The Wayne Michigan Special Needs Irrevocable Trust Agreement for the Benefit of a Disabled Child of the Trust or is a legal document that provides financial support and care for disabled individuals in Wayne, Michigan. This agreement ensures that a disabled child receives necessary assistance while preserving their eligibility for government benefits. The primary purpose of this trust agreement is to safeguard the assets and resources earmarked for the disabled child's future needs. By establishing an irrevocable trust, the trust or ensures that the funds are protected and will not be subject to taxes or Medicaid calculations. This way, the child can benefit from the trust without jeopardizing their eligibility for various assistance programs. Multiple types of Wayne Michigan Special Needs Irrevocable Trust Agreements for the Benefit of Disabled Children of Trustees exist, each serving distinct purposes based on the trust or's individual circumstances. Some common types are: 1. Supplemental Special Needs Trust: This type of trust is designed to provide additional financial support for the disabled child, supplementing the government benefits they receive. The assets in this trust can be used for various purposes, such as medical expenses, education, vocational training, housing, and transportation. 2. Pooled Special Needs Trust: In this arrangement, multiple trustees contribute their assets to a pooled trust managed by a nonprofit organization or a trustee. The assets are invested together, allowing for more efficient management and potential growth. Each trust or's child has a separate account within the pooled trust, and the funds can be used to enhance the child's quality of life without negatively impacting their government assistance. 3. Third-Party Special Needs Trust: This type of trust is established by a third party, such as a grandparent or sibling, for the benefit of the disabled child. It allows the third party to leave assets to the child while ensuring those assets are not counted as a resource when determining government benefit eligibility. 4. Self-Funded Special Needs Trust: Created using the disabled child's own assets, this trust is often utilized when the child receives funds from a lawsuit settlement, inheritance, or other sources. It provides a secure means of managing and preserving the assets while safeguarding the child's eligibility for government support. With these various types of Wayne Michigan Special Needs Irrevocable Trust Agreements, families can explore their options and choose the most suitable arrangement for their disabled child's specific needs. Seeking professional legal advice is crucial when setting up any of these trusts to ensure compliance with Michigan laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Acuerdo de fideicomiso irrevocable para necesidades especiales en beneficio del hijo discapacitado del fideicomitente - Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor

Description

How to fill out Wayne Michigan Acuerdo De Fideicomiso Irrevocable Para Necesidades Especiales En Beneficio Del Hijo Discapacitado Del Fideicomitente?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a lawyer to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Wayne Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor, it may cost you a fortune. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case accumulated all in one place. Therefore, if you need the current version of the Wayne Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Wayne Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor:

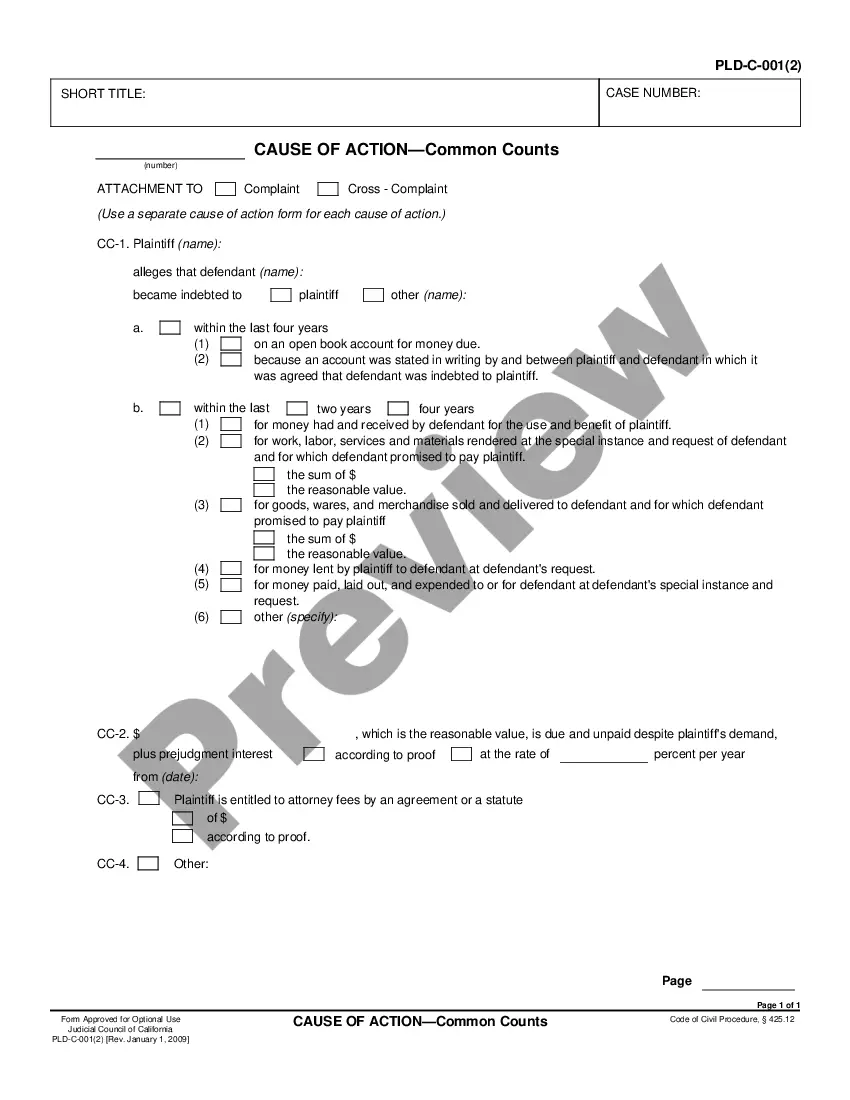

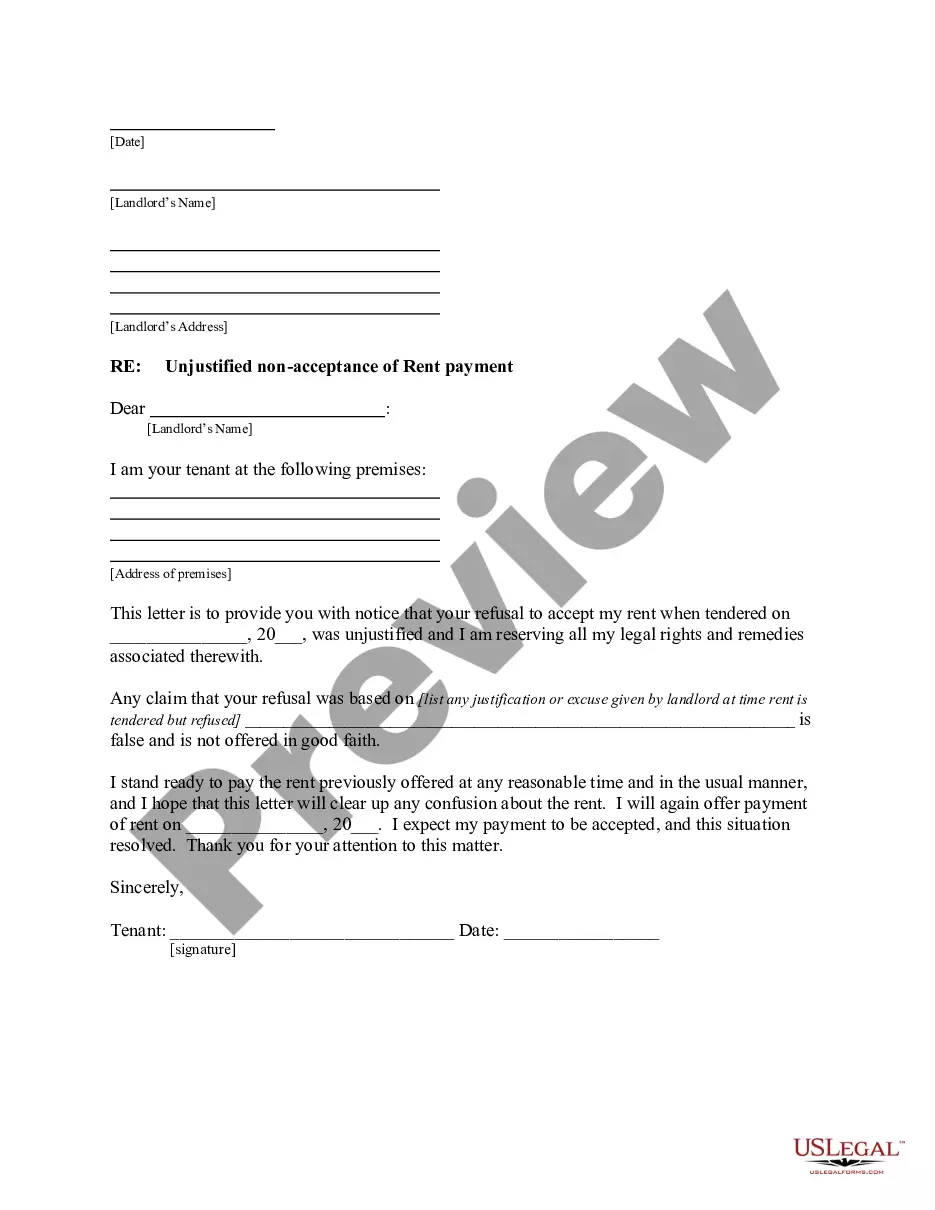

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the document format for your Wayne Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor and save it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!