Establishing a Qualified Personal Residence Trust (QPRT) involves transferring the residence to a trust that names the persons who are to receive the residence at the end of the stated term, usually a child or children of the donor. The donor is the tr The Franklin Ohio Qualified Personnel Residence Trust (PRT) is a legal tool that allows residents of Franklin, Ohio, to transfer their primary residence into a trust while retaining the right to live in the property for a specified period of time. This trust offers several benefits for homeowners, including potential estate tax savings and asset protection. A Franklin Ohio PRT is designed for individuals who own a primary residence and wish to transfer ownership to their heirs while reducing or eliminating estate taxes. By utilizing this trust, homeowners can significantly reduce the value of their estate for tax purposes, ultimately minimizing the tax burden on their beneficiaries upon their passing. One of the essential features of a PRT is the ability to live in the property for a predefined period, typically between 10 and 20 years. After this period expires, the property is transferred to the designated beneficiaries, typically the granter's children or other loved ones. This unique arrangement allows homeowners to maintain occupancy and control over their primary residence during their lifetimes, providing both security and peace of mind. It's important to note that there are different types of Franklin Ohio Parts, each tailored to meet the specific needs and objectives of homeowners. These variations include: 1. Granter Retained Annuity Trust (GREAT): In this type of PRT, the granter sets up the trust and retains the right to receive an annuity payment for a fixed term. At the end of the term, the property transfers to the beneficiaries. 2. Granter Retained Unit rust (GUT): With a GUT, the granter also retains the right to receive yearly payments, but these payments are based on a fixed percentage of the trust's value, which is reassessed annually. 3. Irrevocable Qualified Personnel Residence Trust (IQ PRT): In an IQ PRT, the granter establishes an irrevocable trust, removing the property's value completely from their estate. This type of trust provides more substantial tax benefits, but the granter cannot change or revoke the trust once it is established. The Franklin Ohio Qualified Personnel Residence Trust is an effective estate planning tool for Ohio residents who want to preserve wealth, minimize estate taxes, and ensure a smooth transition of their primary residence to their loved ones. Consulting with a qualified estate planning attorney is highly recommended evaluating individual circumstances and determine the most appropriate type of PRT for optimal results.

The Franklin Ohio Qualified Personnel Residence Trust (PRT) is a legal tool that allows residents of Franklin, Ohio, to transfer their primary residence into a trust while retaining the right to live in the property for a specified period of time. This trust offers several benefits for homeowners, including potential estate tax savings and asset protection. A Franklin Ohio PRT is designed for individuals who own a primary residence and wish to transfer ownership to their heirs while reducing or eliminating estate taxes. By utilizing this trust, homeowners can significantly reduce the value of their estate for tax purposes, ultimately minimizing the tax burden on their beneficiaries upon their passing. One of the essential features of a PRT is the ability to live in the property for a predefined period, typically between 10 and 20 years. After this period expires, the property is transferred to the designated beneficiaries, typically the granter's children or other loved ones. This unique arrangement allows homeowners to maintain occupancy and control over their primary residence during their lifetimes, providing both security and peace of mind. It's important to note that there are different types of Franklin Ohio Parts, each tailored to meet the specific needs and objectives of homeowners. These variations include: 1. Granter Retained Annuity Trust (GREAT): In this type of PRT, the granter sets up the trust and retains the right to receive an annuity payment for a fixed term. At the end of the term, the property transfers to the beneficiaries. 2. Granter Retained Unit rust (GUT): With a GUT, the granter also retains the right to receive yearly payments, but these payments are based on a fixed percentage of the trust's value, which is reassessed annually. 3. Irrevocable Qualified Personnel Residence Trust (IQ PRT): In an IQ PRT, the granter establishes an irrevocable trust, removing the property's value completely from their estate. This type of trust provides more substantial tax benefits, but the granter cannot change or revoke the trust once it is established. The Franklin Ohio Qualified Personnel Residence Trust is an effective estate planning tool for Ohio residents who want to preserve wealth, minimize estate taxes, and ensure a smooth transition of their primary residence to their loved ones. Consulting with a qualified estate planning attorney is highly recommended evaluating individual circumstances and determine the most appropriate type of PRT for optimal results.

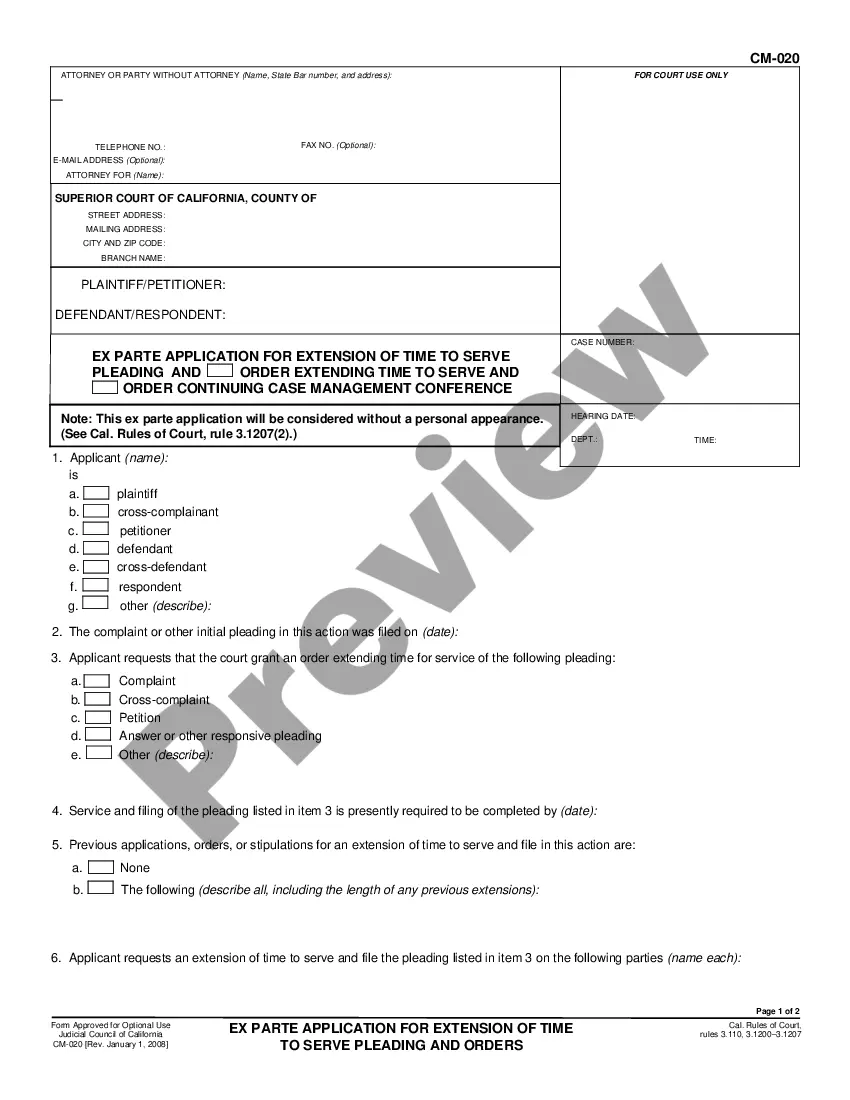

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.