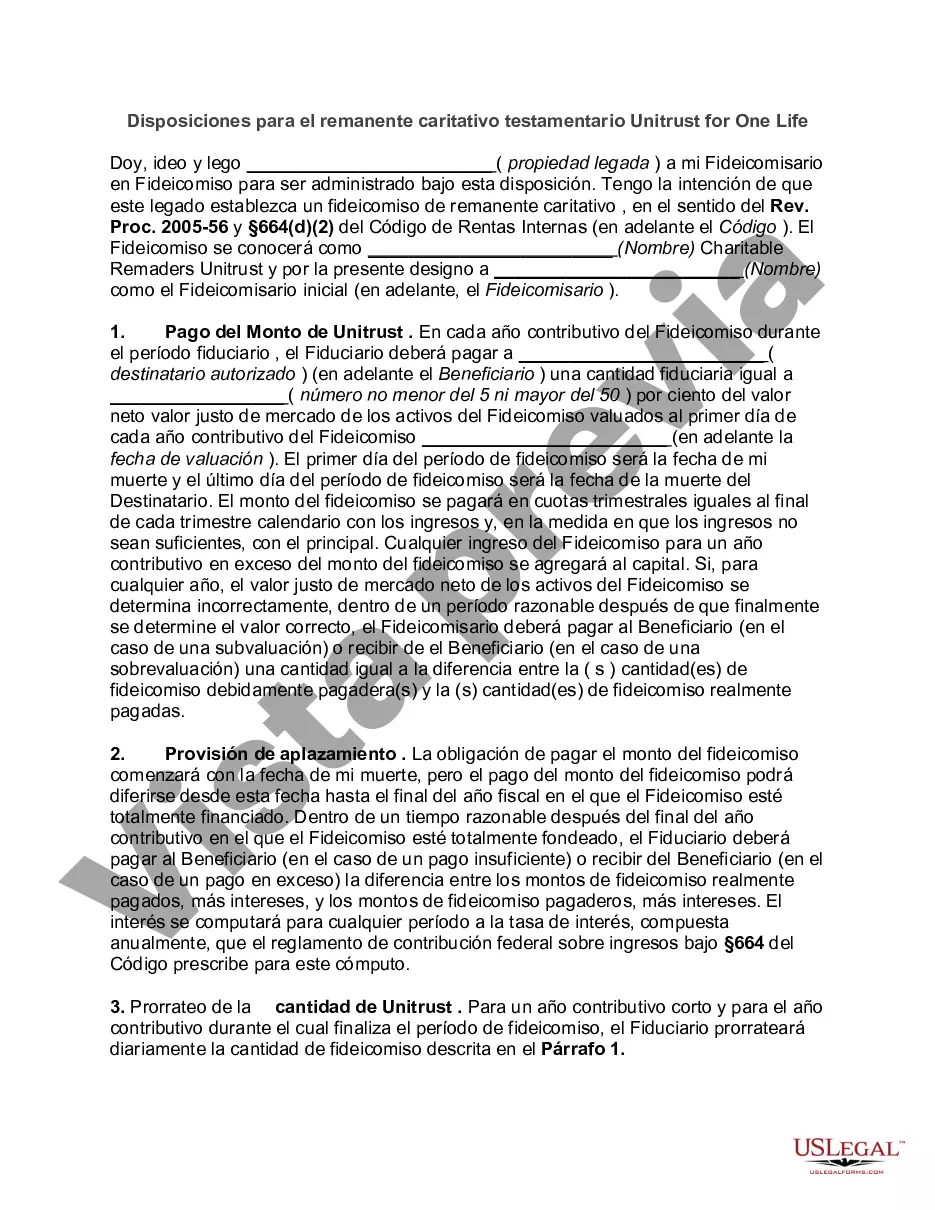

Maricopa, Arizona, offers an array of provisions for a Testamentary Charitable Remainder Unit rust for One Life, providing individuals with an impactful avenue to plan their estate while supporting charitable causes. This unique type of trust allows donors to designate a specific lifetime beneficiary while allotting the remaining assets to selected charitable organizations upon the beneficiary's passing. The Maricopa Provisions for Testamentary Charitable Remainder Unit rust for One Life ensure that philanthropic individuals can establish a lasting legacy by incorporating their charitable interests into their estate plans. By contributing assets such as stocks, real estate, or cash to this trust, donors can receive immediate tax benefits while still enjoying a regular income stream during their lifetime. Different types of the Maricopa Arizona Provisions for Testamentary Charitable Remainder Unit rust for One Life may include: 1. Charitable Remainder Annuity Trust (CAT): Under this provision, the lifetime beneficiary receives a fixed annual payment, predetermined at the trust's creation. Regardless of investment performance, the beneficiary's income remains constant. 2. Charitable Remainder Unit rust (CUT): This provision offers a fluctuating income stream based on a fixed percentage of the trust's net fair market value. As the trust assets generate income or appreciate, the beneficiary's payments vary accordingly. 3. Net Income Charitable Remainder Unit rust (NICEST): With this provision, the beneficiary receives the least of a fixed percentage of the trust's net fair market value or the trust's actual income for the year. Any unused income can be carried forward for distribution in subsequent years. 4. Flip Unit rust: This provision allows the trust to start as a Net Income Charitable Remainder Unit rust (NICEST) during the beneficiary's lifetime, but "flips" to a Charitable Remainder Unit rust (CUT) when a triggering event occurs (e.g., the sale of a specific asset). Following the flip, the beneficiary will then receive a fixed percentage of the trust's net fair market value. These Maricopa Arizona Provisions for Testamentary Charitable Remainder Unit rust for One Life enable individuals to support causes dear to their hearts while enjoying financial benefits during their lifetime. Donors can tailor these trusts to meet their specific charitable and financial goals, ultimately leaving a meaningful and lasting impact on their community.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Disposiciones para el remanente caritativo testamentario Unitrust for One Life - Provisions for Testamentary Charitable Remainder Unitrust for One Life

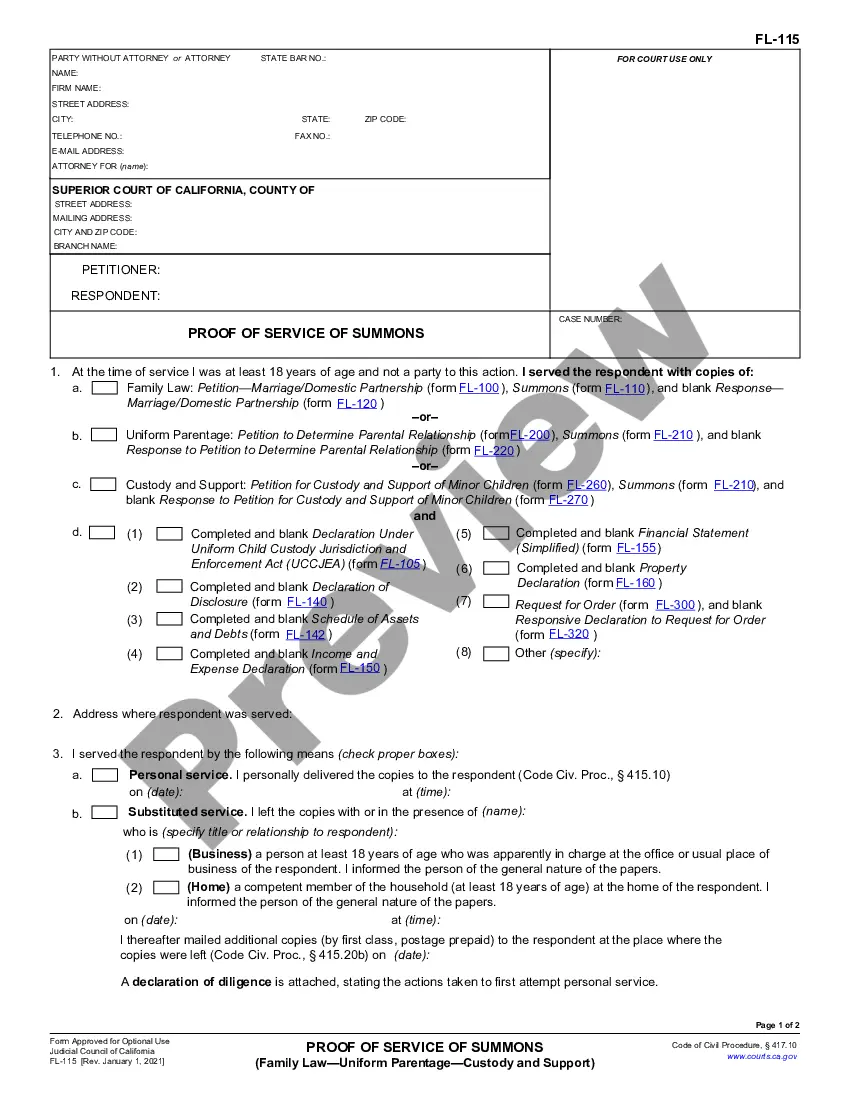

Description

How to fill out Maricopa Arizona Disposiciones Para El Remanente Caritativo Testamentario Unitrust For One Life?

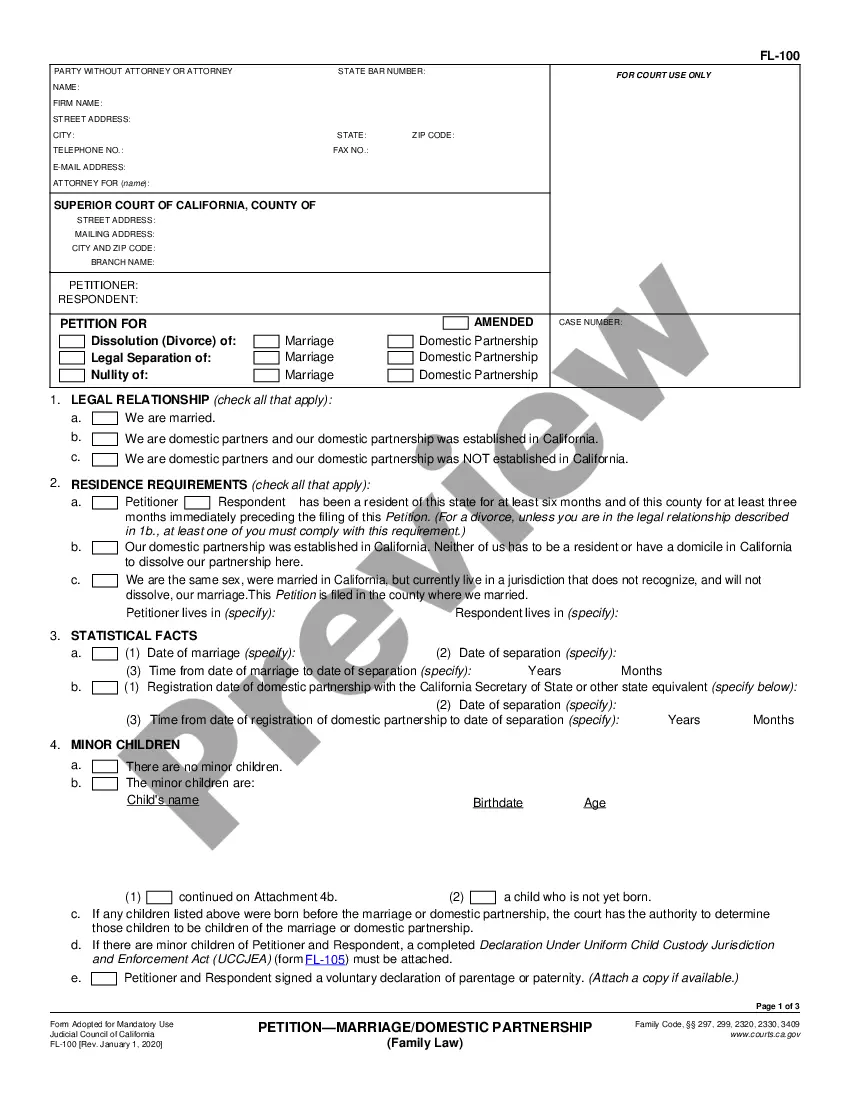

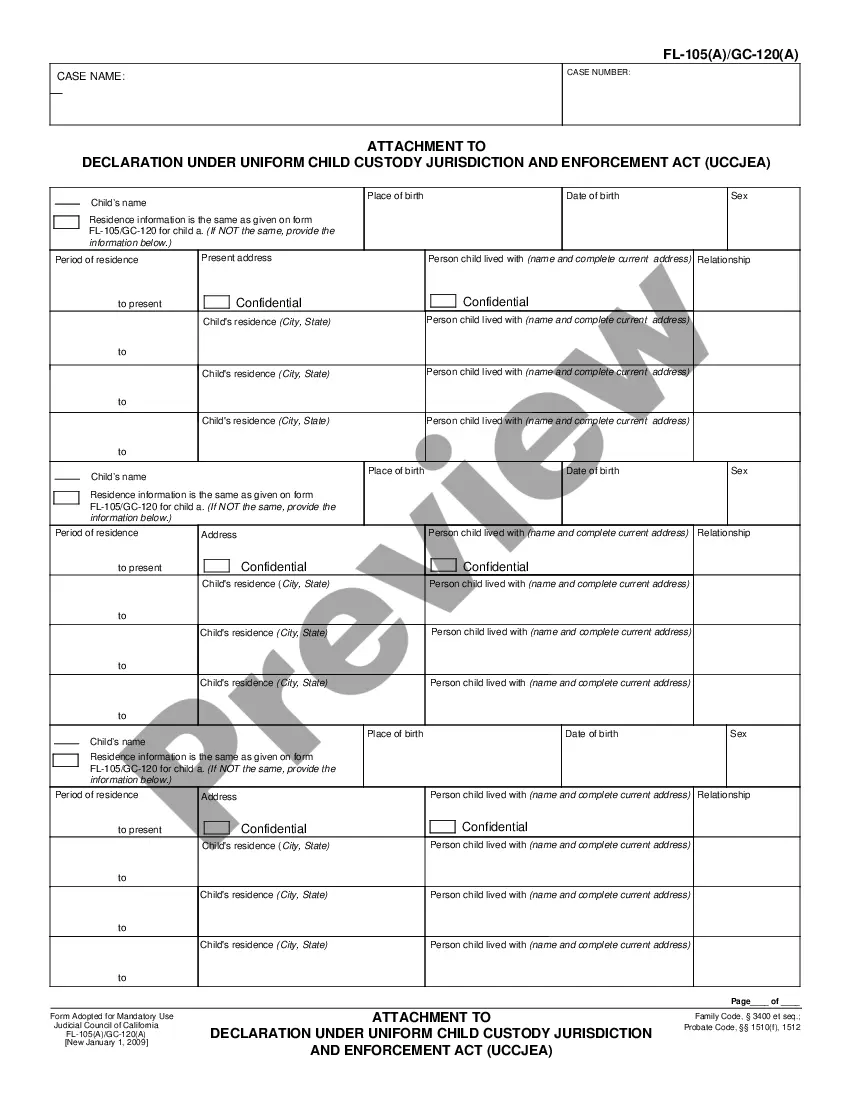

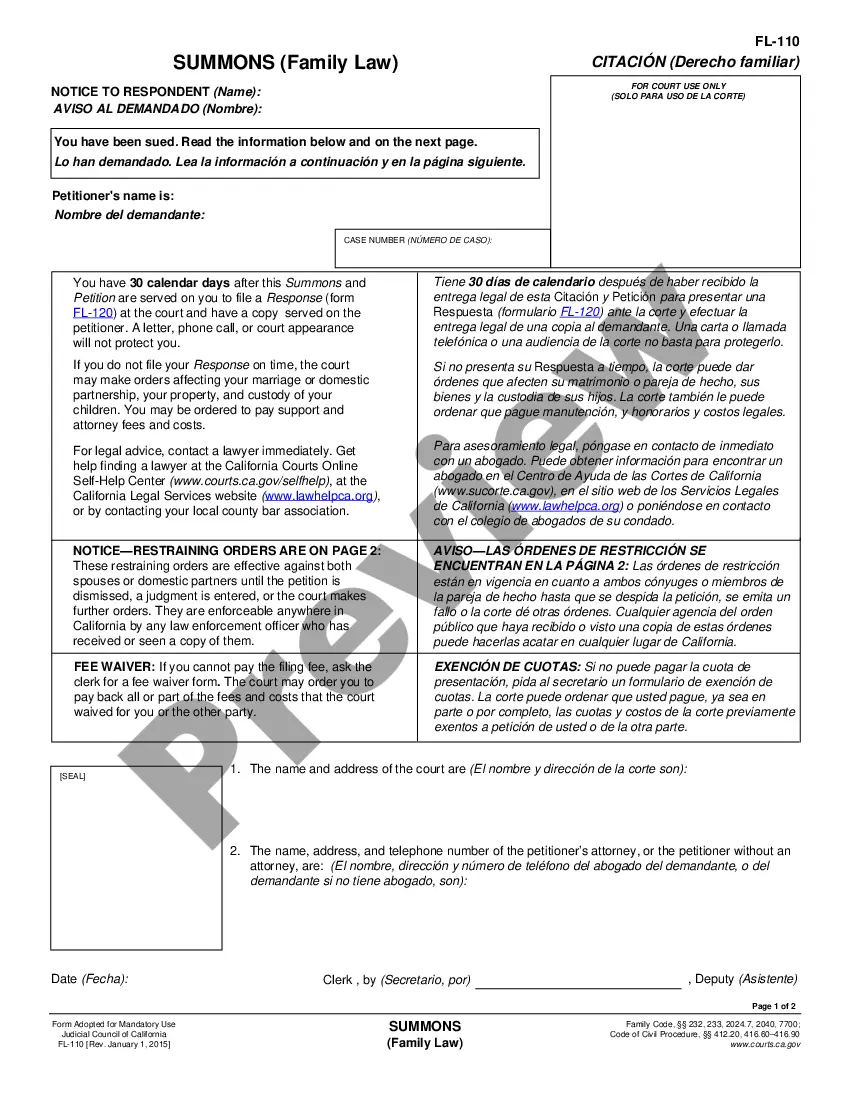

Are you looking to quickly create a legally-binding Maricopa Provisions for Testamentary Charitable Remainder Unitrust for One Life or maybe any other form to manage your personal or business matters? You can select one of the two options: contact a professional to write a valid document for you or draft it entirely on your own. Luckily, there's an alternative option - US Legal Forms. It will help you get neatly written legal papers without paying unreasonable fees for legal services.

US Legal Forms offers a huge collection of over 85,000 state-specific form templates, including Maricopa Provisions for Testamentary Charitable Remainder Unitrust for One Life and form packages. We provide templates for an array of use cases: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and got a spotless reputation among our clients. Here's how you can become one of them and obtain the needed document without extra hassles.

- To start with, double-check if the Maricopa Provisions for Testamentary Charitable Remainder Unitrust for One Life is adapted to your state's or county's laws.

- If the form includes a desciption, make sure to verify what it's intended for.

- Start the search over if the document isn’t what you were looking for by using the search box in the header.

- Select the subscription that is best suited for your needs and proceed to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Maricopa Provisions for Testamentary Charitable Remainder Unitrust for One Life template, and download it. To re-download the form, just go to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. Additionally, the paperwork we provide are reviewed by industry experts, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!