A Suffolk New York Special Needs Irrevocable Trust Agreement for the Benefit of a Disabled Child of the Trust or is a legal document that provides financial security and support for a disabled child, ensuring they receive the necessary care and resources throughout their lifetime. This type of trust agreement is specifically designed to address the unique needs and challenges faced by disabled children, while also safeguarding their eligibility for government benefits. The Suffolk New York Special Needs Irrevocable Trust Agreement enables parents or legal guardians, referred to as the Trust or, to set aside funds and assets for the benefit of their disabled child. The agreement outlines the specific terms and conditions of the trust, including the management and distribution of funds, the appointment of a trustee, and the intended purpose of the trust assets. By creating this trust agreement, parents can protect their disabled child's well-being by ensuring they have adequate financial support even after the parents' passing. This arrangement is crucial as it prevents the child from losing entitlements to public assistance programs, such as Medicaid and Supplementary Security Income (SSI), due to excess financial resources. Different types or variations of the Suffolk New York Special Needs Irrevocable Trust Agreement may include: 1. Third-Party Special Needs Trust: This type of trust is established and funded by a third party, such as grandparents, relatives, or friends, for the benefit of the disabled child. It allows the disabled child to benefit from the trust without jeopardizing their government benefits. 2. Self-Settled Special Needs Trust: Also known as a "payback" trust, this type of trust is funded with the disabled child's own assets, typically received through an inheritance, personal injury settlement, or other forms of funds. The trust allows the disabled child to maintain their eligibility for public benefits while still preserving the assets for future use. 3. Pooled Special Needs Trust: A pooled special needs trust combines assets from multiple individuals with disabilities into one pool for investment purposes. Each disabled beneficiary has a separate account within the trust and can benefit from the available funds according to their needs. Overall, the Suffolk New York Special Needs Irrevocable Trust Agreement for the Benefit of a Disabled Child of the Trust or provides peace of mind to parents, ensuring their child's financial future is carefully managed to meet their unique needs. Consulting with an experienced attorney specializing in this area of law is highly recommended navigating the complex legal requirements and tailor the trust to the specific circumstances of the disabled child.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Acuerdo de fideicomiso irrevocable para necesidades especiales en beneficio del hijo discapacitado del fideicomitente - Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor

Description

How to fill out Suffolk New York Acuerdo De Fideicomiso Irrevocable Para Necesidades Especiales En Beneficio Del Hijo Discapacitado Del Fideicomitente?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and many other life situations require you prepare official paperwork that differs from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and get a document for any individual or business purpose utilized in your region, including the Suffolk Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor.

Locating templates on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Suffolk Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to obtain the Suffolk Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor:

- Make sure you have opened the correct page with your regional form.

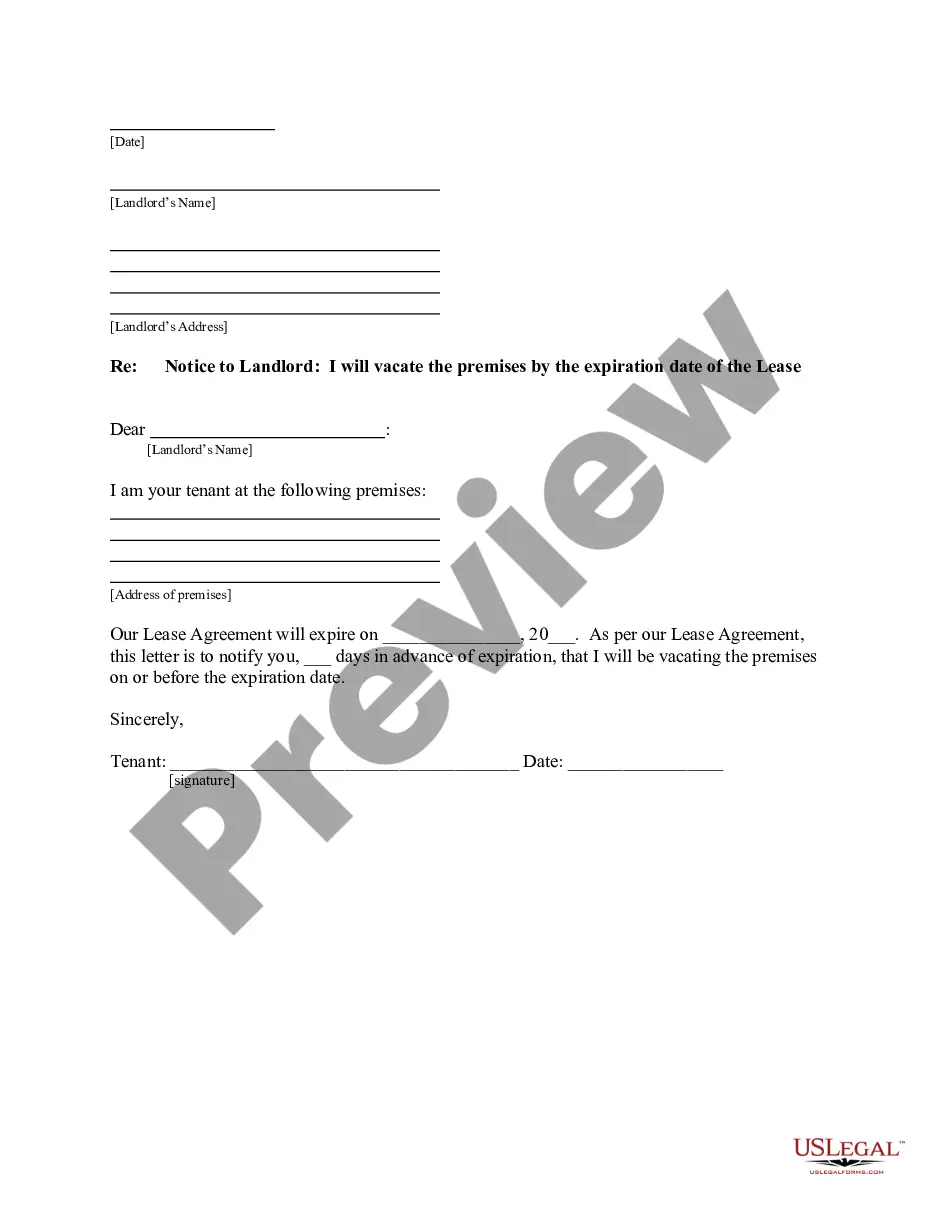

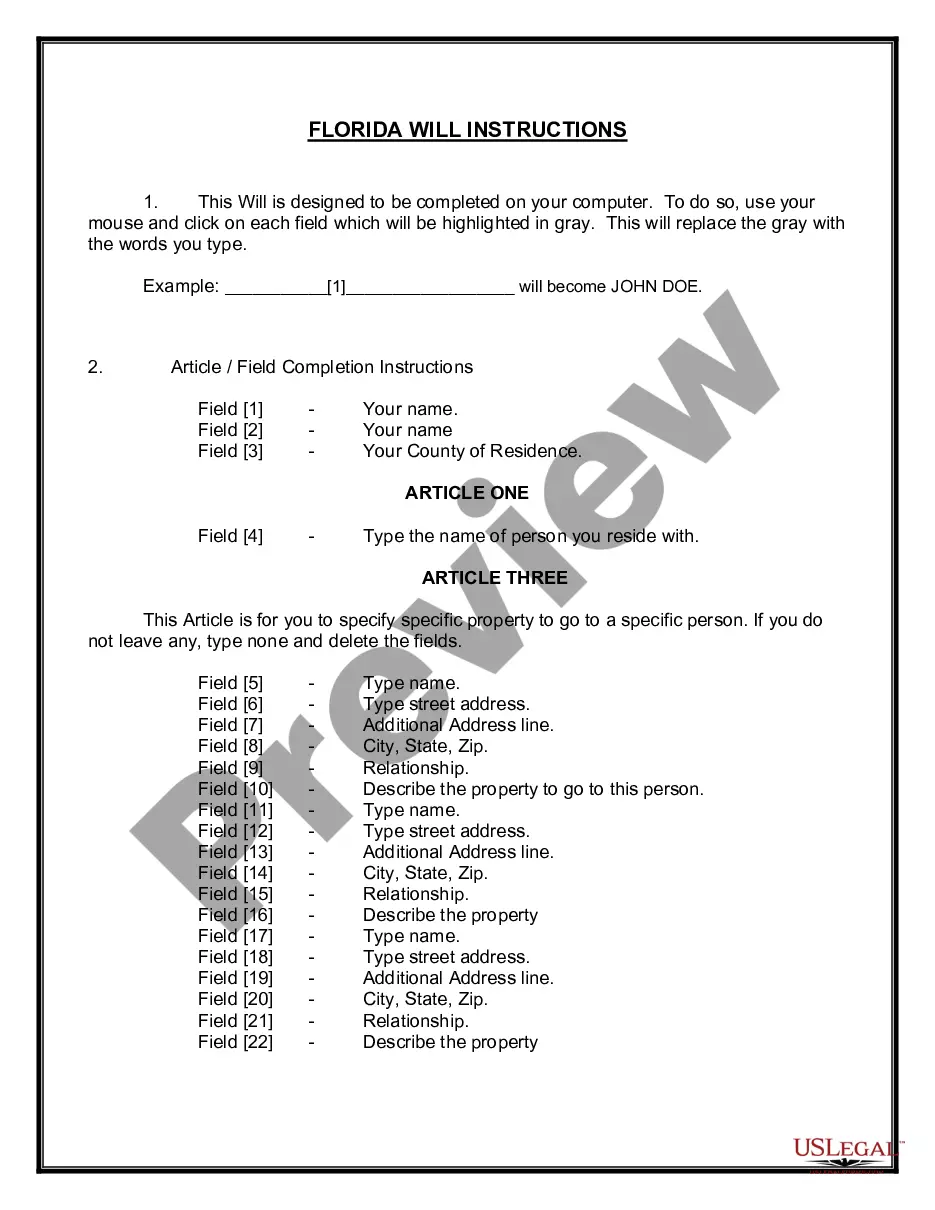

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the suitable subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Suffolk Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!