Santa Clara California Pacto de no demandar por viuda de accionista fallecido - Covenant Not to Sue by Widow of Deceased Stockholder

Description

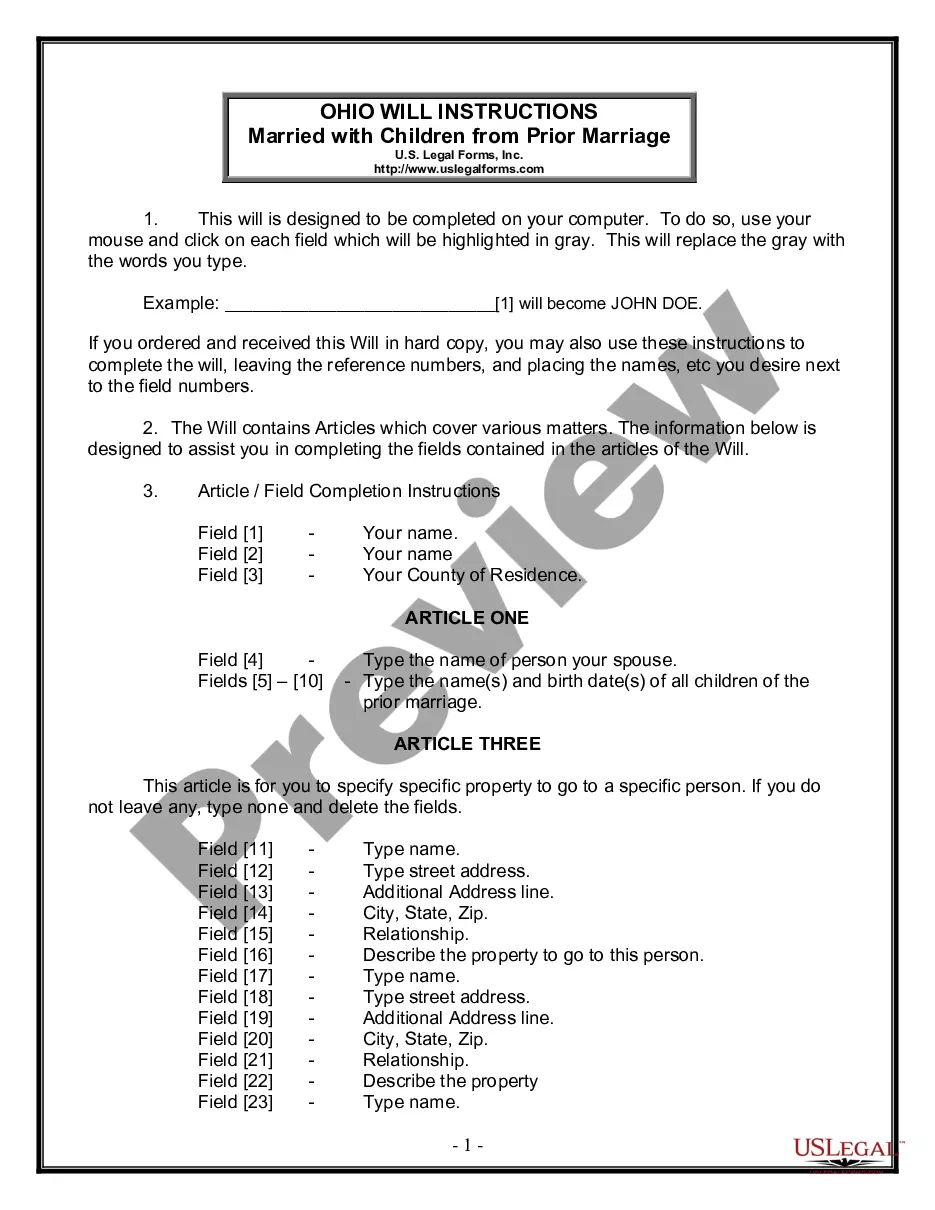

How to fill out Pacto De No Demandar Por Viuda De Accionista Fallecido?

Whether you intend to launch your enterprise, engage in a contract, request your identification modification, or address family-related legal issues, you must assemble particular paperwork in accordance with your regional laws and regulations.

Locating the appropriate documents may require significant time and exertion unless you utilize the US Legal Forms library.

The service offers users over 85,000 expertly drafted and verified legal templates for any personal or business matter.

Log in to your account and process the payment through a credit card or PayPal. Download the Santa Clara Covenant Not to Sue by Widow of Deceased Stockholder in your preferred file format. Print the document or complete it and sign it electronically using an online editor to save time. The forms offered by our library are reusable. With an active subscription, you can access all your previously purchased documents anytime from the My documents section of your profile. Stop wasting time in a perpetual search for current official documents. Register for the US Legal Forms platform and maintain your paperwork in order with the most comprehensive online form collection!

- All documents are categorized by state and purpose, making it quick and straightforward to select a copy like the Santa Clara Covenant Not to Sue by Widow of Deceased Stockholder.

- Users of the US Legal Forms library merely need to Log In to their account and click the Download button adjacent to the desired template.

- If you are new to the service, it will involve several additional steps to acquire the Santa Clara Covenant Not to Sue by Widow of Deceased Stockholder.

- Ensure the sample meets your unique requirements and adheres to state law stipulations.

- Examine the form description and inspect the Preview if available on the page.

- Utilize the search bar above to locate another template relevant to your state.

- Click Buy Now to purchase the file when you identify the correct one.

- Choose the subscription plan that best fits your needs to proceed.

Form popularity

FAQ

Al dia siguiente de que tu socio fallece, sus familiares directos pasan a convertirse en tus nuevos socios, con derechos y obligaciones en temas de propiedad, direccion y operacion del negocio.

Es decir, la regla general es que en caso de fallecimiento de alguno de los socios el contrato social se resuelve parcialmente, lo cual significa que los herederos no continuan como socios (no heredan el puesto de socio), debiendo pagarseles, en dinero o mediante la entrega de algun bien, el valor (real) de la parte

"En caso de muerte de un socio y ante la falta de prevision contractual, los herederos que acrediten su calidad tales se incorporaran a la sociedad, en el interin actuara en su representacion el administrador de la sucesion.

En caso de muerte de un socio, la sociedad solamente podra continuar con los herederos, cuando estos manifiesten su consentimiento; de lo contrario, la sociedad, dentro del plazo de dos meses, debera entregar a los herederos la cuota correspondiente al socio difunto, de acuerdo con el ultimo balance aprobado.

Una sociedad anonima es una sociedad comercial en al cual el capital se divide en acciones, que pueden presentarse en titulos negociables y la responsabilidad de los accionistas se limita a las acciones que suscriban con el capital aportado en la sociedad.

Uno de los tipos de sociedades contemplado por la Ley General de Sociedades Mercantiles y que es una de las mas comunes en nuestro derecho mexicano es la sociedad anonima. La sociedad anonima es la que existe bajo una denominacion y se compone exclusivamente de socios cuya obligacion se limita al pago de sus acciones.

De acuerdo con el Codigo General del Proceso, se debera buscar a los familiares del fallecido. En caso de no obtener respuesta de alguno de los allegados o no encontrar herederos, los demas socios estan legitimados para solicitar la apertura del proceso de sucesion.

La sociedad anonima es una de las mas populares y de mayor importancia, a la cual recurren las personas fisicas y morales para reunirse, formar una empresa y realizar actos de comercio.

El socio A fallece y les hereda en partes iguales sus acciones a su conyuge y a sus dos hijos. Sin embargo, esto es contrario a lo estipulado en los Estatutos Sociales. Por lo que se debe llegar a un acuerdo entre los socios y los herederos, o en su caso, estos ultimos vender sus acciones.

Una sociedad anonima, tambien conocida por su abreviatura S.A., es un tipo de sociedad mercantil en el que la responsabilidad de los socios se limita al capital que han aportado. La sociedad anonima es el mas claro ejemplo de sociedad capitalista en el mundo empresarial y economico.