San Bernardino, California is a bustling city located in the inland region of Southern California. With a population of over 200,000 people, it is the county seat of San Bernardino County and the 17th-largest city in the state. Known for its rich history and diverse community, San Bernardino offers a wide range of attractions, cultural events, and natural beauty. When it comes to estate planning and financial matters, a General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion can be a valuable tool. This type of trust agreement allows individuals to make gifts to minors while taking advantage of the annual gift tax exclusion, which is currently set at $15,000 per person (as of 2021). In San Bernardino, California, there are several variations of the General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion. These may include: 1. Revocable Trust Agreement: This type of trust agreement can be altered or revoked by the granter during their lifetime. It allows for flexibility and control over assets while still qualifying for the annual gift tax exclusion when gifting to minors. 2. Irrevocable Trust Agreement: In contrast to a revocable trust, an irrevocable trust agreement cannot be changed or revoked once it is established. This type of trust is often used to protect assets and minimize estate tax liability, while still allowing for gifting to minors within the annual gift tax limits. 3. Testamentary Trust Agreement: This trust agreement is created through a will and only takes effect upon the granter's death. It can be used to allocate assets to minors while ensuring they remain within the annual gift tax exclusion limits. When creating a General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion in San Bernardino, it is essential to consult with an experienced estate planning attorney who is familiar with California state laws. They can provide guidance and tailor the trust agreement to meet individual needs, ensuring compliance with tax regulations and protecting the interests of both the granter and the minor beneficiary.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Bernardino California Formulario general de acuerdo de fideicomiso para menores que califican para la exclusión anual del impuesto sobre donaciones - General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion

Description

How to fill out San Bernardino California Formulario General De Acuerdo De Fideicomiso Para Menores Que Califican Para La Exclusión Anual Del Impuesto Sobre Donaciones?

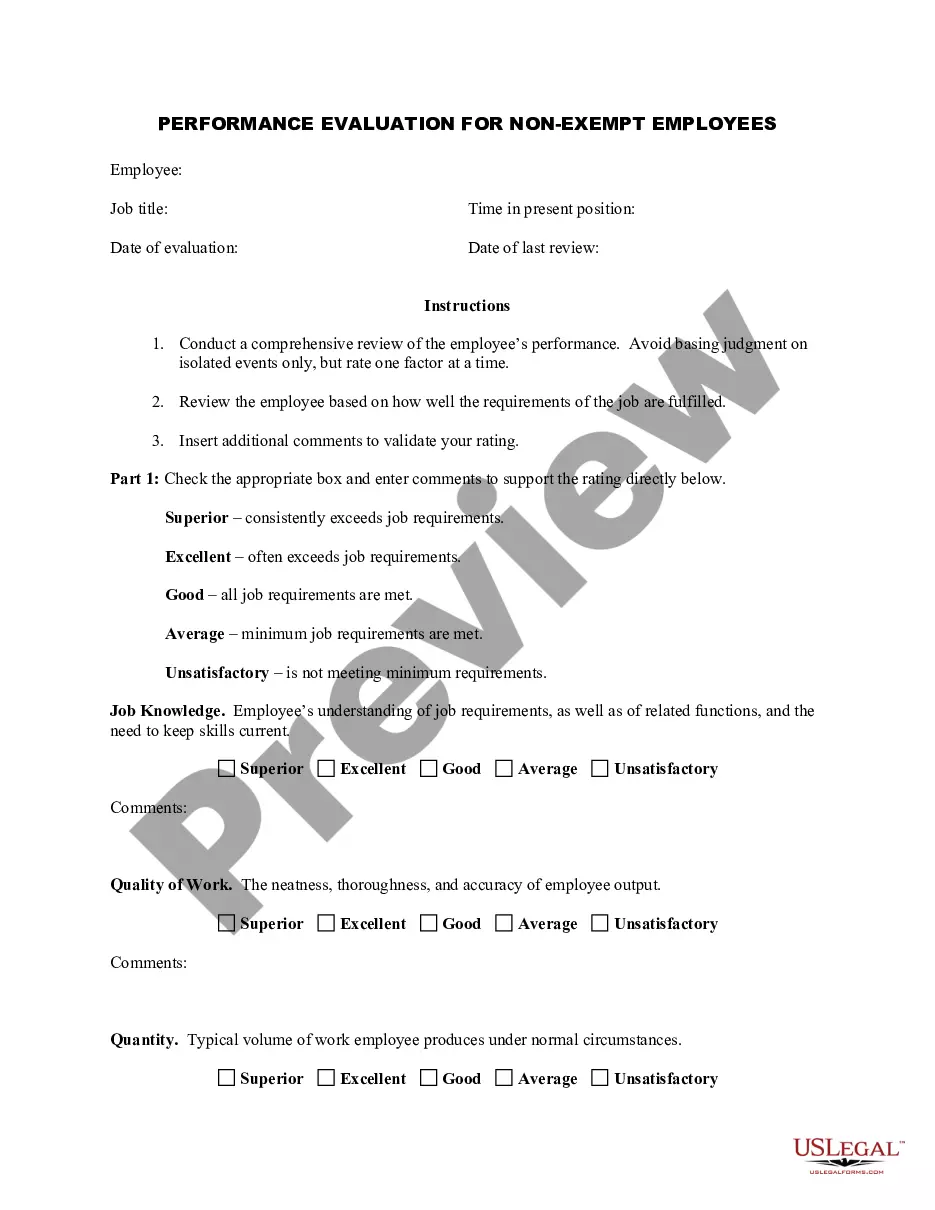

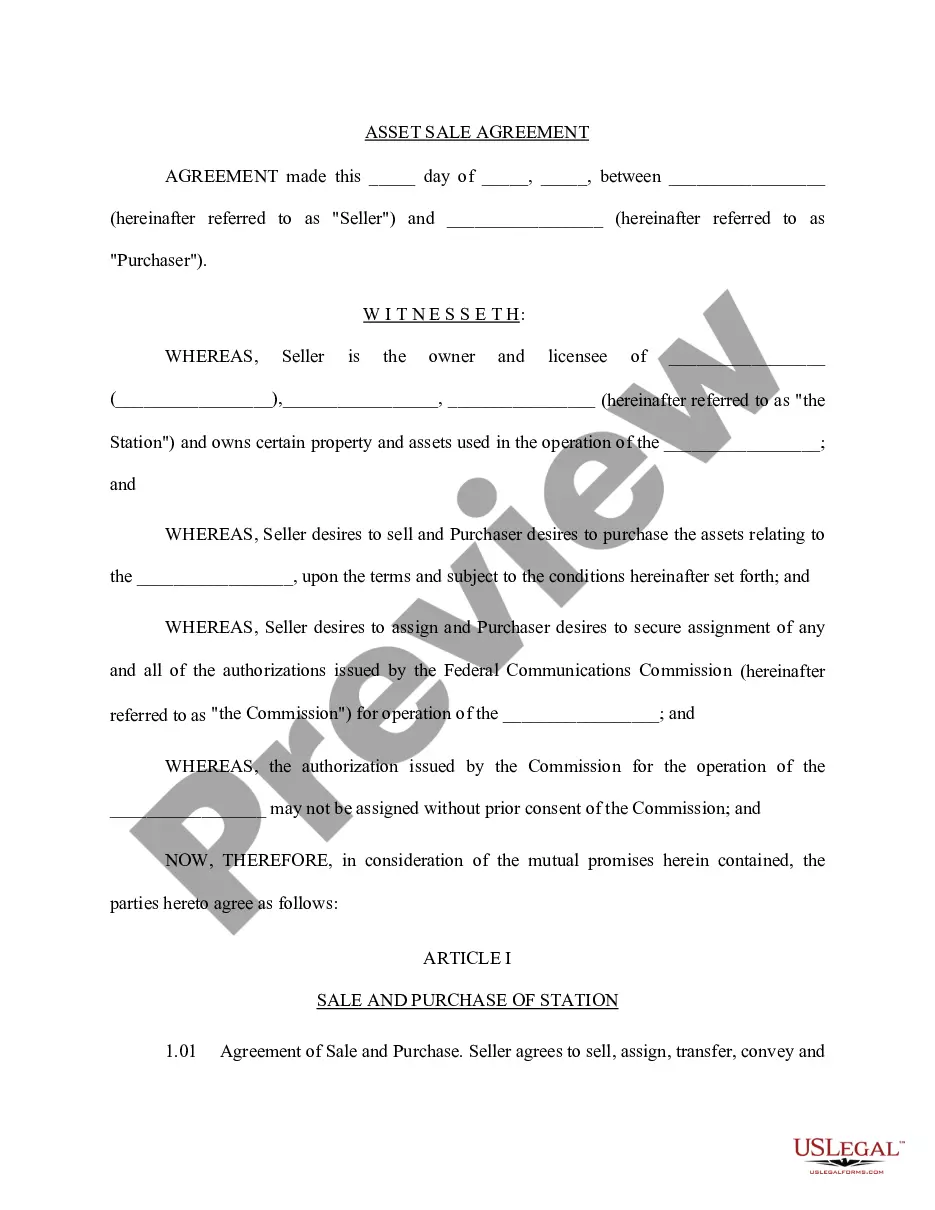

If you need to get a reliable legal document supplier to get the San Bernardino General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion, consider US Legal Forms. No matter if you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate form.

- You can select from over 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of supporting materials, and dedicated support make it easy to find and complete different paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

Simply select to search or browse San Bernardino General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion, either by a keyword or by the state/county the form is created for. After locating needed form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the San Bernardino General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion template and check the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Register an account and select a subscription option. The template will be instantly ready for download as soon as the payment is processed. Now you can complete the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes this experience less costly and more reasonably priced. Set up your first company, arrange your advance care planning, create a real estate contract, or complete the San Bernardino General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion - all from the comfort of your sofa.

Sign up for US Legal Forms now!