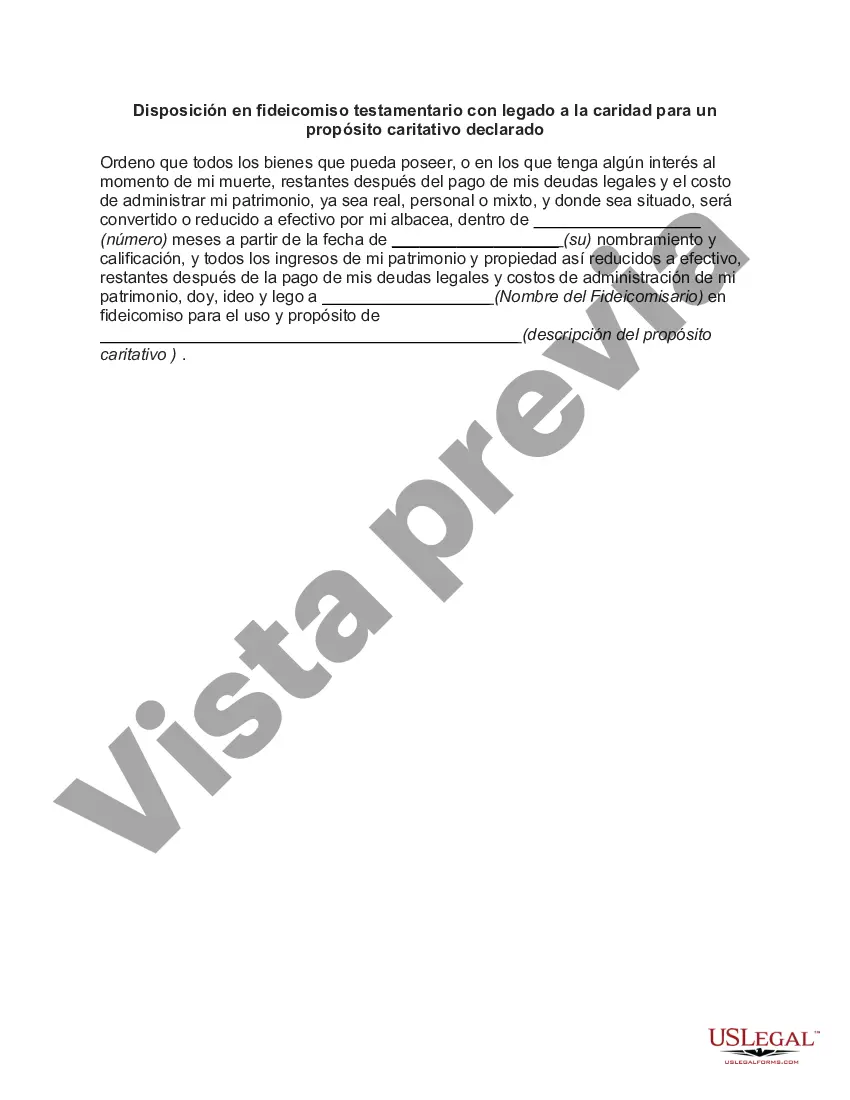

A San Diego California Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose refers to a specific clause in a testamentary trust document that designates a charitable donation, typically a bequest, to a charitable organization or for a specific charitable purpose. This provision allows individuals to leave a lasting impact on their community by supporting causes they are passionate about even after their passing. There are various types of San Diego California Provisions in Testamentary Trusts with Bequests to Charity for Stated Charitable Purposes. Some examples include: 1. General Charitable Bequest: This type of provision allows the trustee to distribute a specific amount or percentage of the trust assets to one or more charities of the testator's choosing. The funds are used by the charities to further their missions and support various programs. 2. Charitable Remainder Trust: This provision creates a trust where income is paid to one or more beneficiaries (usually the testator or their loved ones) for a specified period, after which the remaining trust assets are donated to a charity or charities of the testator's choice. This arrangement allows individuals to provide financial support to both their loved ones and their favored charitable causes. 3. Charitable Lead Trust: In this provision, income generated from the trust assets is paid to one or more charitable organizations for a specified period. After that period, the remaining trust assets are distributed to the designated beneficiaries, such as family members or friends. 4. Donor-Advised Fund: This provision establishes a fund within a charitable organization, where the trustee or the testator's designated advisor has the ability to recommend charitable grants to various organizations or causes. The funds are managed by the charitable organization, which ensures that the testator's charitable intentions are carried out. 5. Charitable Foundation: This type of provision involves the creation of a private charitable foundation, typically funded by a significant portion of the testator's estate. The foundation is intended to support specific charitable causes or organizations identified by the testator and any distribution of funds is governed by the foundation's bylaws. When preparing a testamentary trust with a San Diego California Provision for a Stated Charitable Purpose, it is essential to consult with an experienced estate planning attorney who can provide guidance based on the individual's specific circumstances and philanthropic goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Disposición en fideicomiso testamentario con legado a la caridad para un propósito caritativo declarado - Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose

Description

How to fill out San Diego California Disposición En Fideicomiso Testamentario Con Legado A La Caridad Para Un Propósito Caritativo Declarado?

Do you need to quickly create a legally-binding San Diego Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose or maybe any other document to manage your personal or business affairs? You can go with two options: hire a legal advisor to draft a valid document for you or draft it entirely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you get professionally written legal papers without having to pay sky-high fees for legal services.

US Legal Forms provides a huge catalog of more than 85,000 state-specific document templates, including San Diego Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose and form packages. We offer documents for an array of life circumstances: from divorce paperwork to real estate documents. We've been on the market for over 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed template without extra troubles.

- First and foremost, carefully verify if the San Diego Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose is tailored to your state's or county's laws.

- If the document comes with a desciption, make sure to verify what it's intended for.

- Start the search again if the document isn’t what you were looking for by using the search bar in the header.

- Choose the plan that best fits your needs and proceed to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the San Diego Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose template, and download it. To re-download the form, just go to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Moreover, the templates we offer are updated by law professionals, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!