Fairfax Virginia Crummy Trust Agreement for Benefit of Child with Parents as Trustees is a legal arrangement that allows parents in Fairfax, Virginia, to set aside assets for their child's benefit while utilizing the Crummy power. The Crummy power is named after the Crummy v. Commissioner court case, which established that trust beneficiaries have a limited right to withdraw contributions made to the trust, thus qualifying them for gift tax exclusion. By utilizing this power, the trust can offer tax advantages to the trustees (parents) while securing financial security for their child. There are several types of Fairfax Virginia Crummy Trust Agreements for Benefit of Child with Parents as Trustees, which include: 1. Irrevocable Life Insurance Trust (IIT): This type of trust is commonly used to fund life insurance policies. The trust is created and assets are contributed by the trustees, which are then used to pay the insurance premiums. Upon the death of the trustees, the insurance proceeds are paid into the trust, providing financial support for the child. 2. Educational Trust: This trust is specifically designed to provide funds for the child's education. The trustees contribute assets that are then invested and grow over time. When the child reaches a certain age or specific educational milestones, the trust can distribute funds for educational expenses. 3. Special Needs Trust: A Special Needs Trust is established to benefit a child with special needs. This trust ensures that assets set aside for the child's benefit do not affect their eligibility for government assistance programs. The trustees can contribute assets while carefully structuring the distributions to supplement the child's needs without jeopardizing their assistance. 4. Dynasty Trust: Also known as a "generation-skipping trust," this type of trust is designed to transfer wealth and assets to future generations while minimizing estate taxes. The trustees can transfer a significant amount of assets into the trust, which will be managed for the benefit of the child. The trust's provisions can span multiple generations, allowing wealth to grow and pass down over time. In summary, the Fairfax Virginia Crummy Trust Agreement for Benefit of Child with Parents as Trustees is a versatile legal instrument that allows parents to protect and provide for their child's future financial needs. Various types of these trusts, such as the Irrevocable Life Insurance Trust, Educational Trust, Special Needs Trust, Dynasty Trust, cater to specific circumstances and goals of the trustees while maximizing the tax advantages offered by the Crummy power.

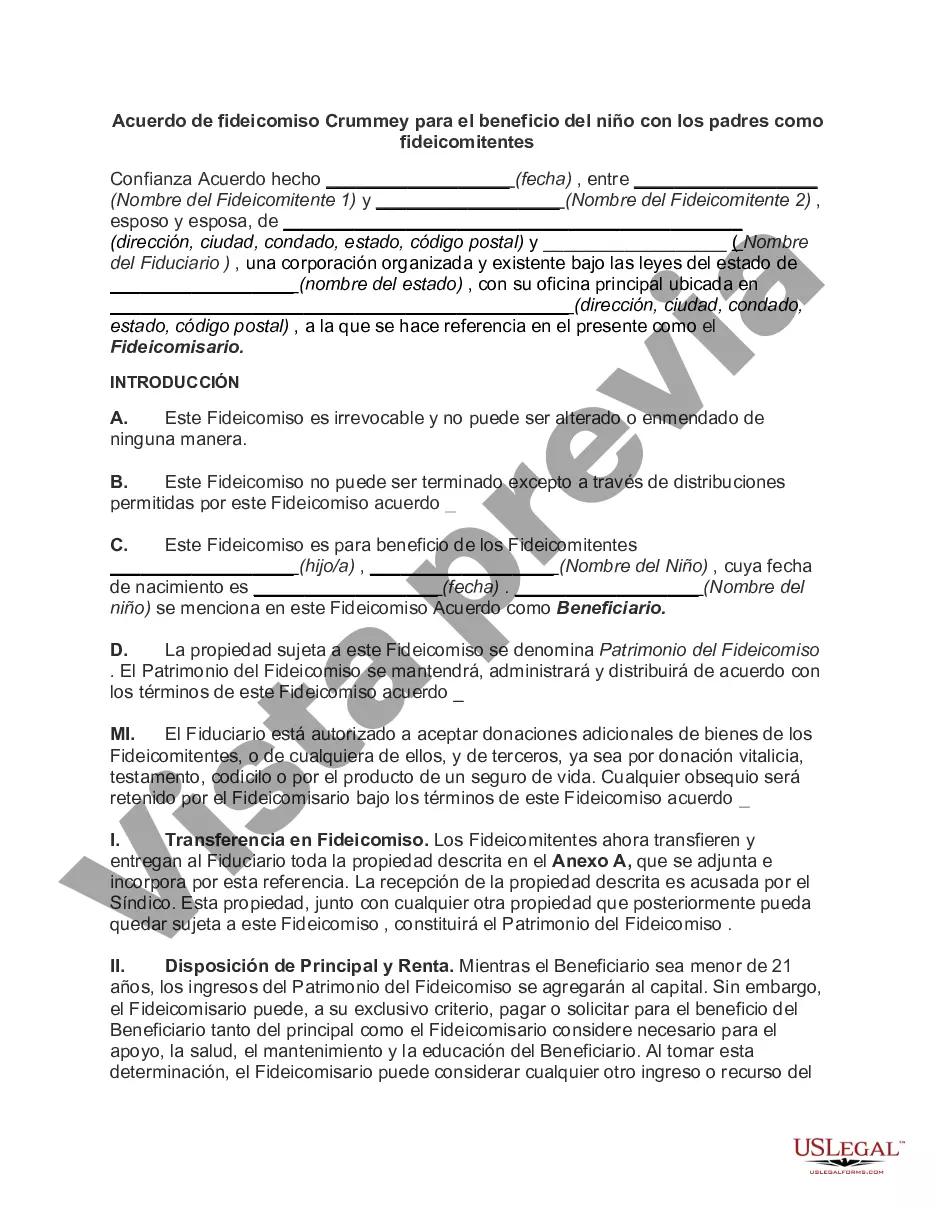

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Acuerdo de fideicomiso Crummey para el beneficio del niño con los padres como fideicomitentes - Crummey Trust Agreement for Benefit of Child with Parents as Trustors

Description

How to fill out Fairfax Virginia Acuerdo De Fideicomiso Crummey Para El Beneficio Del Niño Con Los Padres Como Fideicomitentes?

Preparing paperwork for the business or personal demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state regulations of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to generate Fairfax Crummey Trust Agreement for Benefit of Child with Parents as Trustors without professional assistance.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Fairfax Crummey Trust Agreement for Benefit of Child with Parents as Trustors by yourself, using the US Legal Forms web library. It is the biggest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary form.

If you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Fairfax Crummey Trust Agreement for Benefit of Child with Parents as Trustors:

- Look through the page you've opened and check if it has the document you require.

- To do so, use the form description and preview if these options are presented.

- To find the one that satisfies your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any use case with just a couple of clicks!

Form popularity

FAQ

Caracteristicas del Fideicomiso Contiene bienes de cualquier naturaleza. Constituye un patrimonio separado. Se constituye por escrito y ante notario. Posee un regimen de publicidad registral que lo hace oponible a terceros.

Beneficiario. Es la persona que percibe los beneficios estipulados en el fideicomiso. Fideicomisario. Es el destinatario final de la propiedad.

Un fideicomiso es una forma de titularidad de propiedad que separa la titularidad efectiva de la titularidad legal. Designa a un fideicomisario como propietario legal de los activos, al tiempo que designa a uno o varios beneficiarios que gozaran de los beneficios de los bienes depositados en el fideicomiso.

UN FIDEICOMISO ES: Una operacion mercantil mediante la cual una persona -fisica o moral- llamada fideicomitente, destina ciertos bienes a la realizacion de un fin licito determinado, encomendando esta a una Institucion de Credito (Art. 381 de la Ley General de Titulos y Operaciones de Credito).

Es la persona que en virtud del negocio fiduciario, recibe el provecho del fideicomiso y, eventualmente, los mismos bienes fideicometidos al vencimiento del termino estipulado.

Dichos actos deben generar algun beneficio de caracter economico y estos beneficios deben ser dados a una persona a la que se conoce como fideicomisario. La persona que da los bienes es el fideicomitente y la que los recibe es la institucion fiduciaria.

Hay tres partes clave que componen un fideicomiso: un otorgante, que establece un fideicomiso y lo llena con sus activos, un beneficiario, que es la persona elegida para recibir los activos del fideicomiso y un fiduciario, que es el encargado de administrar los activos que se le han confiado.

O Bienes fideicometidos. o Finalidad del fideicomiso. o Instrucciones de inversion o disposicion. o Remuneracion del fiduciario y cobertura de otros gastos. o Ejercicio economico de la administracion fiduciaria (fecha cierre). o Rendicion de cuentas. o Duracion del contrato. o Condiciones de modificacion, sustitucion,

Hay tres partes clave que componen un fideicomiso: un otorgante, que establece un fideicomiso y lo llena con sus activos, un beneficiario, que es la persona elegida para recibir los activos del fideicomiso y un fiduciario, que es el encargado de administrar los activos que se le han confiado.

Es un termino legal que se refiere a cualquier persona con propiedad, autoridad, posicion de confianza o responsabilidad sobre los bienes de otra persona. En consecuencia, este es una persona a quien se le permite realizar tareas de administracion sobre unos bienes sin lucrarse de ellos.