The Clark Nevada Special Needs Irrevocable Trust Agreement for the Benefit of a Disabled Child of the Trust or is a legal document that outlines the terms and conditions under which assets are held in trust for the benefit of a disabled child or individual. This type of trust is specifically designed to provide financial support and resources to individuals with special needs while ensuring they remain eligible for government assistance programs. The Clark Nevada Special Needs Irrevocable Trust Agreement is carefully drafted to meet the unique needs of the disabled child, allowing them to receive supplemental support without jeopardizing their eligibility for programs such as Medicaid, SSI (Supplemental Security Income), or other means-tested benefits. By establishing this trust, the trustee can manage and distribute the trust assets to maintain the beneficiary's quality of life while preserving their eligibility for essential government benefits. There are different types of Clark Nevada Special Needs Irrevocable Trust Agreements available, each tailored to meet specific circumstances and requirements based on the disabled child's needs and the trust or's preferences. Some varying types include: 1. First-Party Special Needs Trust: This type of trust is funded by the disabled individual's own assets, such as personal injury settlements, inheritances, or accumulated savings. It allows the individual to place their excess resources into the trust without impacting their eligibility for government programs. 2. Third-Party Special Needs Trust: Created by a family member or another person, this trust is funded using assets that do not belong to the disabled individual. It allows the family to contribute funds or assets on behalf of the disabled child, ensuring their long-term financial well-being without affecting their eligibility for government benefits. 3. Pooled Special Needs Trust: Managed by a nonprofit organization, a pooled special needs trust allows individuals with disabilities to pool their resources for investment purposes while still maintaining eligibility for government benefits. This option is ideal for those without sufficient funds to create an individual trust or if a suitable trustee is unavailable. 4. Testamentary Special Needs Trust: Established through a last will and testament, this trust only comes into effect upon the death of the parent or guardian. It ensures that assets intended for the disabled child are properly managed after the trust or's passing, providing a continuous source of support and care. In summary, the Clark Nevada Special Needs Irrevocable Trust Agreement for the Benefit of a Disabled Child of the Trust or is a crucial legal tool that enables parents, guardians, or other concerned individuals to secure the financial well-being of a disabled child while also safeguarding their eligibility for government benefits. By tailoring the trust to meet the individual's specific needs and circumstances, it serves as a valuable mechanism for long-term support and care.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Clark Nevada Acuerdo de fideicomiso irrevocable para necesidades especiales en beneficio del hijo discapacitado del fideicomitente - Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor

Description

How to fill out Clark Nevada Acuerdo De Fideicomiso Irrevocable Para Necesidades Especiales En Beneficio Del Hijo Discapacitado Del Fideicomitente?

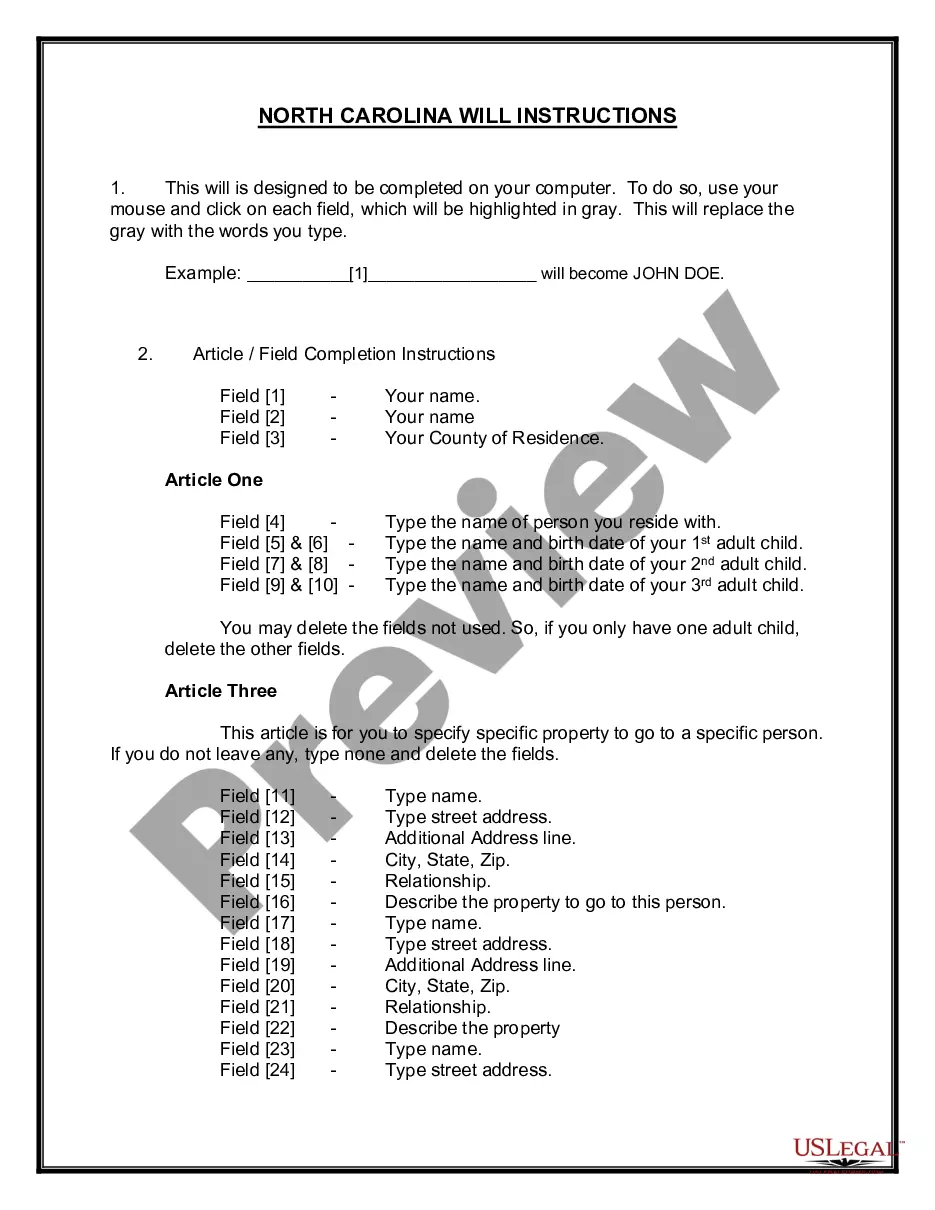

Creating documents, like Clark Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor, to take care of your legal affairs is a challenging and time-consumming task. Many situations require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can get your legal issues into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal forms created for a variety of cases and life circumstances. We make sure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Clark Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor form. Go ahead and log in to your account, download the form, and personalize it to your requirements. Have you lost your document? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as straightforward! Here’s what you need to do before downloading Clark Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor:

- Ensure that your form is compliant with your state/county since the rules for creating legal documents may vary from one state another.

- Find out more about the form by previewing it or going through a brief intro. If the Clark Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to start using our website and download the document.

- Everything looks good on your end? Click the Buy now button and select the subscription option.

- Select the payment gateway and type in your payment information.

- Your form is ready to go. You can go ahead and download it.

It’s an easy task to locate and buy the needed template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!