A Salt Lake Utah Crummy Trust Agreement for the Benefit of Child with Parents as Trustees is a legal document that allows parents to set up a trust for their child's benefit in Salt Lake City, Utah. This agreement provides specific guidelines for managing and distributing assets, ensuring the child's financial security while allowing the parents to maintain control over the trust. The Crummy Trust Agreement is named after the Crummy power, which is an essential aspect of this trust. It refers to the ability of the beneficiaries, in this case, the child, to withdraw gifted assets from the trust for a limited time. This provision helps qualify the trust for certain tax advantages by allowing the assets to be considered as a present interest gift. There are different types of Salt Lake Utah Crummy Trust Agreements that parents can choose from, depending on their specific needs and goals. These include: 1. Irrevocable Crummy Trust: This type of trust cannot be modified or revoked once it is established. It provides a higher level of asset protection and can help minimize tax liabilities. 2. Revocable Crummy Trust: Unlike the irrevocable trust, this type of trust allows the parents to modify or revoke it at any time. It offers greater flexibility but without the same level of asset protection or tax advantages. 3. Dynasty Crummy Trust: This trust aims to extend beyond one generation and provides a way to transfer wealth to subsequent generations while still qualifying for certain tax benefits. 4. Discretionary Crummy Trust: In this trust, the trustee has discretionary authority over when and how distributions are made to the child. The trustee considers various factors such as the child's needs, health, education, and overall well-being. 5. Testamentary Crummy Trust: This trust is established through a will and only comes into effect upon the death of the parents. It allows parents to ensure their child's financial security while maintaining control over the distribution of assets. A Salt Lake Utah Crummy Trust Agreement for the Benefit of Child with Parents as Trustees provides an effective way for parents to safeguard and manage their child's financial future. By selecting the appropriate type of trust and including specific provisions, parents can tailor the agreement to meet their unique circumstances and estate planning objectives.

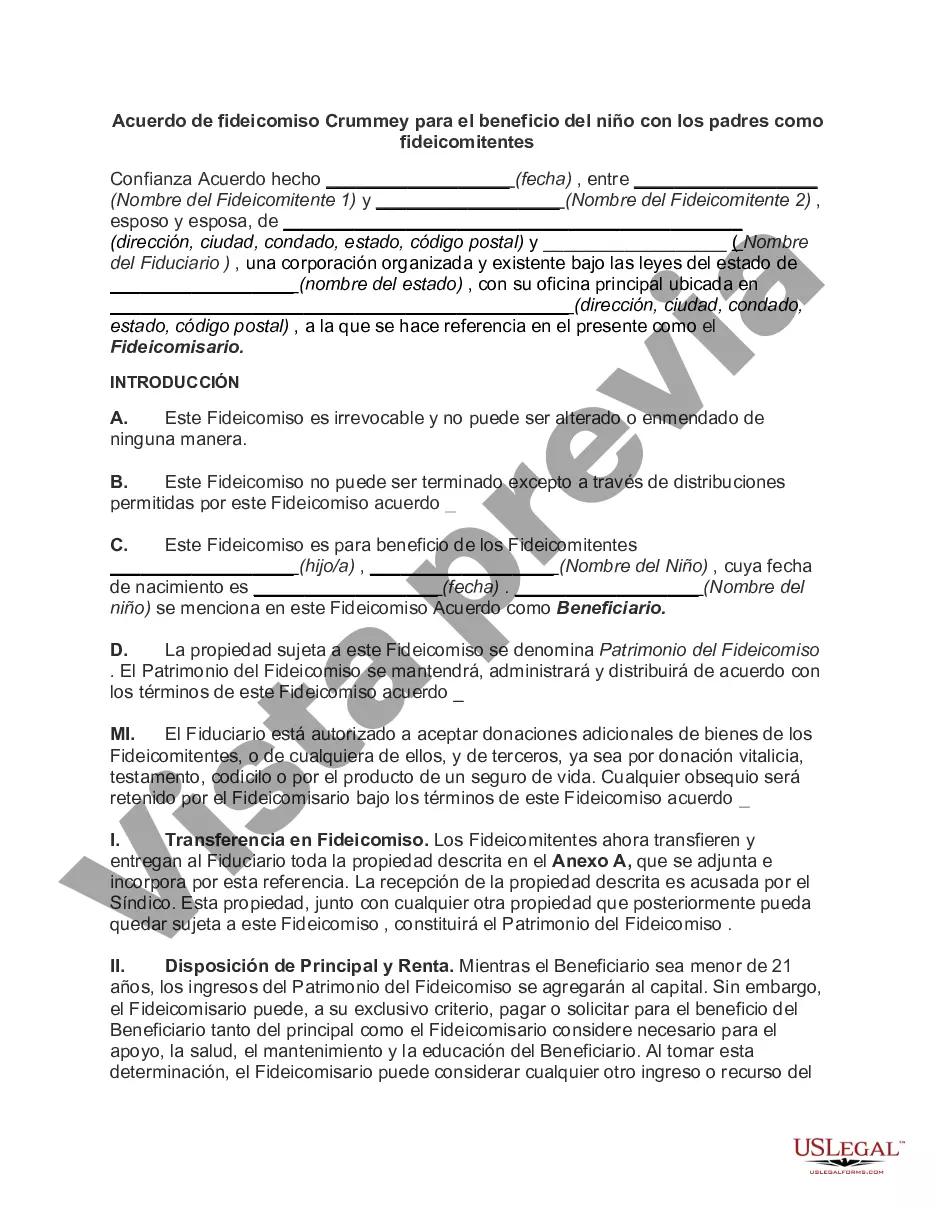

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Acuerdo de fideicomiso Crummey para el beneficio del niño con los padres como fideicomitentes - Crummey Trust Agreement for Benefit of Child with Parents as Trustors

Description

How to fill out Salt Lake Utah Acuerdo De Fideicomiso Crummey Para El Beneficio Del Niño Con Los Padres Como Fideicomitentes?

If you need to get a trustworthy legal document supplier to find the Salt Lake Crummey Trust Agreement for Benefit of Child with Parents as Trustors, consider US Legal Forms. Whether you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can search from more than 85,000 forms arranged by state/county and situation.

- The intuitive interface, variety of learning materials, and dedicated support make it easy to find and complete various documents.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

Simply type to look for or browse Salt Lake Crummey Trust Agreement for Benefit of Child with Parents as Trustors, either by a keyword or by the state/county the form is created for. After locating necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the Salt Lake Crummey Trust Agreement for Benefit of Child with Parents as Trustors template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Register an account and select a subscription plan. The template will be immediately ready for download as soon as the payment is processed. Now you can complete the form.

Taking care of your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive collection of legal forms makes this experience less expensive and more reasonably priced. Set up your first business, arrange your advance care planning, create a real estate agreement, or execute the Salt Lake Crummey Trust Agreement for Benefit of Child with Parents as Trustors - all from the comfort of your home.

Join US Legal Forms now!