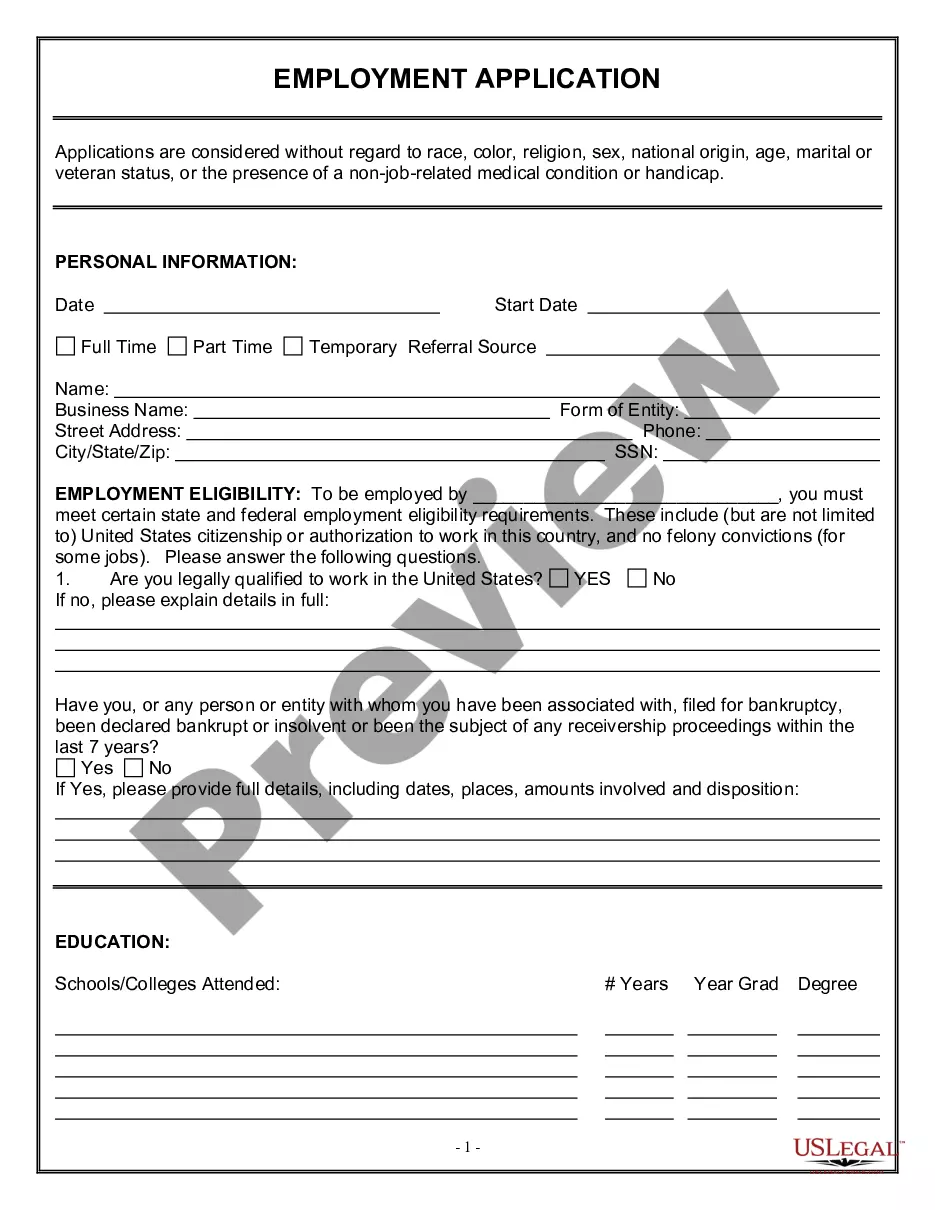

Creating forms, like King Covenant Not to Sue by Widow of Deceased Stockholder, to manage your legal matters is a challenging and time-consumming task. A lot of circumstances require an attorney’s participation, which also makes this task expensive. Nevertheless, you can take your legal matters into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal documents created for various scenarios and life circumstances. We make sure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the King Covenant Not to Sue by Widow of Deceased Stockholder template. Simply log in to your account, download the form, and customize it to your needs. Have you lost your form? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as simple! Here’s what you need to do before getting King Covenant Not to Sue by Widow of Deceased Stockholder:

- Make sure that your template is specific to your state/county since the regulations for writing legal papers may vary from one state another.

- Find out more about the form by previewing it or going through a brief intro. If the King Covenant Not to Sue by Widow of Deceased Stockholder isn’t something you were looking for, then use the header to find another one.

- Sign in or register an account to start using our service and download the document.

- Everything looks good on your side? Click the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment details.

- Your form is all set. You can go ahead and download it.

It’s an easy task to find and purchase the needed template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive library. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!