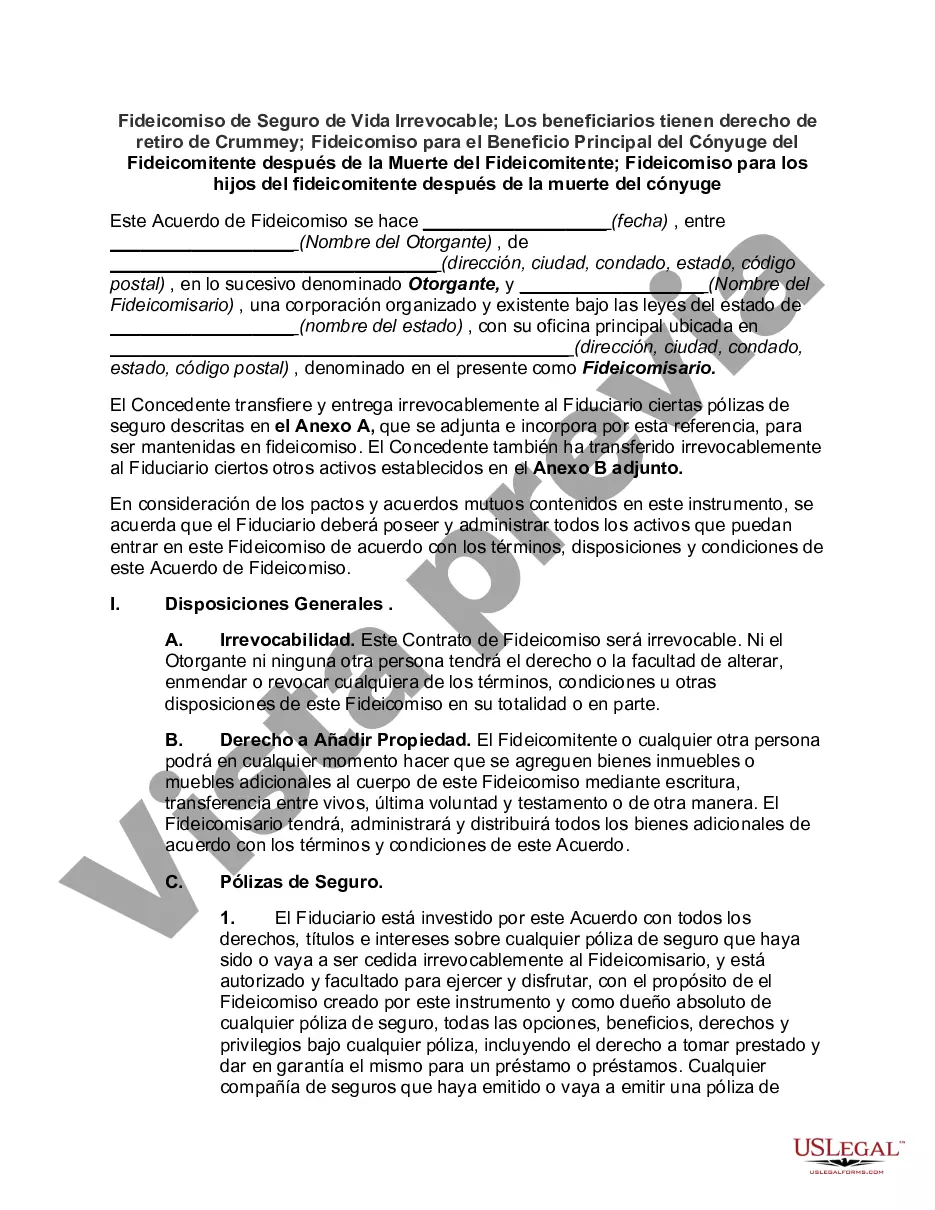

Chicago, Illinois is a thriving metropolis located in the heart of the Midwest. It is known for its rich history, stunning architectural beauty, world-class cuisine, and vibrant cultural scene. The city offers a wide range of attractions and activities for residents and visitors alike, making it an exceptional place to live and explore. One important aspect of financial planning in Chicago is the creation of an irrevocable life insurance trust, specifically designed to provide beneficiaries with the Crummy right of withdrawal. This trust, commonly referred to as an IIT, allows for tax-efficient wealth transfer and ensures that the proceeds from a life insurance policy are handled in a strategic manner. The Crummy right of withdrawal is a crucial component of an IIT in Chicago, Illinois. It gives beneficiaries the power to withdraw the funds gifted to the trust, typically for a limited time, usually 30 days after the gift is made. This withdrawal right allows the beneficiaries to exert control over the assets received, making the gift qualify for the annual gift tax exclusion. By utilizing this strategy, the granter can minimize estate taxes and provide for the financial security of their loved ones. It is essential to understand that there are different types of Slits available in Chicago, Illinois. Some variations include: 1. IIT with a Crummy Power Trust: This type of IIT is structured to provide the beneficiaries with the ability to exercise the Crummy right of withdrawal. It allows the trust assets to grow outside the granter's estate while still maintaining control over the funds passed on to the beneficiaries. 2. IIT with a Crummy Power and Generation-Skipping Trust: In certain situations, an IIT can be combined with a generation-skipping trust (GST) to capitalize on additional tax planning advantages. This allows wealth transfer from the granter to beneficiaries who are more than one generation younger, reducing estate tax liabilities even further. 3. IIT with Crummy Power and Wealth Replacement Trust: This type of IIT includes an additional strategy called the wealth replacement trust. With this structure, the IIT purchases a second-to-die life insurance policy, which replaces the value of the assets gifted to the trust, ensuring that the beneficiaries receive the intended inheritance while preserving the estate. An IIT with the Crummy right of withdrawal is a powerful tool for estate planning in Chicago, Illinois. It provides individuals with the ability to secure and transfer their wealth tax-efficiently while maintaining control over the assets passed down to their loved ones. By working with experienced professionals in the field, individuals can tailor an IIT to their specific needs and goals, ultimately safeguarding their financial legacy for future generations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuando Se Aplica Al Seguro De Vida Entera La Palabra Straight Denota - Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal

Description

How to fill out Chicago Illinois Fideicomiso De Seguro De Vida Irrevocable: Los Beneficiarios Tienen Derecho De Retiro De Crummey?

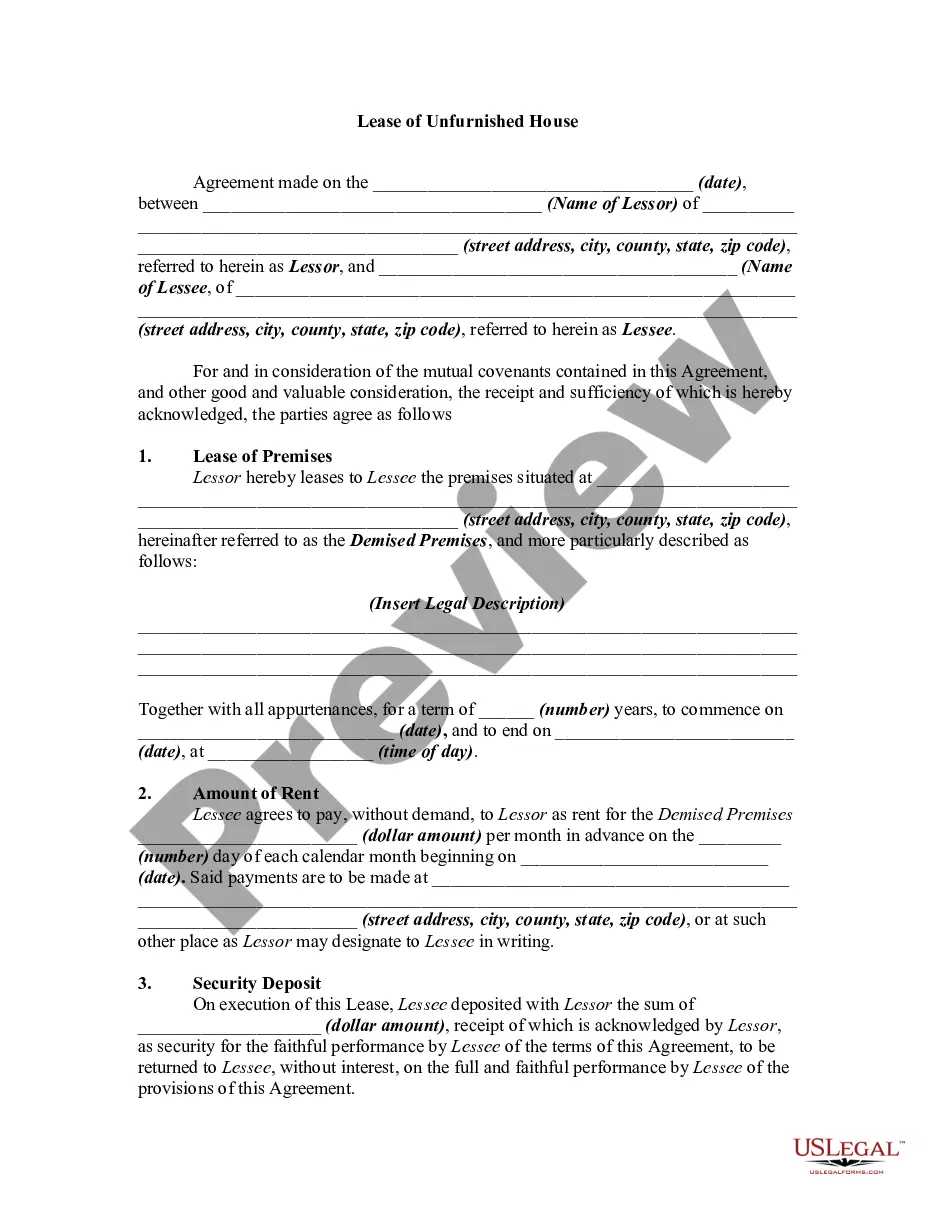

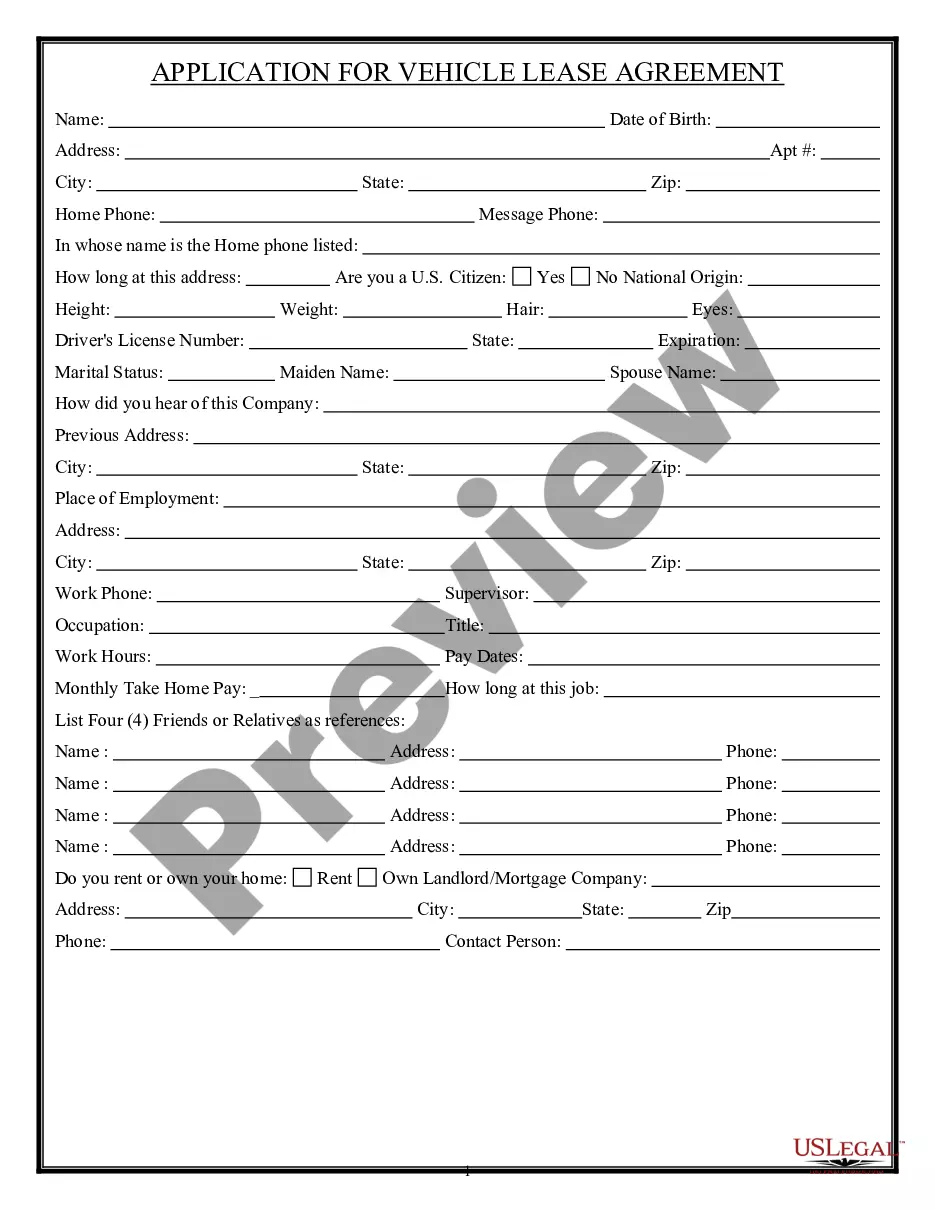

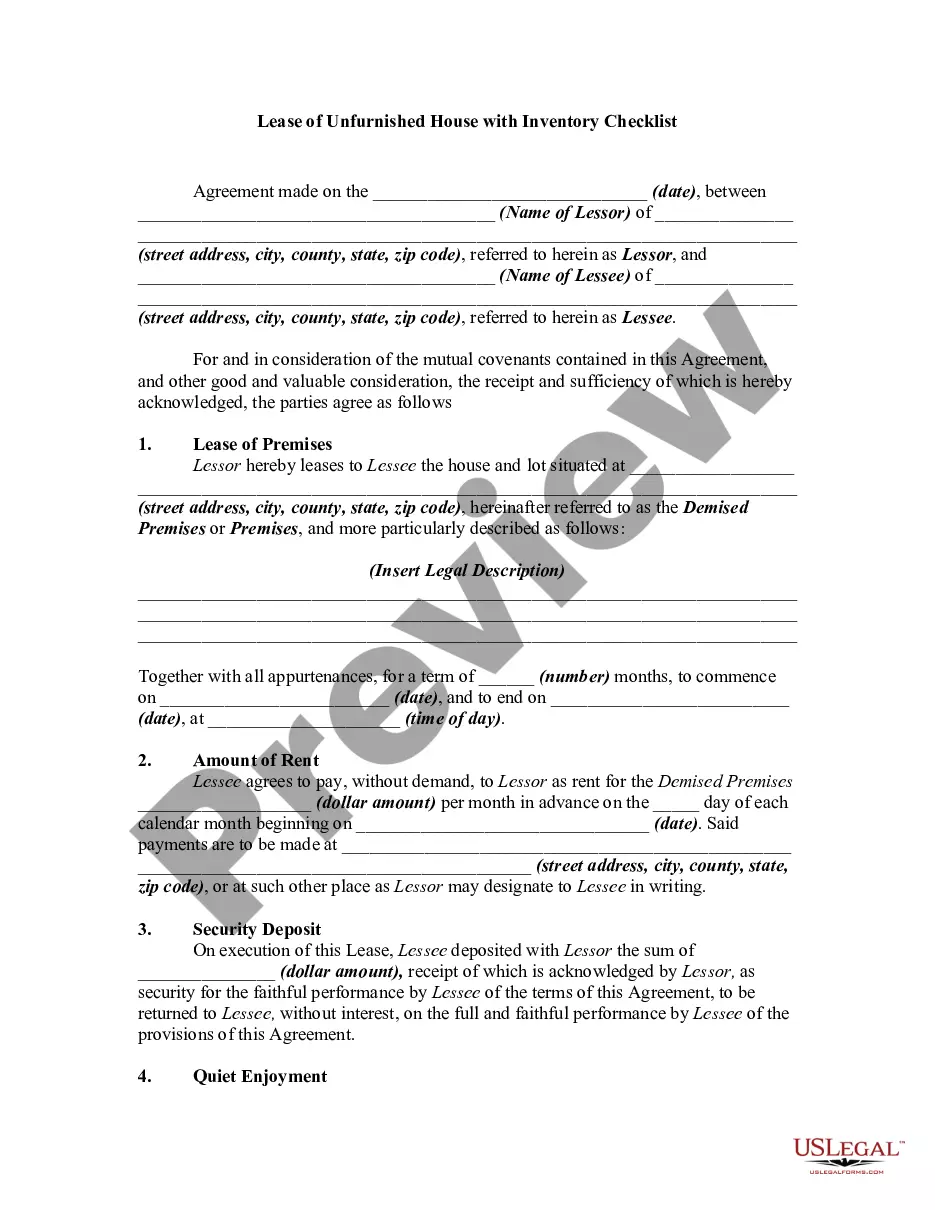

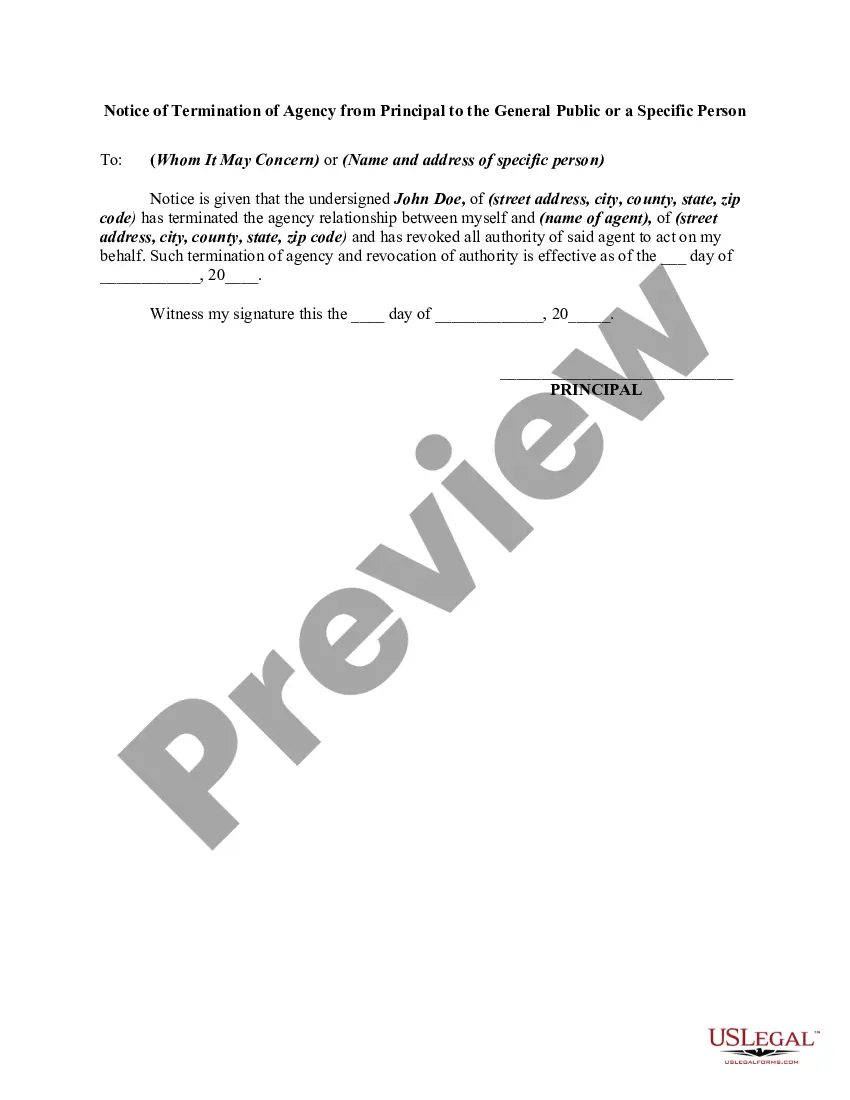

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from scratch, including Chicago Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in various types ranging from living wills to real estate paperwork to divorce papers. All forms are arranged based on their valid state, making the searching process less overwhelming. You can also find detailed materials and guides on the website to make any activities related to document completion simple.

Here's how to locate and download Chicago Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal.

- Go over the document's preview and description (if available) to get a basic information on what you’ll get after downloading the document.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can impact the validity of some records.

- Examine the similar forms or start the search over to locate the correct file.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the option, then a suitable payment gateway, and buy Chicago Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Chicago Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal, log in to your account, and download it. Needless to say, our website can’t take the place of a legal professional completely. If you need to deal with an exceptionally challenging situation, we recommend getting a lawyer to examine your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Become one of them today and get your state-compliant paperwork effortlessly!