Establishing a Qualified Personal Residence Trust (QPRT) involves transferring the residence to a trust that names the persons who are to receive the residence at the end of the stated term, usually a child or children of the donor. The donor is the tr Orange California Qualified Personnel Residence Trust, also known as SCRIPT, is a legal estate planning tool designed to help individuals minimize taxes and protect their primary residence. It allows the owner to transfer their residence into an irrevocable trust while retaining the right to live in the home for a fixed number of years. By doing so, the homeowner can reduce the value of their estate, potentially resulting in lower estate taxes upon their death. One type of Orange California Qualified Personnel Residence Trust is the Granter Retained Interest Trust (GRIT). This type of trust allows the granter to retain the right to live in the property for a predetermined time, after which the property is transferred to the beneficiaries. By utilizing a GRIT, the granter may minimize the estate tax consequences associated with the transfer of their primary residence. Another type of Orange California Qualified Personnel Residence Trust is the Qualified Personnel Residence Trust (PRT). With a PRT, the granter transfers their primary residence into the trust while reserving the right to live in the property for a predetermined term. At the end of the term, the property is passed to the named beneficiaries, such as children or other family members. The main advantage of a PRT is that it allows the granter to freeze the value of the property for estate tax purposes, potentially reducing the tax burden on their estate. Orange County residents who own valuable homes and wish to protect their assets from estate taxes may find an Orange California Qualified Personnel Residence Trust to be a beneficial estate planning tool. By strategically transferring their primary residence into a properly structured trust, individuals can potentially lower their estate's overall value, ultimately saving their beneficiaries from considerable tax liabilities. However, it is important to consult with a qualified estate planning attorney familiar with California laws before implementing any trust strategy to ensure compliance and maximize the potential benefits.

Orange California Qualified Personnel Residence Trust, also known as SCRIPT, is a legal estate planning tool designed to help individuals minimize taxes and protect their primary residence. It allows the owner to transfer their residence into an irrevocable trust while retaining the right to live in the home for a fixed number of years. By doing so, the homeowner can reduce the value of their estate, potentially resulting in lower estate taxes upon their death. One type of Orange California Qualified Personnel Residence Trust is the Granter Retained Interest Trust (GRIT). This type of trust allows the granter to retain the right to live in the property for a predetermined time, after which the property is transferred to the beneficiaries. By utilizing a GRIT, the granter may minimize the estate tax consequences associated with the transfer of their primary residence. Another type of Orange California Qualified Personnel Residence Trust is the Qualified Personnel Residence Trust (PRT). With a PRT, the granter transfers their primary residence into the trust while reserving the right to live in the property for a predetermined term. At the end of the term, the property is passed to the named beneficiaries, such as children or other family members. The main advantage of a PRT is that it allows the granter to freeze the value of the property for estate tax purposes, potentially reducing the tax burden on their estate. Orange County residents who own valuable homes and wish to protect their assets from estate taxes may find an Orange California Qualified Personnel Residence Trust to be a beneficial estate planning tool. By strategically transferring their primary residence into a properly structured trust, individuals can potentially lower their estate's overall value, ultimately saving their beneficiaries from considerable tax liabilities. However, it is important to consult with a qualified estate planning attorney familiar with California laws before implementing any trust strategy to ensure compliance and maximize the potential benefits.

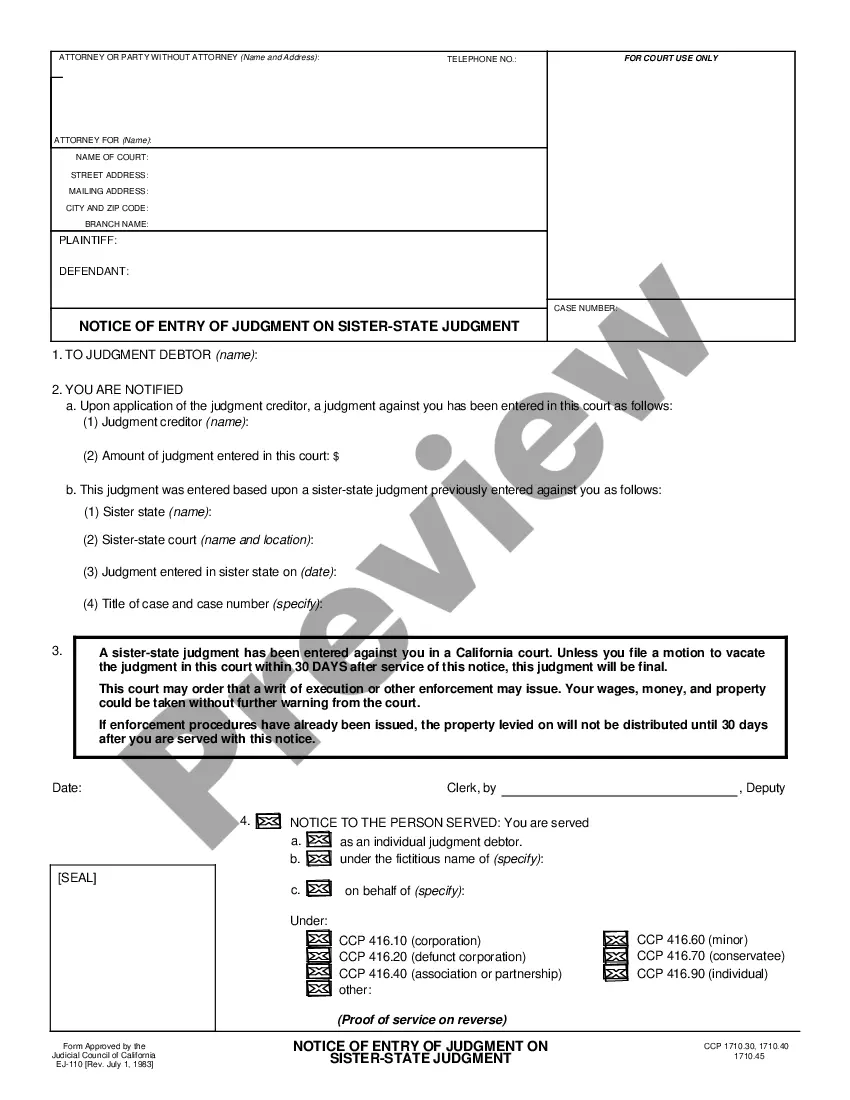

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.