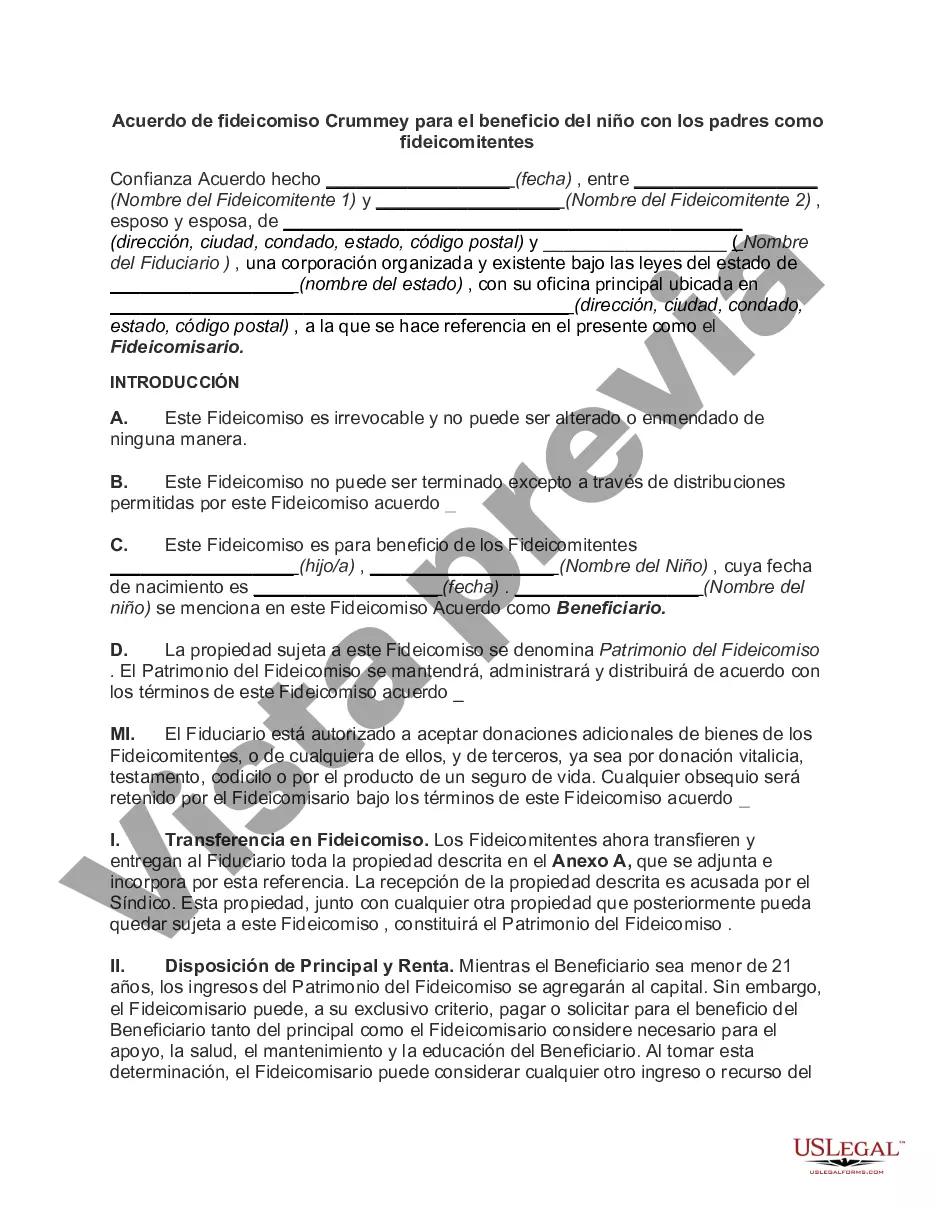

The Nassau New York Crummy Trust Agreement for the Benefit of a Child with Parents as Trustees is a legal document that outlines the terms, conditions, and guidelines for creating a trust fund in Nassau County, New York. This trust agreement allows parents to set aside and protect assets for the benefit of their child or children. A Crummy Trust is a type of irrevocable trust that utilizes the Crummy Power, which enables the trustees to make annual gift contributions to the trust on behalf of their child. The Crummy Power allows the trust to qualify for annual gift tax exemptions. By utilizing this type of trust, the parents can transfer assets to their child without incurring gift taxes, while ensuring that the child's future financial needs are taken care of. There are different types of Nassau New York Crummy Trust Agreements for the Benefit of a Child with Parents as Trustees, including: 1. Testamentary Crummy Trust: This type of trust is created through a will and becomes active upon the death of the trust or(s). It allows parents to establish provisions for their child's future financial security after they pass away. 2. Living Crummy Trust: This trust is established during the lifetime of the trustees and remains in effect until a specified event occurs, such as the child reaching a certain age or milestone. Parents can use this trust to manage and allocate assets for their child's benefit while they are alive. 3. Revocable Crummy Trust: This trust provides the flexibility for parents to modify or revoke the trust agreement during their lifetime. It can be altered as circumstances change, allowing the trustees to adapt to any significant events or financial considerations. 4. Special Needs Crummy Trust: Designed specifically for children with special needs or disabilities, this trust ensures that the child's eligibility for government assistance is not compromised. It provides supplemental support without disqualifying them from receiving essential public benefits. A Nassau New York Crummy Trust Agreement for the Benefit of a Child with Parents as Trustees is a valuable tool for parents in Nassau County, New York, who wish to establish a secure financial foundation for their child's future. By utilizing this agreement, parents can protect and manage assets for the benefit of their child while taking advantage of gift tax exemptions afforded by the Crummy Power.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Acuerdo de fideicomiso Crummey para el beneficio del niño con los padres como fideicomitentes - Crummey Trust Agreement for Benefit of Child with Parents as Trustors

Description

How to fill out Nassau New York Acuerdo De Fideicomiso Crummey Para El Beneficio Del Niño Con Los Padres Como Fideicomitentes?

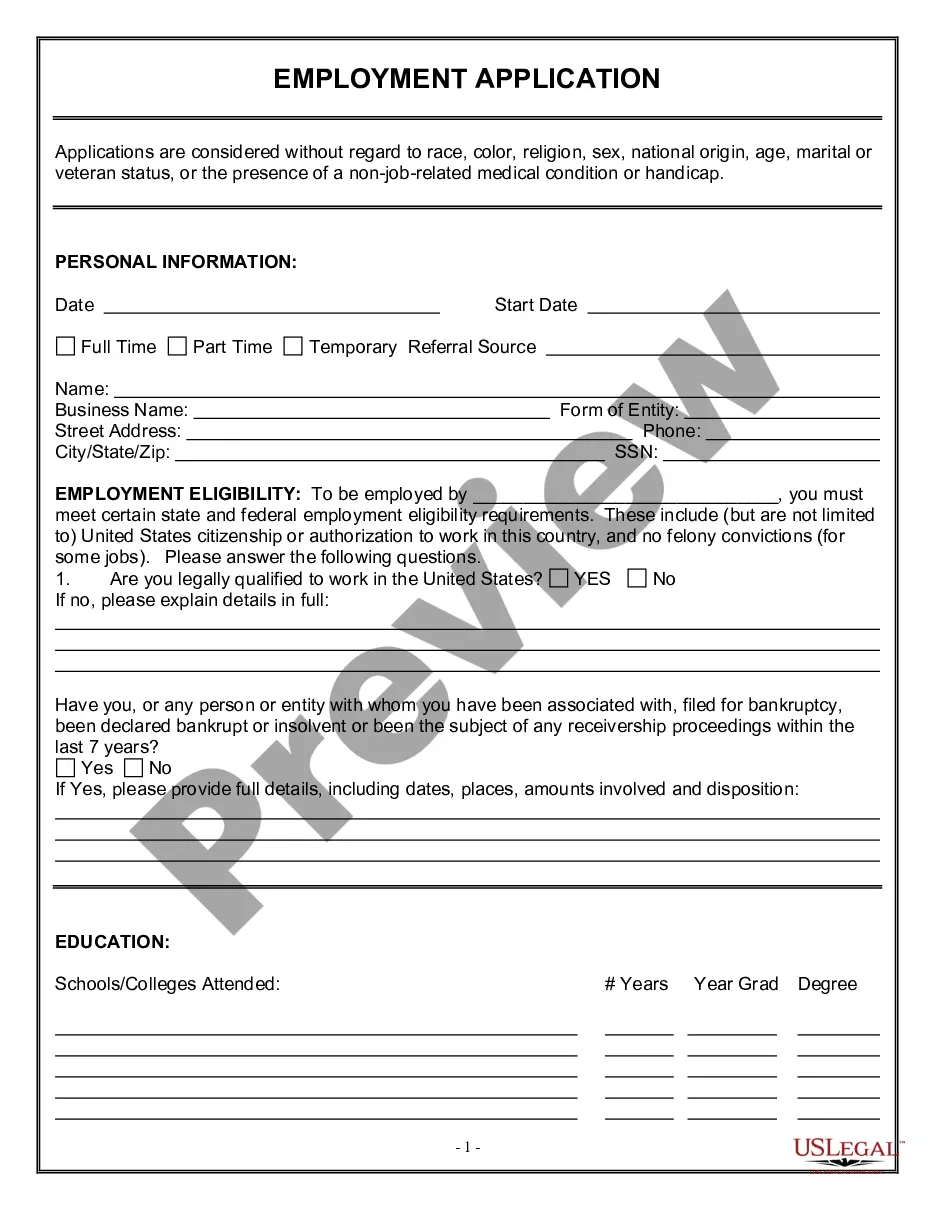

Whether you intend to start your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare certain paperwork corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any individual or business occasion. All files are collected by state and area of use, so opting for a copy like Nassau Crummey Trust Agreement for Benefit of Child with Parents as Trustors is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several additional steps to get the Nassau Crummey Trust Agreement for Benefit of Child with Parents as Trustors. Follow the guidelines below:

- Make sure the sample fulfills your personal needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the file once you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Nassau Crummey Trust Agreement for Benefit of Child with Parents as Trustors in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!