A Dallas Texas Qualified Subchapter-S Trust for the Benefit of a Child with a Crummy Trust Agreement is a legal and financial arrangement designed to provide financial support and protection for a child's future. This type of trust combines the benefits of a Subchapter-S corporation with the flexibility of a trust agreement, maximizing tax advantages and ensuring the child's financial well-being. The Qualified Subchapter-S Trust (SST) structure allows the granter to transfer assets such as stocks, real estate, or business interests to the trust while maintaining the status of a Subchapter-S corporation. As a result, potential tax liabilities are minimized, and the trust enjoys pass-through taxation at the beneficiary child's level. The Crummy Trust Agreement is an essential component of this arrangement, named after Clifford Crummy, who successfully established it in a landmark court case. The Crummy power provision allows contributions to the trust to qualify for the annual gift tax exclusion. It permits the beneficiary child to withdraw the gifted assets for a specific period, typically 30 days, after which the assets become part of the trust. Dallas Texas offers various types of Qualified Subchapter-S Trusts for the Benefit of a Child with Crummy Trust Agreements, each tailored to specific needs and goals. Some common variations include: 1. Education Trust: This type of trust focuses on providing funds for the child's education, including tuition fees, books, living expenses, and other related expenses. It ensures that the child has the necessary financial resources to pursue higher education without the burden of student loans. 2. Medical Trust: A Medical Trust serves the purpose of covering medical expenses, health insurance, and other healthcare-related costs for the child. It ensures access to quality healthcare services and provides financial support in case of unexpected medical emergencies. 3. Special Needs Trust: For children with special needs and disabilities, a Special Needs Trust is specifically designed to protect their eligibility for government benefits while enhancing their quality of life. It can provide funds for medical expenses, therapies, specialized equipment, and other essential needs not covered by benefit programs. 4. General Support Trust: A General Support Trust provides broader financial support for the child's overall well-being, including daily living expenses, housing, transportation, and other necessary costs. It helps ensure the child's basic needs are met and provides a safety net for unexpected circumstances. A Dallas Texas Qualified Subchapter-S Trust for the Benefit of a Child with a Crummy Trust Agreement is a valuable tool for parents or guardians wishing to secure their child's financial future. By carefully selecting the type of trust that aligns with the child's specific needs, one can establish a powerful financial vehicle that allows for tax efficiency, wealth preservation, and the provision of crucial support throughout the child's life.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Fideicomiso Calificado Subcapítulo-S para Beneficio del Niño con Acuerdo de Fideicomiso Crummey - Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement

Description

How to fill out Dallas Texas Fideicomiso Calificado Subcapítulo-S Para Beneficio Del Niño Con Acuerdo De Fideicomiso Crummey?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare official paperwork that differs throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any personal or business purpose utilized in your region, including the Dallas Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement.

Locating forms on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Dallas Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to get the Dallas Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement:

- Ensure you have opened the correct page with your localised form.

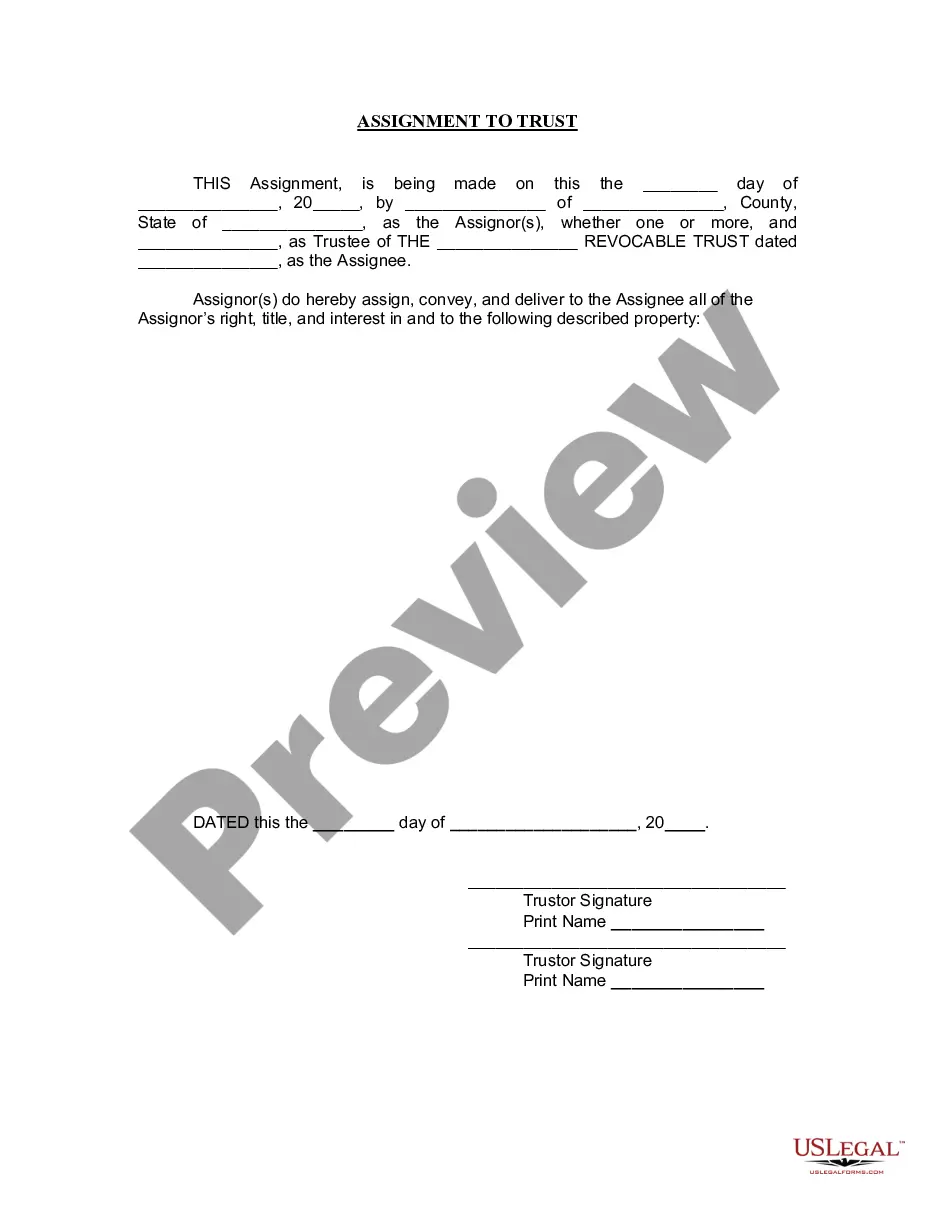

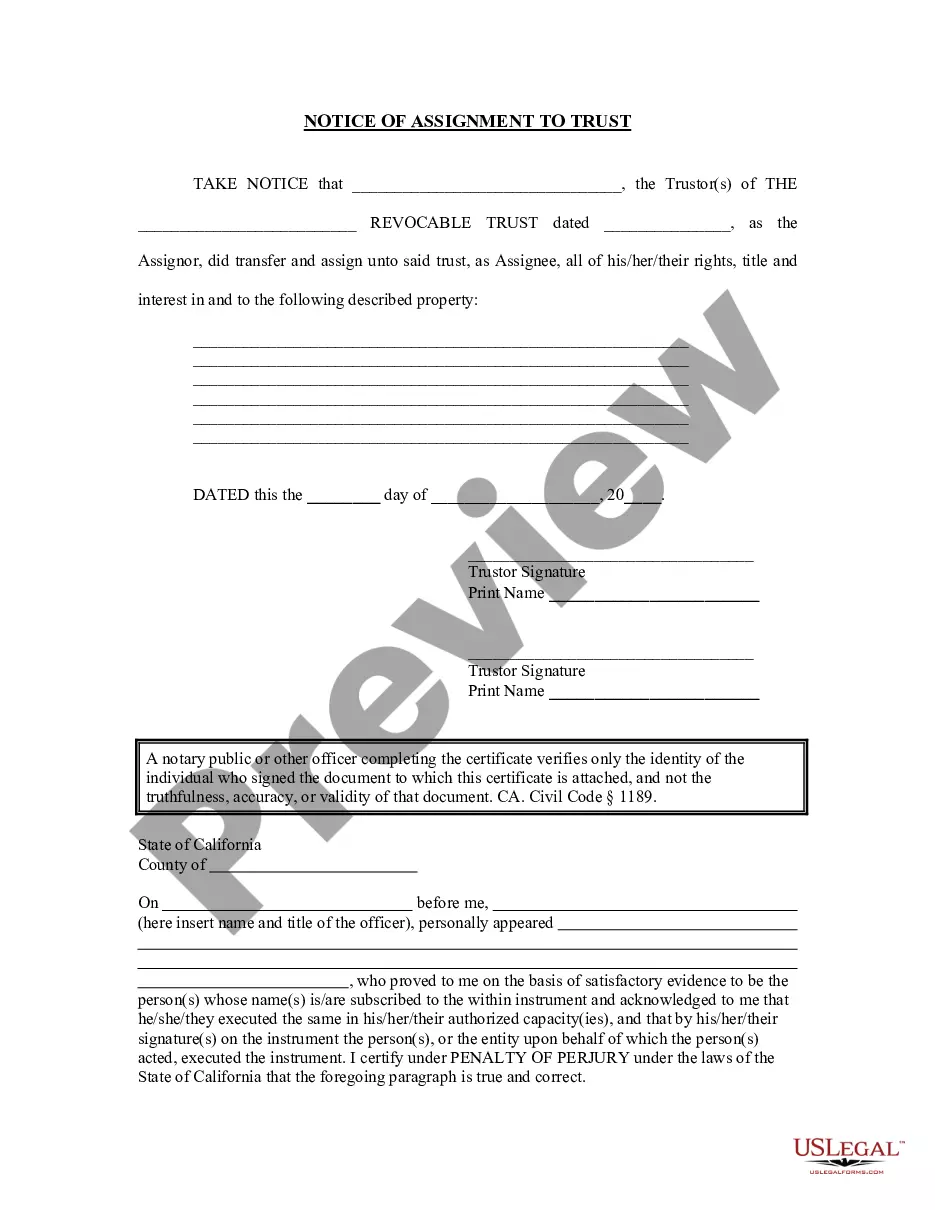

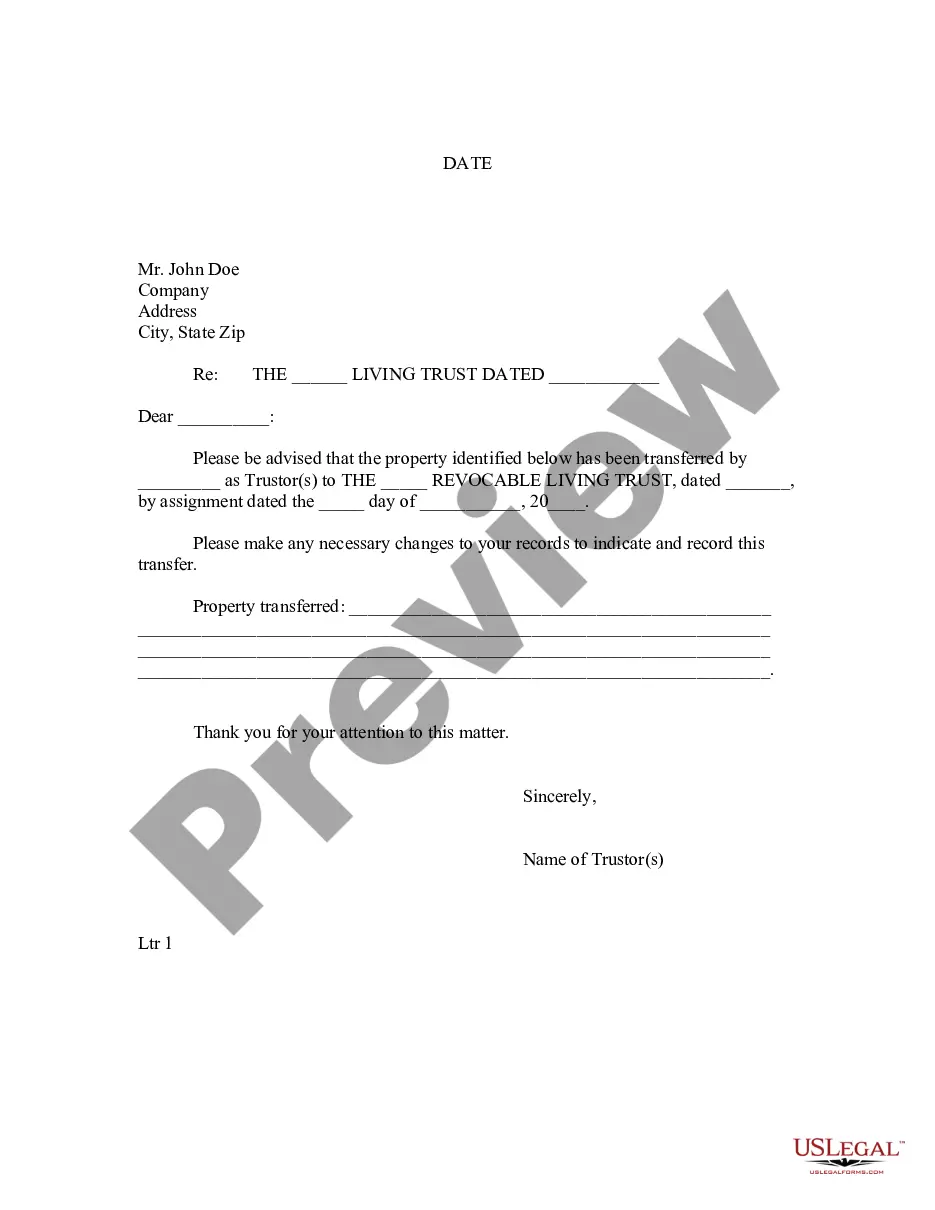

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form satisfies your needs.

- Look for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Dallas Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!