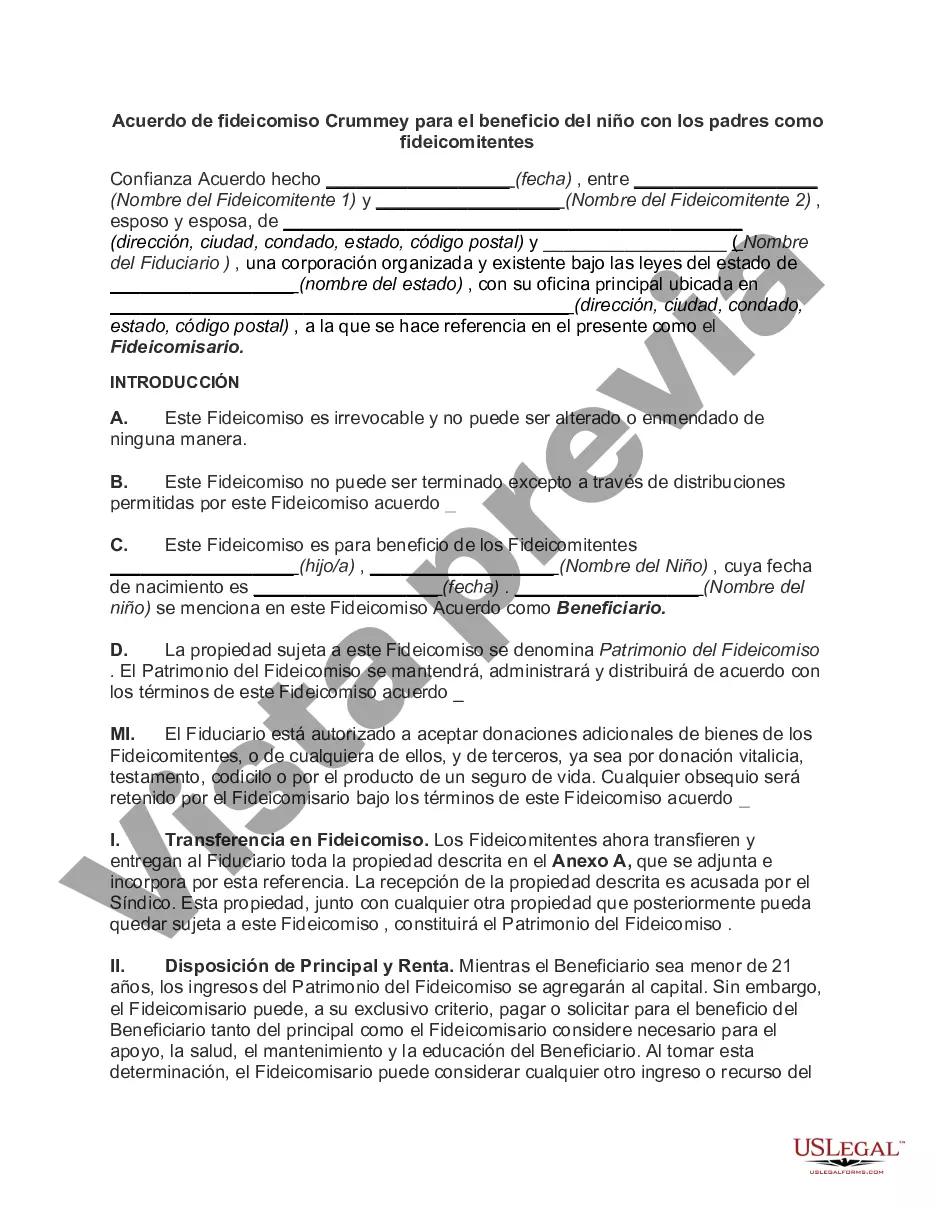

The San Diego California Crummy Trust Agreement for the Benefit of Child with Parents as Trustees is a specialized legal document used in estate planning to establish trusts that provide financial support and asset preservation for minors. This trust agreement ensures that the child, named as the beneficiary, receives specific benefits while the parents act as the trustees or creators of the trust fund. This type of trust agreement is highly advantageous for families seeking to safeguard their assets, minimize estate taxes, and control the distribution of wealth to their children. The main purpose of the San Diego California Crummy Trust Agreement for the Benefit of Child with Parents as Trustees is to utilize the Crummy power, a feature that allows annual tax-free gifts to be made to the trust on behalf of the child beneficiary. By utilizing the Crummy power, parents can maximize their gift tax exclusion while still maintaining control over how the gifted assets are used. There are various types and provisions of the San Diego California Crummy Trust Agreement for the Benefit of Child with Parents as Trustees. Some common variations include: 1. Irrevocable Crummy Trust: This trust agreement is designed to be irrevocable, meaning that once assets are transferred into the trust, they cannot be taken back or revoked. This ensures that the assets are protected and preserved for the child's benefit. 2. Discretionary Distribution Crummy Trust: This variation allows the trustee, appointed by the parents, to have discretionary control over the distribution of trust assets. The trustee has the authority to distribute funds based on the child's needs, such as education, healthcare, or other expenses. 3. Crummy Power Withdrawal Trust: Under this provision, the child beneficiary is given a limited period (usually 30 days) to withdraw the gifted assets from the trust. If the beneficiary chooses not to withdraw the funds within this specified time, they become part of the trust and cannot be accessed until a later date, usually when the child reaches a certain age. 4. Incentive Crummy Trust: This trust arrangement incorporates incentives to encourage certain behaviors or achievements from the child beneficiary, such as academic excellence, community service, or professional development. The trustee has the authority to distribute additional funds or assets based on the achievement of these specific goals. Overall, the San Diego California Crummy Trust Agreement for the Benefit of Child with Parents as Trustees provides a comprehensive and flexible framework for parents to protect and grow their wealth while ensuring the welfare and financial security of their child. It is crucial to consult with a knowledgeable attorney specializing in estate planning to draft a trust agreement that suits the specific needs and goals of the trustees and the beneficiary.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Acuerdo de fideicomiso Crummey para el beneficio del niño con los padres como fideicomitentes - Crummey Trust Agreement for Benefit of Child with Parents as Trustors

Description

How to fill out San Diego California Acuerdo De Fideicomiso Crummey Para El Beneficio Del Niño Con Los Padres Como Fideicomitentes?

Whether you plan to start your business, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you must prepare certain paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business case. All files are grouped by state and area of use, so opting for a copy like San Diego Crummey Trust Agreement for Benefit of Child with Parents as Trustors is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several additional steps to obtain the San Diego Crummey Trust Agreement for Benefit of Child with Parents as Trustors. Follow the instructions below:

- Make sure the sample meets your personal needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the sample once you find the right one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the San Diego Crummey Trust Agreement for Benefit of Child with Parents as Trustors in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!