A Fulton, Georgia Qualified Domestic Trust Agreement, also known as a DOT, is a legal document that allows non-U.S. citizen spouses to take advantage of certain estate tax benefits in the United States. This agreement is specifically designed for couples where one spouse is not a U.S. citizen and the other is a U.S. citizen or resident. The primary purpose of a Fulton, Georgia Qualified Domestic Trust Agreement is to defer the payment of estate taxes that would otherwise be due upon the death of the U.S. citizen or resident spouse. By establishing this trust, the non-U.S. citizen spouse can receive income from the trust without triggering immediate estate taxes. In Fulton, Georgia, there are several types of Qualified Domestic Trust Agreements that cater to the unique needs and circumstances of each couple. These types include: 1. General Qualified Domestic Trust (DOT): This is the most common type of DOT agreement, which allows the non-U.S. citizen spouse to receive income distributions from the trust while ensuring that the estate tax is deferred until the time of their death. The trust must have a U.S. trustee who is responsible for complying with all tax reporting requirements. 2. Election-Qualified Domestic Trust (Election DOT): In certain situations, the non-U.S. citizen spouse may elect to convert a non-qualifying trust into an Election DOT after the death of the U.S. citizen spouse. This allows the estate to still benefit from the DOT provisions and provides flexibility for estate tax planning. 3. Estate Tax Treaty Qualified Domestic Trust (Treaty DOT): If the non-U.S. citizen spouse is a resident of a country that has a tax treaty with the United States, they may qualify for a Treaty DOT. This type of DOT ensures that the estate tax benefits are available under the terms outlined in the specific treaty. 4. Trust Protector Qualified Domestic Trust (Trust Protector DOT): This type of trust includes a designated trust protector who has the authority to modify or amend the trust if circumstances change. This provides additional flexibility and control for the trustee and beneficiaries. It is crucial to consult with an experienced estate planning attorney in Fulton, Georgia, who specializes in Qualified Domestic Trust Agreements to determine the most appropriate type of agreement based on individual circumstances. Understanding the nuances of a Fulton, Georgia Qualified Domestic Trust Agreement and its various types will ensure that estate tax planning is optimized and compliant with applicable laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fulton Georgia Acuerdo de Fideicomiso Nacional Calificado - Qualified Domestic Trust Agreement

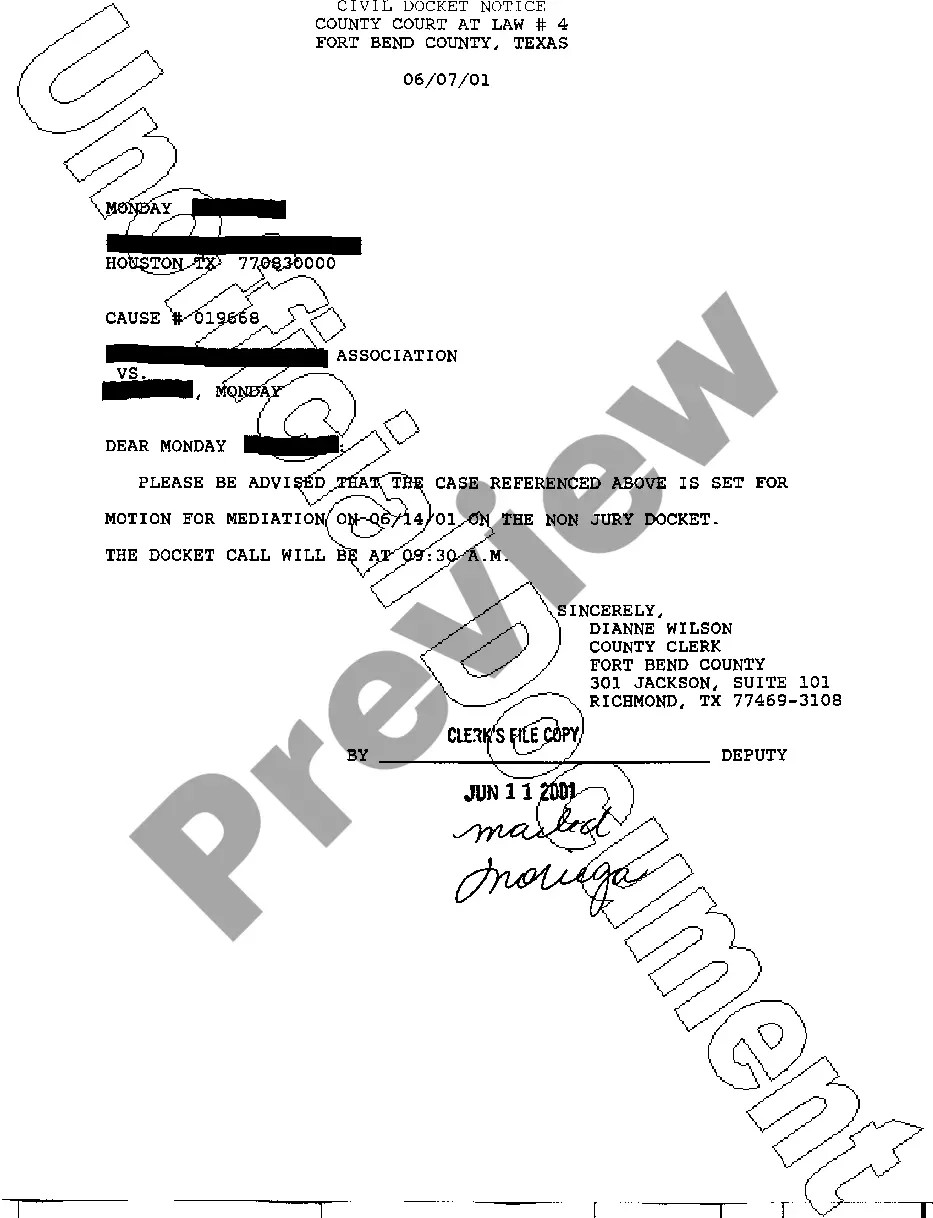

Description

How to fill out Fulton Georgia Acuerdo De Fideicomiso Nacional Calificado?

Do you need to quickly draft a legally-binding Fulton Qualified Domestic Trust Agreement or probably any other document to handle your own or business affairs? You can select one of the two options: contact a legal advisor to write a valid paper for you or create it entirely on your own. Luckily, there's an alternative solution - US Legal Forms. It will help you get neatly written legal paperwork without having to pay unreasonable prices for legal services.

US Legal Forms offers a rich catalog of over 85,000 state-compliant document templates, including Fulton Qualified Domestic Trust Agreement and form packages. We provide documents for an array of life circumstances: from divorce papers to real estate document templates. We've been out there for over 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and get the necessary document without extra hassles.

- First and foremost, carefully verify if the Fulton Qualified Domestic Trust Agreement is tailored to your state's or county's laws.

- In case the document has a desciption, make sure to verify what it's intended for.

- Start the searching process again if the form isn’t what you were seeking by utilizing the search bar in the header.

- Select the plan that best suits your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Fulton Qualified Domestic Trust Agreement template, and download it. To re-download the form, just head to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. In addition, the documents we offer are reviewed by law professionals, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!