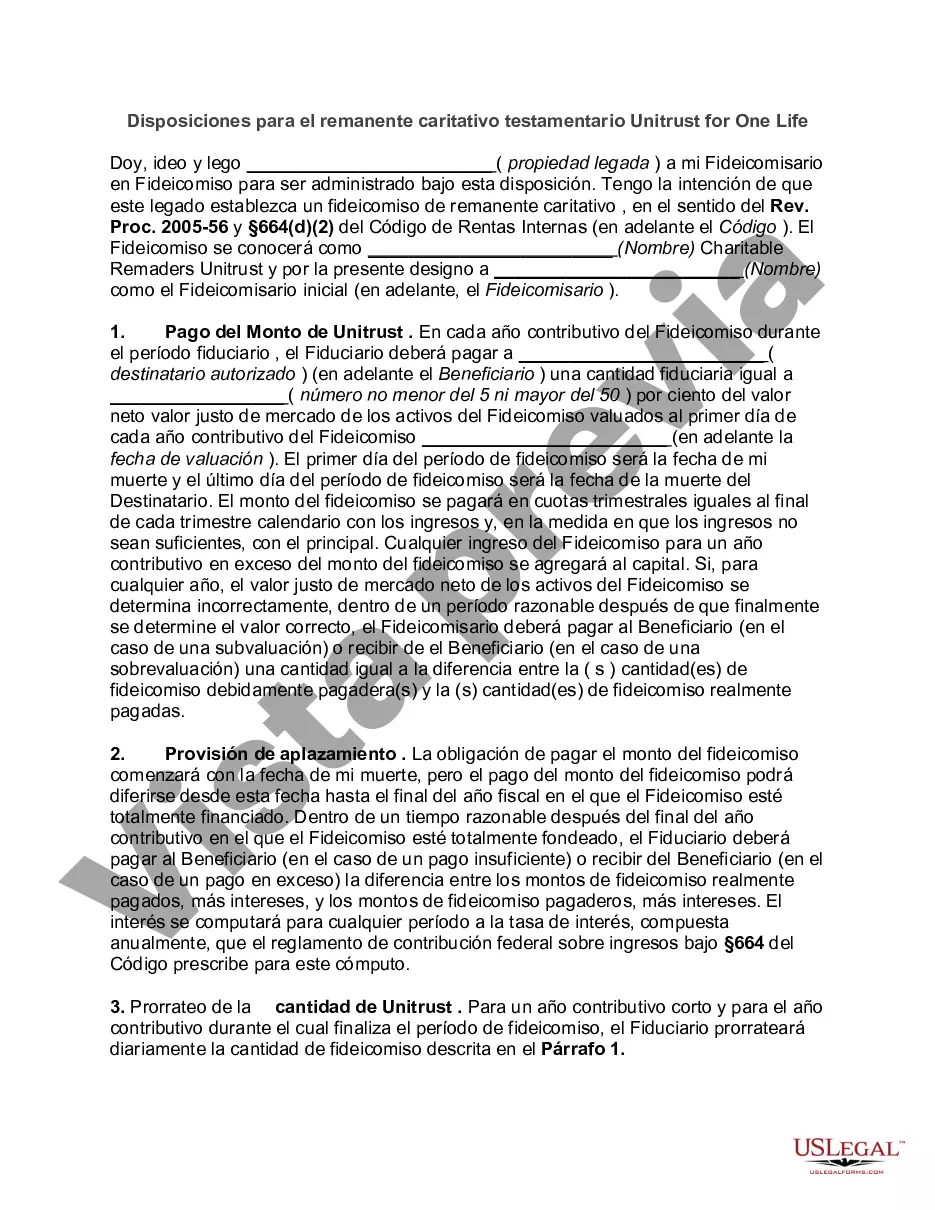

Clark Nevada Provisions for Testamentary Charitable Remainder Unit rust for One Life refers to a legal arrangement that enables individuals to leave assets to a charitable organization while providing income to a designated beneficiary for their lifetime. This type of unit rust is established through a testamentary document, typically a will, in Clark County, Nevada. The Clark Nevada Provisions for Testamentary Charitable Remainder Unit rust for One Life offers individuals various options to customize their charitable giving plans. It allows them to make a significant impact by supporting a cause close to their heart while ensuring their loved ones are financially taken care of during their lifetime. This charitable giving vehicle provides beneficiaries with fixed annual payments, typically a percentage of the trust's value, for their entire life. Upon the beneficiary's passing, the remaining assets are then transferred to the designated charitable organization, helping support their mission and work. There might be different variations or types of Clark Nevada Provisions for Testamentary Charitable Remainder Unit rust for One Life, including: 1. Charitable Remainder Unit rust (CUT) for One Life: This type of unit rust involves naming one beneficiary who receives fixed annual payments for their lifetime. The beneficiary could be the creator of the unit rust or any other individual they choose. 2. Charitable Remainder Annuity Trust (CAT) for One Life: In this variation, the beneficiary receives a fixed dollar amount annually, regardless of the trust's value. This provides a predictable income stream for the beneficiary. 3. Charitable Lead Unit rust (CLUB) for One Life: This type of unit rust provides income to a charitable organization for a specific period before the remaining assets pass to the beneficiary. It enables individuals to support a cause during their lifetime while leaving an inheritance for their loved ones. 4. Pooled Income Fund: A pooled income fund is a type of charitable remainder trust where multiple contributors' assets are combined into a single fund, and income is distributed proportionally amongst the income beneficiaries for their lifetime. By establishing a Clark Nevada Provisions for Testamentary Charitable Remainder Unit rust for One Life, individuals can leave a lasting legacy, provide for their beneficiaries, and support charitable causes they care about. Consulting with an experienced estate planning attorney can assist in tailoring the trust to meet specific goals and comply with legal requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Clark Nevada Disposiciones para el remanente caritativo testamentario Unitrust for One Life - Provisions for Testamentary Charitable Remainder Unitrust for One Life

Description

How to fill out Clark Nevada Disposiciones Para El Remanente Caritativo Testamentario Unitrust For One Life?

Laws and regulations in every area differ around the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Clark Provisions for Testamentary Charitable Remainder Unitrust for One Life, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for various life and business occasions. All the forms can be used many times: once you pick a sample, it remains accessible in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Clark Provisions for Testamentary Charitable Remainder Unitrust for One Life from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Clark Provisions for Testamentary Charitable Remainder Unitrust for One Life:

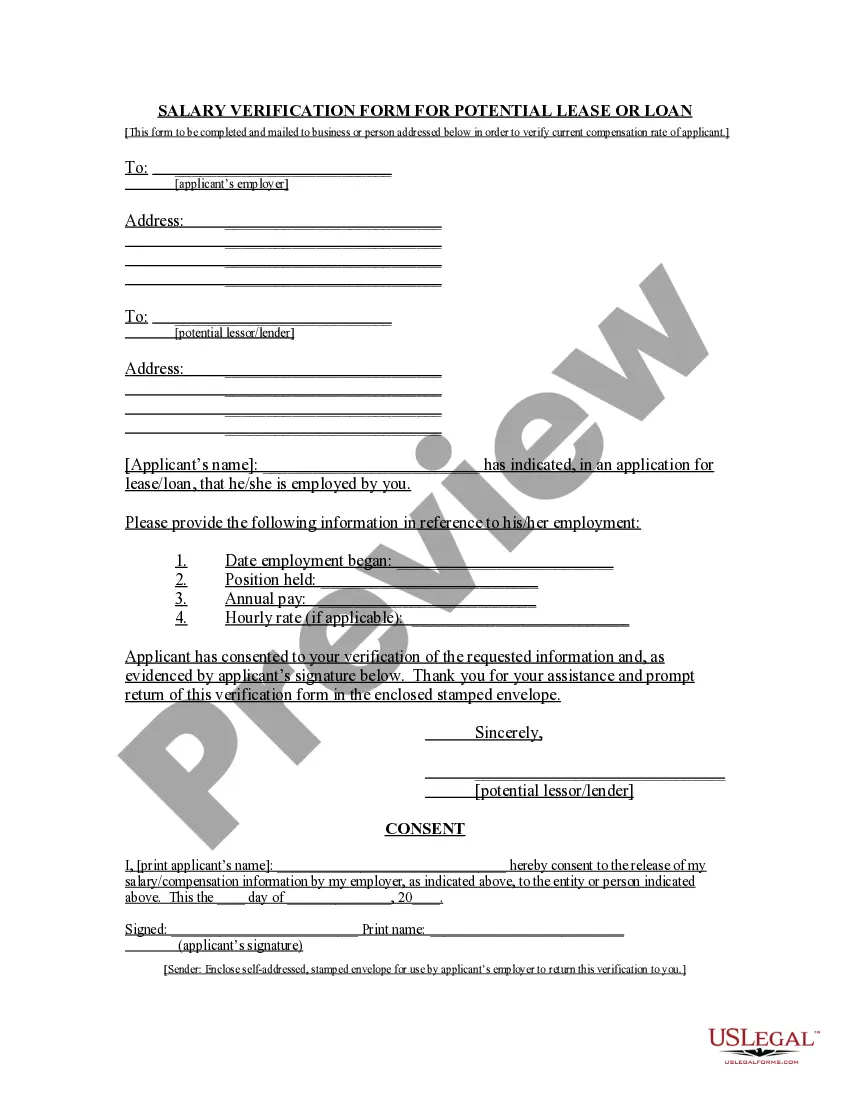

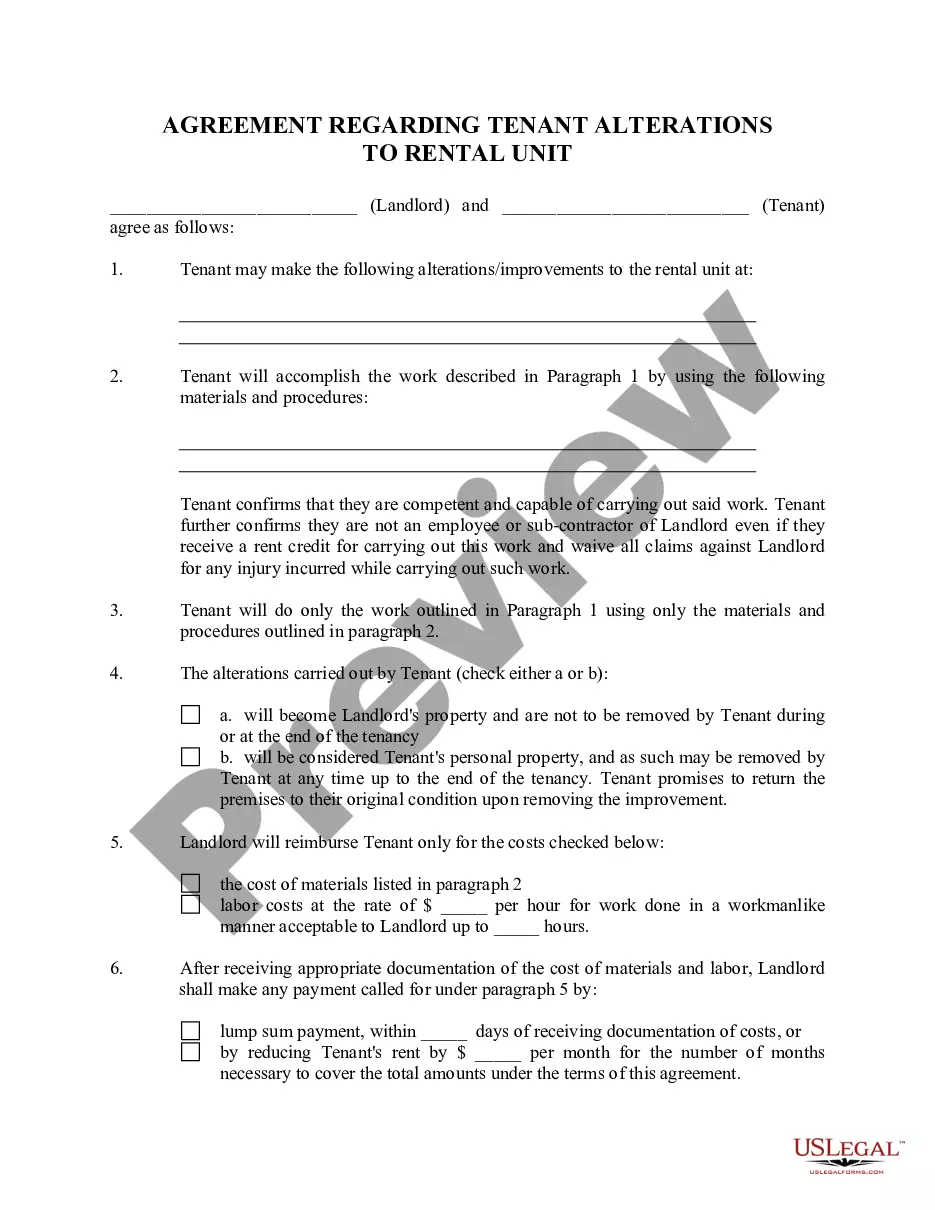

- Analyze the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the document when you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!