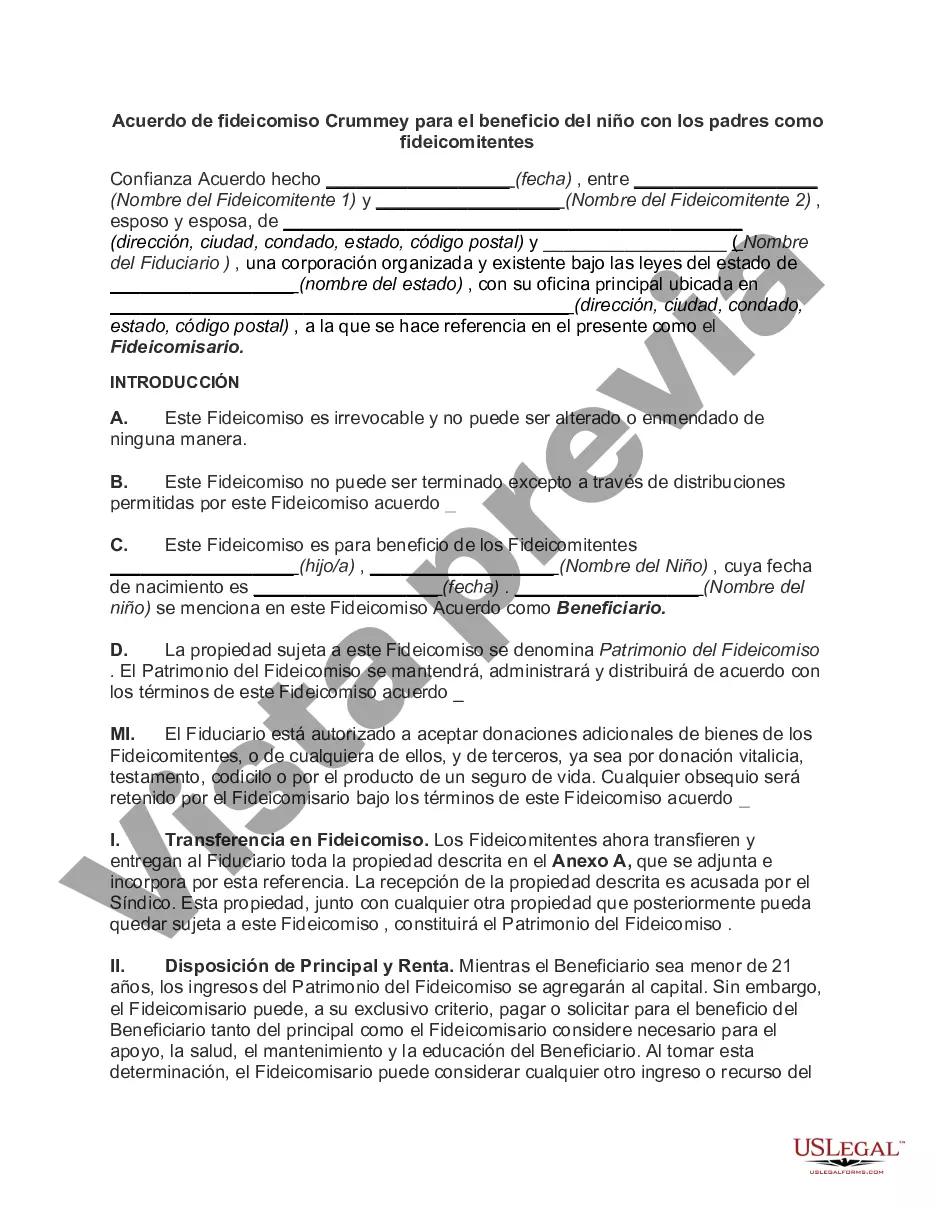

A Mecklenburg North Carolina Crummy Trust Agreement for the Benefit of a Child with Parents as Trustees is a legally binding document that outlines the creation, management, and distribution of a trust fund for the benefit of a child. This type of trust is commonly used for estate planning purposes, allowing parents to establish provisions for their child's financial future. The Mecklenburg North Carolina Crummy Trust Agreement enables parents to set aside assets and designate them to be held in trust until the child reaches a particular age or milestone, such as turning 18 or graduating from college. The trustees, who are typically the child's parents, contribute assets to establish the trust, and also assume the role of trustees, responsible for managing and overseeing the trust's assets. One notable feature of the Mecklenburg North Carolina Crummy Trust Agreement is the inclusion of a "Crummy power" provision. This provision allows the trustees to make gifts into the trust that qualify for the annual gift tax exclusion, which is currently $15,000 per recipient. By using this provision, the trustees can make these gifts without incurring any gift tax liability. Under Mecklenburg North Carolina law, there are no different named types of Crummy Trust Agreements for the benefit of a child with parents as trustees. However, the specific terms and conditions of the trust can be customized according to the trustees' preferences and the needs of the child. The Mecklenburg North Carolina Crummy Trust Agreement typically includes important details such as: 1. Identification of the trustees: The document specifies the names and details of the parents who are establishing the trust on behalf of their child. 2. Appointment of trustees: The trust agreement identifies the parents as trustees responsible for administering and managing the trust's assets while the child is still a minor. It may also appoint successor trustees to take over management in the event the parents are unable or unwilling to fulfill their duties. 3. Beneficiary designation: The name of the child or children who will benefit from the trust is explicitly stated in the agreement. 4. Crummy power provision: This provision outlines the trustees' ability to make contributions to the trust in the form of annual gifts that qualify for the gift tax exclusion. 5. Distribution terms: The agreement defines the circumstances under which the trust's assets may be distributed to the child, such as reaching a certain age or achieving specific milestones, like completing higher education. 6. Trust duration: The document specifies how long the trust will remain in effect and how the assets will be distributed when it terminates, such as dividing them equally among multiple beneficiaries or transferring them to a different trust. It is crucial to consult with an experienced attorney while preparing a Mecklenburg North Carolina Crummy Trust Agreement for the Benefit of a Child with Parents as Trustees, as they can provide guidance and help craft a personalized trust that meets the specific needs and goals of the trustees and their child.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Acuerdo de fideicomiso Crummey para el beneficio del niño con los padres como fideicomitentes - Crummey Trust Agreement for Benefit of Child with Parents as Trustors

Description

How to fill out Mecklenburg North Carolina Acuerdo De Fideicomiso Crummey Para El Beneficio Del Niño Con Los Padres Como Fideicomitentes?

Draftwing forms, like Mecklenburg Crummey Trust Agreement for Benefit of Child with Parents as Trustors, to manage your legal matters is a difficult and time-consumming task. A lot of circumstances require an attorney’s participation, which also makes this task not really affordable. However, you can get your legal matters into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms intended for different cases and life circumstances. We ensure each form is compliant with the regulations of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Mecklenburg Crummey Trust Agreement for Benefit of Child with Parents as Trustors template. Simply log in to your account, download the template, and customize it to your requirements. Have you lost your form? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as straightforward! Here’s what you need to do before downloading Mecklenburg Crummey Trust Agreement for Benefit of Child with Parents as Trustors:

- Make sure that your template is specific to your state/county since the regulations for writing legal papers may vary from one state another.

- Learn more about the form by previewing it or going through a quick description. If the Mecklenburg Crummey Trust Agreement for Benefit of Child with Parents as Trustors isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin utilizing our service and download the document.

- Everything looks great on your end? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your template is all set. You can go ahead and download it.

It’s easy to locate and buy the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!