The Philadelphia Pennsylvania Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children is an important legal provision that outlines the creation of a trust to support disabled children in the Philadelphia area. This provision focuses on ensuring the long-term care and treatment of disabled children by establishing a trust fund dedicated to this cause. The testamentary trust provision serves as a means to support and provide financial assistance to charitable institutions dedicated to the care and treatment of disabled children in Philadelphia, Pennsylvania. It allows individuals to leave behind assets or funds specifically designated for this purpose in their will or estate plan. The provision aims to address the unique needs and challenges faced by disabled children and ensure that they receive proper care and treatment throughout their lives. The trust fund established through the testamentary provision can assist in covering medical expenses, therapy costs, education, recreational activities, and any other support necessary for the well-being and development of disabled children. Key benefits of establishing a Philadelphia Pennsylvania Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children include: 1. Ensuring long-term support: By including this provision in their will or estate plan, individuals can secure ongoing financial support for disabled children even after their passing. This provision helps in maintaining continuity and stability in the provision of care for disabled children. 2. Tailored care for disabled children: The trust funds can be specifically designated to support different types of disabled children and their unique needs. This can include physical disabilities, cognitive disabilities, developmental disorders, sensory impairments, or any other form of disability. 3. Tax benefits: The testamentary trust provision may qualify for certain tax benefits, as charitable contributions are often tax-deductible. This can help to optimize the assets and funds included in the trust, ensuring that a larger portion is directly used for the care and treatment of disabled children. It is important to note that there may not be different "types" of Philadelphia Pennsylvania Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children per se. However, the provision can be personalized and tailored to accommodate the specific needs of the individual's chosen charitable institution or the disabled children it serves. This allows for flexibility in determining the scope, terms, and conditions of the trust. In conclusion, the Philadelphia Pennsylvania Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children is a crucial legal provision that ensures the long-term support and care of disabled children in Philadelphia. Through the establishment of a trust fund, this provision helps to secure financial resources and assistance for charitable institutions dedicated to serving disabled children, covering their unique needs and improving their quality of life.

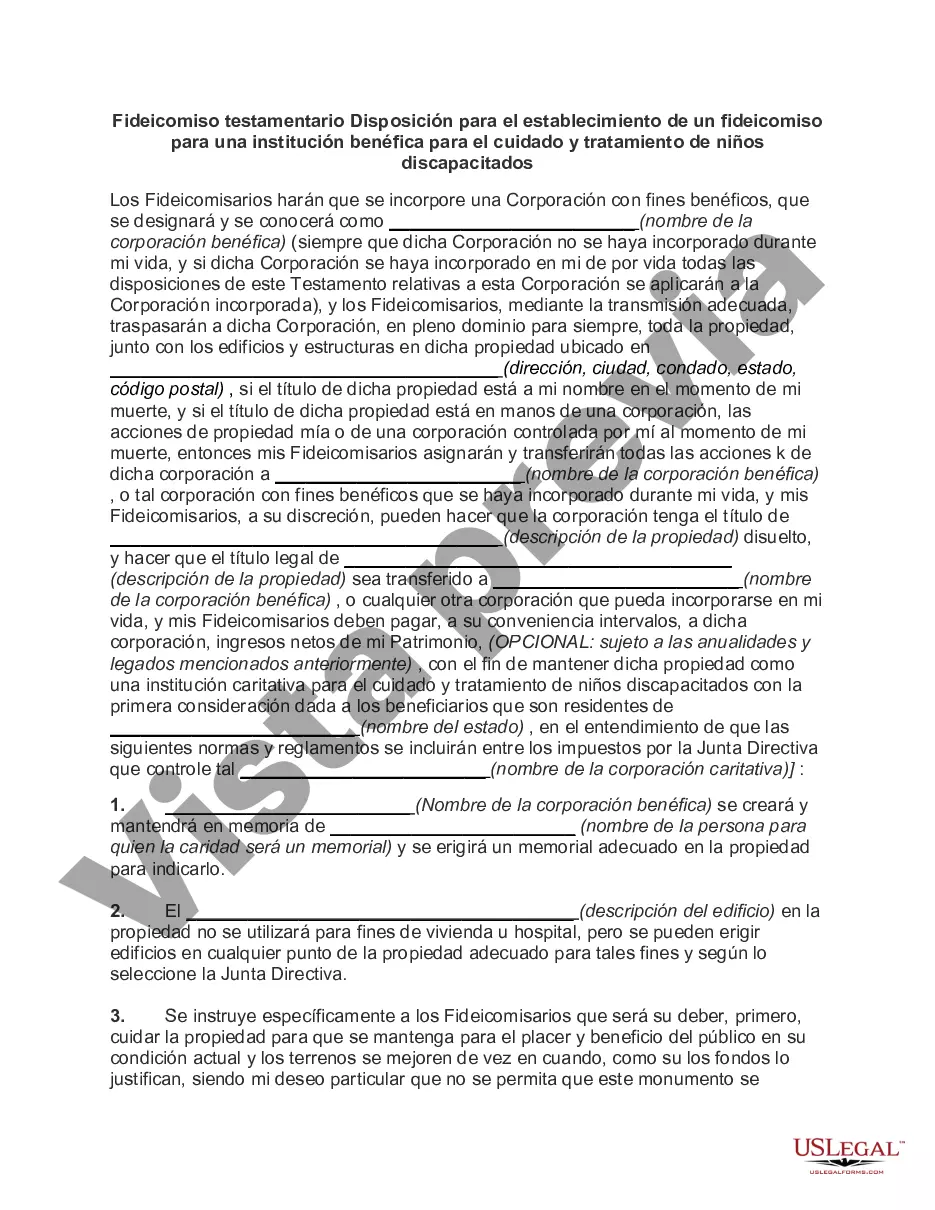

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Philadelphia Pennsylvania Fideicomiso testamentario Disposición para el establecimiento de un fideicomiso para una institución benéfica para el cuidado y tratamiento de niños discapacitados - Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children

Description

How to fill out Philadelphia Pennsylvania Fideicomiso Testamentario Disposición Para El Establecimiento De Un Fideicomiso Para Una Institución Benéfica Para El Cuidado Y Tratamiento De Niños Discapacitados?

Draftwing documents, like Philadelphia Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children, to take care of your legal affairs is a tough and time-consumming task. Many circumstances require an attorney’s involvement, which also makes this task expensive. However, you can consider your legal issues into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms created for a variety of cases and life situations. We ensure each form is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Philadelphia Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children template. Go ahead and log in to your account, download the form, and personalize it to your requirements. Have you lost your form? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as easy! Here’s what you need to do before downloading Philadelphia Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children:

- Ensure that your document is specific to your state/county since the rules for writing legal papers may differ from one state another.

- Discover more information about the form by previewing it or reading a quick description. If the Philadelphia Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or create an account to start utilizing our website and download the form.

- Everything looks great on your side? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your form is all set. You can try and download it.

It’s an easy task to find and buy the appropriate document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!