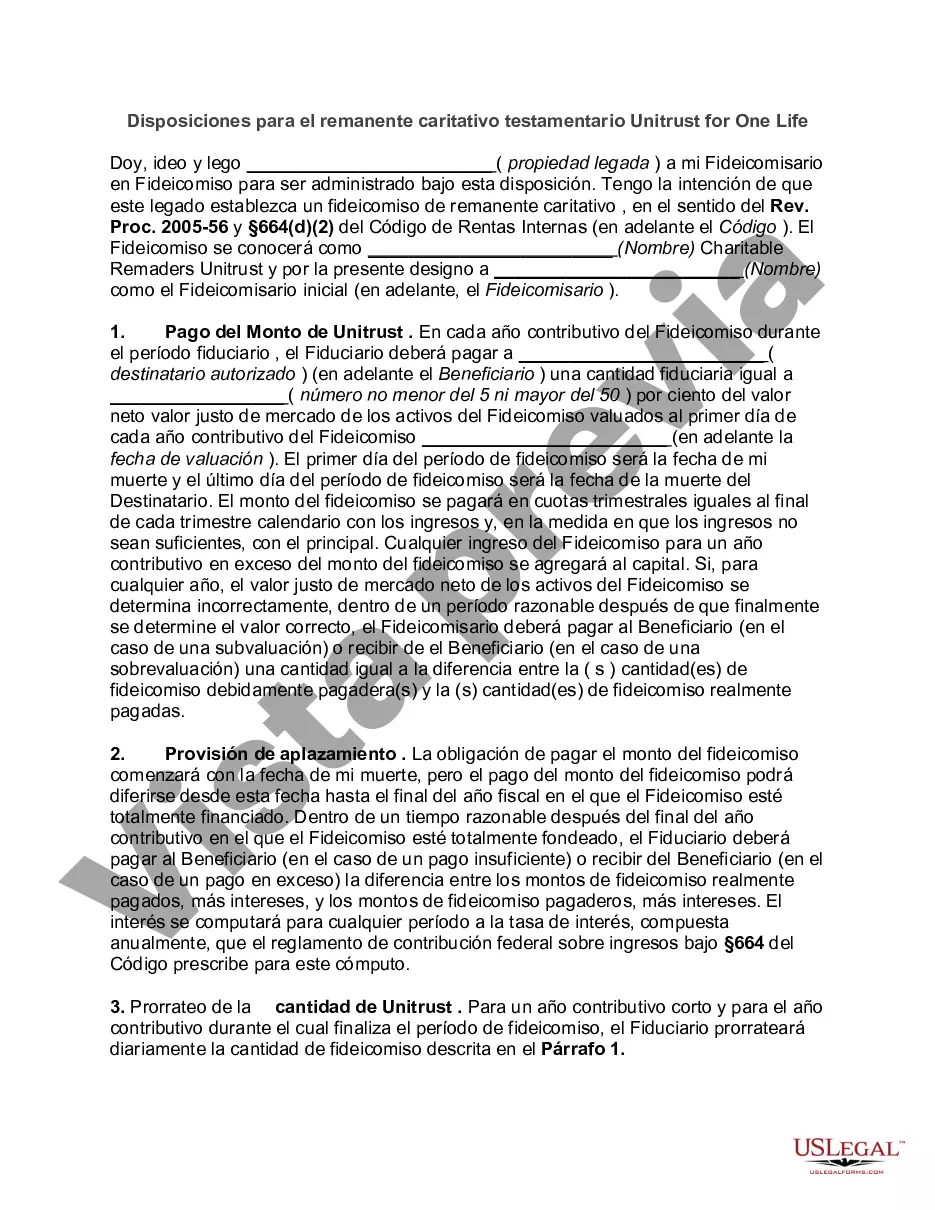

A Phoenix Arizona Provisions for Testamentary Charitable Remainder Unit rust for One Life is a legal instrument that allows an individual (the donor) to provide for charitable giving while also ensuring their financial needs are met during their lifetime. This type of trust is established through a written document, typically a last will and testament, and becomes effective upon the donor's death. Keywords: Phoenix Arizona, Provisions, Testamentary Charitable Remainder Unit rust, One Life A testamentary charitable remainder unit rust (CUT) is a specific type of charitable trust that allows the donor to transfer assets into the trust, which are then invested to generate income. The donor retains the right to receive income from the trust during their lifetime, usually in the form of annual payments. After the donor's passing, the remaining assets in the trust are distributed to charitable organizations or causes specified by the donor. In Phoenix, Arizona, there are various provisions that can be included when establishing a testamentary charitable remainder unit rust for one life. These provisions can be tailored to meet the specific charitable objectives and financial circumstances of the donor. Some commonly used provisions include: 1. Charitable Beneficiaries: The donor can select one or more charitable organizations or causes benefiting from the trust's assets. These organizations may include local charities in Phoenix, Arizona, such as educational institutions, healthcare organizations, cultural centers, or environmental conservation groups. 2. Income Distribution: The donor can decide how the income from the trust will be distributed during their lifetime. They may choose to receive a fixed percentage of the trust's value annually or a fixed dollar amount. This provision ensures that the donor has financial security while also supporting charitable endeavors. 3. Remainder Beneficiaries: The remainder beneficiaries are the charitable organizations or causes that will receive the remaining assets in the trust upon the donor's death. The donor can specify the exact distribution percentages or provide general guidelines for the trustee to follow when distributing the assets to charitable organizations in Phoenix, Arizona. 4. Trustee Selection: The donor can appoint a trusted individual or a professional trustee to manage the trust's assets and ensure that the trust's provisions are being followed. The trustee plays a pivotal role in overseeing investments, making distributions, and maintaining compliance with legal requirements. 5. Tax Benefits: Testamentary charitable remainder unit rusts may offer various tax benefits to the donor's estate and beneficiaries. These benefits can include income tax deductions, capital gains tax savings, and estate tax reductions. Consulting with an experienced attorney or financial advisor in Phoenix, Arizona is essential to maximize these tax advantages. It is important to note that the specific provisions and legal requirements for a Phoenix Arizona Provisions for Testamentary Charitable Remainder Unit rust for One Life may vary depending on state laws and individual circumstances. Consulting with an attorney specializing in trust and estate planning is highly recommended ensuring the trust is properly structured and fulfills the donor's charitable goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Disposiciones para el remanente caritativo testamentario Unitrust for One Life - Provisions for Testamentary Charitable Remainder Unitrust for One Life

Description

How to fill out Phoenix Arizona Disposiciones Para El Remanente Caritativo Testamentario Unitrust For One Life?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and many other life scenarios require you prepare official paperwork that varies from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any individual or business purpose utilized in your region, including the Phoenix Provisions for Testamentary Charitable Remainder Unitrust for One Life.

Locating templates on the platform is amazingly straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Phoenix Provisions for Testamentary Charitable Remainder Unitrust for One Life will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guide to get the Phoenix Provisions for Testamentary Charitable Remainder Unitrust for One Life:

- Ensure you have opened the right page with your localised form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template meets your needs.

- Search for another document using the search option if the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Phoenix Provisions for Testamentary Charitable Remainder Unitrust for One Life on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!