A Harris Texas Irrevocable Life Insurance Trust is a legal arrangement in which a person's life insurance policy is placed in a trust for the benefit of their chosen beneficiaries. This type of trust provides various advantages, including tax benefits and asset protection. One crucial aspect of a Harris Texas Irrevocable Life Insurance Trust is the inclusion of a "Crummy" power, which grants beneficiaries the right to make withdrawals from the trust for a limited period. This withdrawal right is typically set for a specific timeframe, often 30 days, following each contribution made to the trust. The Crummy power is a crucial element in estate planning as it allows the trust to qualify for the gift tax exclusion. When the beneficiaries receive the withdrawal right, each contribution made to the trust by the insured individual is considered a present interest gift, making it eligible for the annual gift tax exclusion. This exclusion enables the insured individual to avoid incurring gift taxes up to a certain amount per beneficiary per year. There are different variations of Harris Texas Irrevocable Life Insurance Trusts with Crummy withdrawal rights, depending on the specific needs and objectives of the granter. Some of these variations may include: 1. Standard Crummy Trust: This type of trust includes the Crummy power of withdrawal for each beneficiary, ensuring ongoing eligibility for the annual gift tax exclusion. 2. Dynasty Crummy Trust: A dynasty trust extends the Crummy withdrawal power beyond the ordinary 30-day window, allowing beneficiaries to exert control over the trust assets for an extended period. This can help preserve generational wealth and protect assets from estate taxes. 3. TIP Crummy Trust: A TIP (Qualified Terminable Interest Property) trust is typically utilized in second marriage situations. It allows the insured individual to provide for their surviving spouse while ensuring that the remaining trust assets ultimately pass to the beneficiaries designated by the insured individual. 4. Testamentary Crummy Trust: Unlike other types of irrevocable trusts, a testamentary Crummy trust is created upon the insured individual's death through their will. This trust enables the insured individual to dictate precisely how proceeds from the life insurance policy should be distributed to beneficiaries, ensuring control and protection over assets even after their passing. In summary, a Harris Texas Irrevocable Life Insurance Trust with Crummy withdrawal rights is an estate planning tool that offers flexibility, tax advantages, and protection for the insured individual's beneficiaries. With various types of Crummy trusts available, individuals can tailor their trust to meet specific objectives and ensure the smooth transfer of assets to future generations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuando Se Aplica Al Seguro De Vida Entera La Palabra Straight Denota - Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal

Description

How to fill out Harris Texas Fideicomiso De Seguro De Vida Irrevocable: Los Beneficiarios Tienen Derecho De Retiro De Crummey?

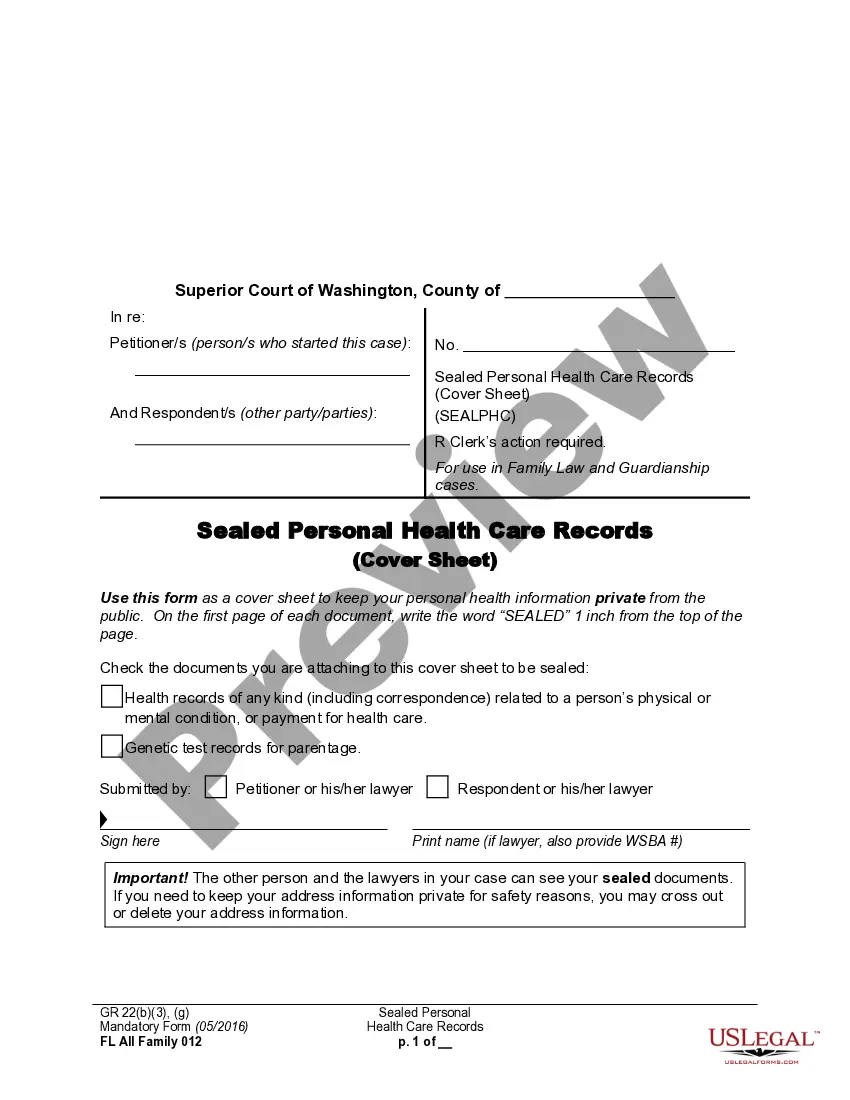

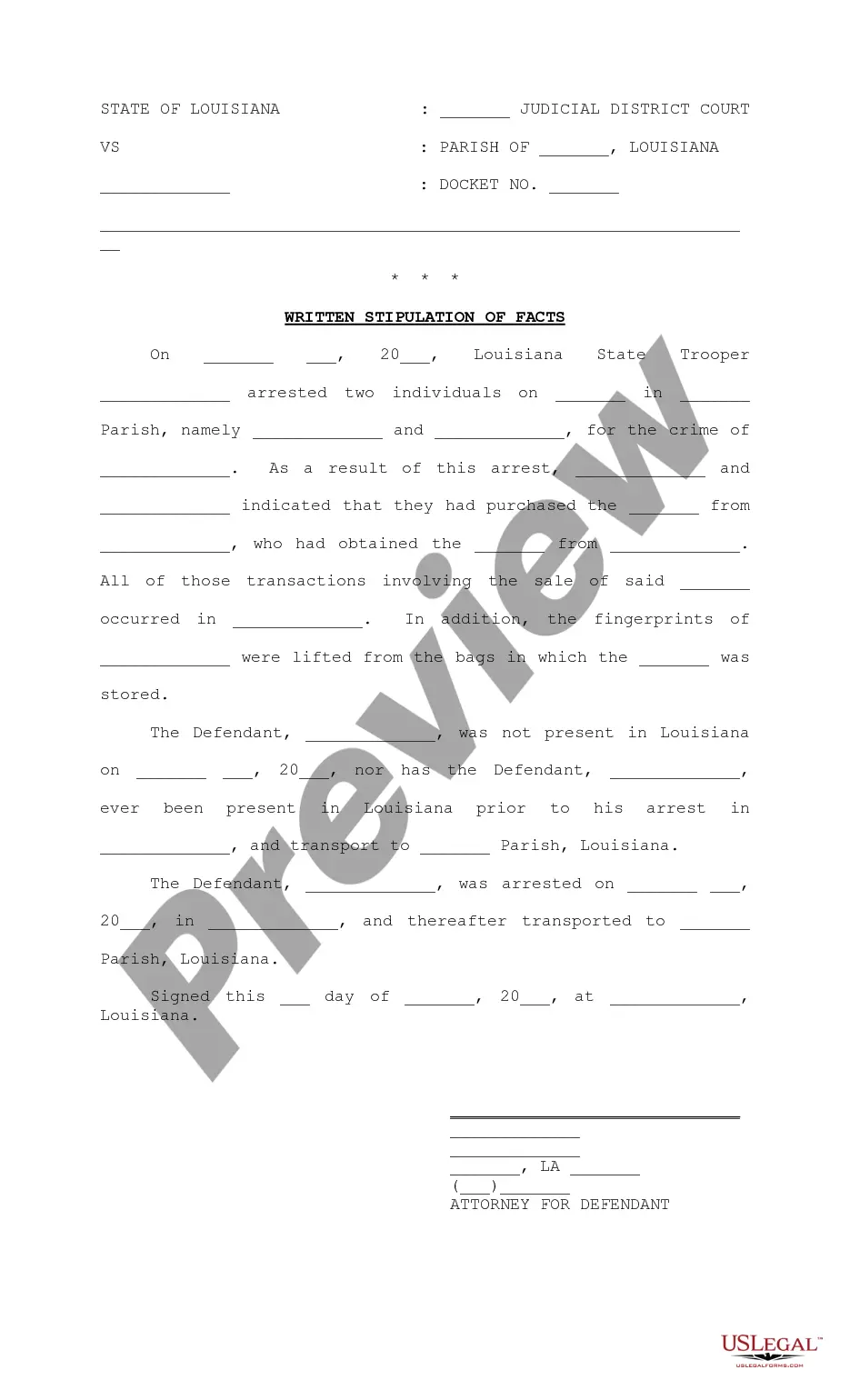

If you need to find a reliable legal form provider to get the Harris Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal, consider US Legal Forms. Whether you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed form.

- You can search from over 85,000 forms arranged by state/county and case.

- The intuitive interface, number of supporting materials, and dedicated support make it easy to find and execute different paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

Simply select to search or browse Harris Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal, either by a keyword or by the state/county the form is intended for. After finding the required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the Harris Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal template and check the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Create an account and choose a subscription plan. The template will be instantly ready for download as soon as the payment is completed. Now you can execute the form.

Taking care of your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes this experience less expensive and more reasonably priced. Set up your first business, arrange your advance care planning, create a real estate contract, or complete the Harris Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal - all from the convenience of your home.

Sign up for US Legal Forms now!