Establishing a Qualified Personal Residence Trust (QPRT) involves transferring the residence to a trust that names the persons who are to receive the residence at the end of the stated term, usually a child or children of the donor. The donor is the tr A Mecklenburg North Carolina Qualified Personnel Residence Trust (PRT) is a legal tool that enables individuals to transfer ownership of their primary residence or vacation home to the trust, while still being able to use the property for a specified period. This trust provides significant estate planning benefits, as it allows the granter to reduce the value of their taxable estate, potentially avoiding substantial estate taxes. By establishing a PRT in Mecklenburg County, North Carolina, residents can preserve their wealth for future generations and ensure their loved ones inherit the property with minimized tax implications. Here are some relevant keywords and different types of Mecklenburg North Carolina Qualified Personnel Residence Trust: 1. Mecklenburg County: Located in the heart of North Carolina, Mecklenburg County is home to the bustling city of Charlotte, making it an ideal location for establishing a PRT. 2. Estate Planning: Mecklenburg North Carolina Qualified Personnel Residence Trusts are often utilized as part of comprehensive estate planning strategies to manage assets and minimize tax liabilities. 3. Tax Reduction: A PRT can help homeowners reduce the overall value of their taxable estate, potentially resulting in substantial tax savings for their heirs. 4. Primary Residence Trust: This type of PRT allows the granter to retain the right to live in their primary residence for a specified term, after which ownership of the property transfers to the beneficiaries. 5. Vacation Home Trust: Mecklenburg North Carolina residents who own vacation homes can establish a PRT to ensure the property remains within the family while addressing potential estate tax consequences. 6. Granter: The granter refers to the individual(s) who establish the PRT, transfer the property into the trust, and retain certain rights as specified in the trust agreement. 7. Beneficiary: The beneficiary of a Mecklenburg North Carolina PRT is the individual(s) who will eventually gain ownership of the property after the specified term, often a family member or loved one. 8. Term Length: The PRT agreement outlines the duration during which the granter can continue living in the residence. This period is critical for determining the value of the gift to the trust for tax purposes. 9. Asset Protection: Establishing a PRT can provide some level of asset protection, shielding the property from potential creditors or legal claims. 10. Estate Tax Exemption: By placing the property into a PRT, the value of the gift is generally eligible for the granter's gift tax exemption, reducing potential estate tax liabilities in the future. 11. Medicaid Planning: Some individuals consider a PRT as part of their long-term care or Medicaid planning strategy, as it allows them to transfer their primary residence while still maintaining residency rights. In summary, a Mecklenburg North Carolina Qualified Personnel Residence Trust is an estate planning tool that enables residents to transfer ownership of their primary residence or vacation home while minimizing tax liabilities and preserving wealth for future generations.

A Mecklenburg North Carolina Qualified Personnel Residence Trust (PRT) is a legal tool that enables individuals to transfer ownership of their primary residence or vacation home to the trust, while still being able to use the property for a specified period. This trust provides significant estate planning benefits, as it allows the granter to reduce the value of their taxable estate, potentially avoiding substantial estate taxes. By establishing a PRT in Mecklenburg County, North Carolina, residents can preserve their wealth for future generations and ensure their loved ones inherit the property with minimized tax implications. Here are some relevant keywords and different types of Mecklenburg North Carolina Qualified Personnel Residence Trust: 1. Mecklenburg County: Located in the heart of North Carolina, Mecklenburg County is home to the bustling city of Charlotte, making it an ideal location for establishing a PRT. 2. Estate Planning: Mecklenburg North Carolina Qualified Personnel Residence Trusts are often utilized as part of comprehensive estate planning strategies to manage assets and minimize tax liabilities. 3. Tax Reduction: A PRT can help homeowners reduce the overall value of their taxable estate, potentially resulting in substantial tax savings for their heirs. 4. Primary Residence Trust: This type of PRT allows the granter to retain the right to live in their primary residence for a specified term, after which ownership of the property transfers to the beneficiaries. 5. Vacation Home Trust: Mecklenburg North Carolina residents who own vacation homes can establish a PRT to ensure the property remains within the family while addressing potential estate tax consequences. 6. Granter: The granter refers to the individual(s) who establish the PRT, transfer the property into the trust, and retain certain rights as specified in the trust agreement. 7. Beneficiary: The beneficiary of a Mecklenburg North Carolina PRT is the individual(s) who will eventually gain ownership of the property after the specified term, often a family member or loved one. 8. Term Length: The PRT agreement outlines the duration during which the granter can continue living in the residence. This period is critical for determining the value of the gift to the trust for tax purposes. 9. Asset Protection: Establishing a PRT can provide some level of asset protection, shielding the property from potential creditors or legal claims. 10. Estate Tax Exemption: By placing the property into a PRT, the value of the gift is generally eligible for the granter's gift tax exemption, reducing potential estate tax liabilities in the future. 11. Medicaid Planning: Some individuals consider a PRT as part of their long-term care or Medicaid planning strategy, as it allows them to transfer their primary residence while still maintaining residency rights. In summary, a Mecklenburg North Carolina Qualified Personnel Residence Trust is an estate planning tool that enables residents to transfer ownership of their primary residence or vacation home while minimizing tax liabilities and preserving wealth for future generations.

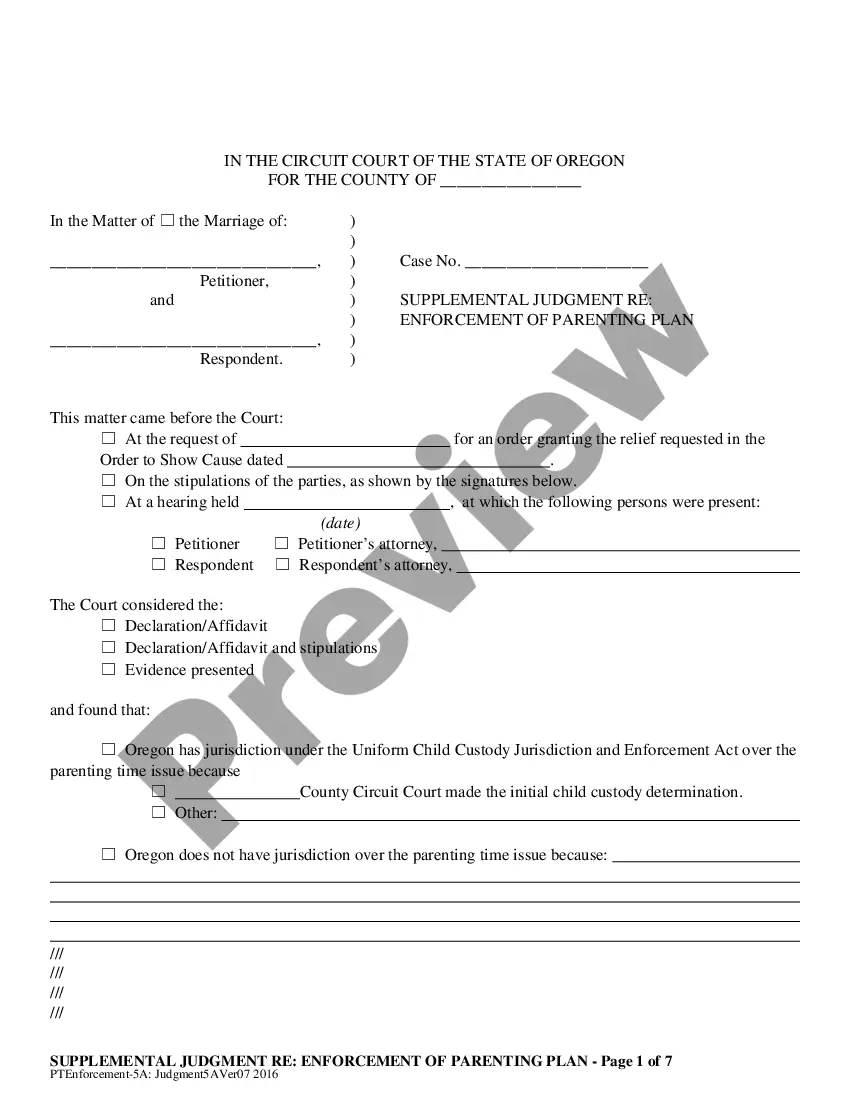

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.