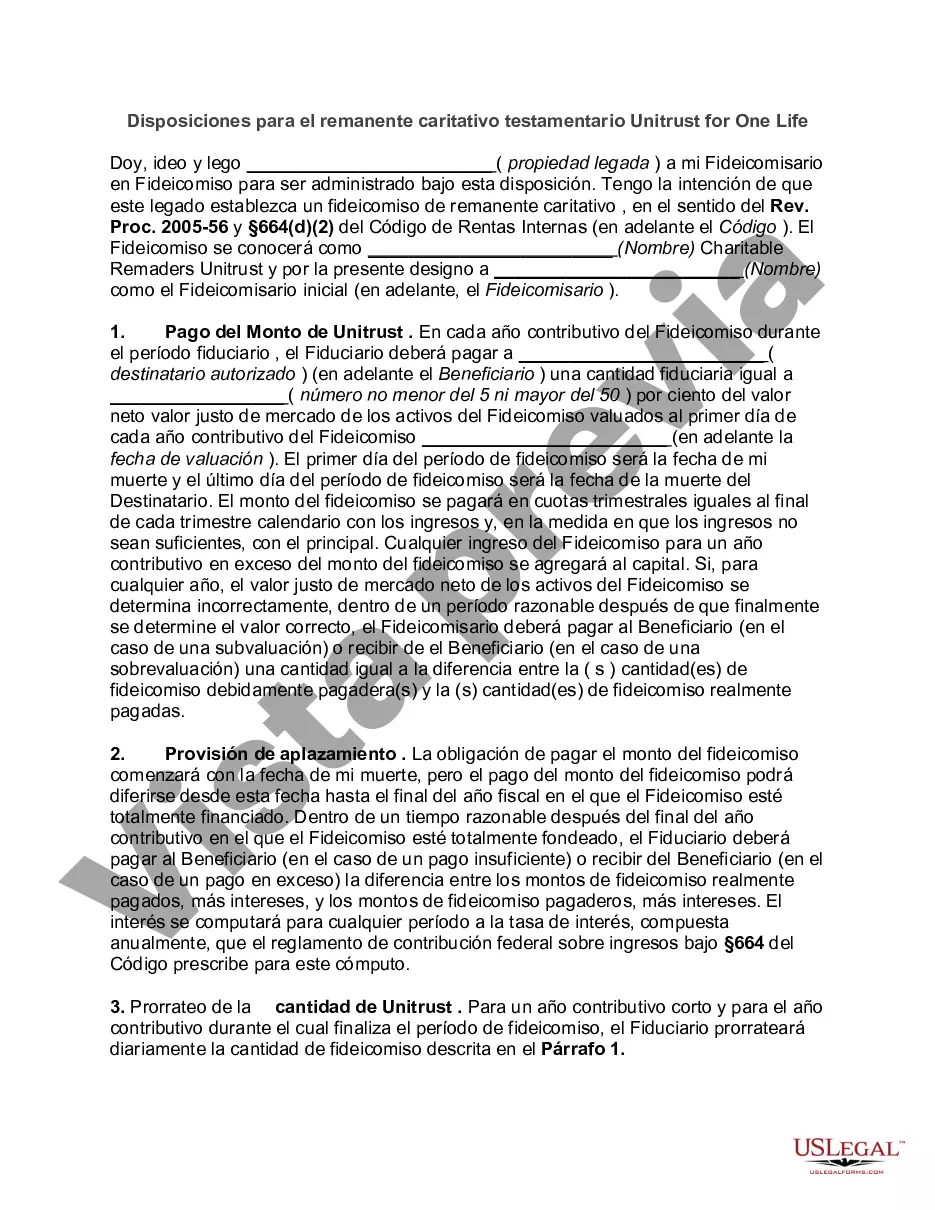

Lima Arizona Provisions for Testamentary Charitable Remainder Unit rust for One Life A Lima Arizona Provisions for Testamentary Charitable Remainder Unit rust for One Life is a legal arrangement that allows individuals to provide for their loved ones and make charitable contributions simultaneously. It involves a trust created in compliance with the laws of Lima, Arizona, that includes provisions for a charitable remainder unit rust to be established upon the death of one individual (the "income beneficiary") for the benefit of one or more charitable organizations. This type of trust ensures that the income beneficiary receives regular payments from the trust for their lifetime, while also providing a charitable deduction to the estate. After the income beneficiary's passing, the remaining assets in the trust are distributed to the designated charitable organizations or causes. The Lima Arizona Provisions for Testamentary Charitable Remainder Unit rust for One Life offers flexibility in terms of charitable organizations and causes that can be supported. The trust creator can select one or multiple charitable organizations that align with their philanthropic goals and values. Additionally, specific criteria or guidelines can be set to ensure the charitable donations are used in a manner that meets the creator's intentions. Different types of Lima Arizona Provisions for Testamentary Charitable Remainder Unit rust for One Life may include variations in the income beneficiary's chosen charitable organizations, their corresponding percentages of distribution, or specific guidelines for the use of charitable funds. The options are tailored to suit the individual's preferences and to create a lasting impact in their community or in a cause they hold dear. Some relevant keywords for this topic include: Lima Arizona, Provisions, Testamentary, Charitable Remainder Unit rust, One Life, legal arrangement, trust, income beneficiary, charitable organizations, regular payments, charitable deduction, estate, assets, distribution, philanthropic goals, values, criteria, guidelines, donations, community, lasting impact. It is important to consult with an experienced estate planning attorney or financial advisor to ensure that the Lima Arizona Provisions for Testamentary Charitable Remainder Unit rust for One Life meets all legal requirements and matches the individual's specific goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pima Arizona Disposiciones para el remanente caritativo testamentario Unitrust for One Life - Provisions for Testamentary Charitable Remainder Unitrust for One Life

Description

How to fill out Pima Arizona Disposiciones Para El Remanente Caritativo Testamentario Unitrust For One Life?

If you need to find a trustworthy legal document supplier to find the Pima Provisions for Testamentary Charitable Remainder Unitrust for One Life, look no further than US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed template.

- You can search from over 85,000 forms arranged by state/county and case.

- The intuitive interface, variety of learning resources, and dedicated support make it easy to locate and complete different documents.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

You can simply type to search or browse Pima Provisions for Testamentary Charitable Remainder Unitrust for One Life, either by a keyword or by the state/county the form is intended for. After finding the required template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Pima Provisions for Testamentary Charitable Remainder Unitrust for One Life template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Register an account and select a subscription option. The template will be immediately ready for download as soon as the payment is processed. Now you can complete the form.

Taking care of your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes these tasks less costly and more affordable. Set up your first company, arrange your advance care planning, create a real estate contract, or complete the Pima Provisions for Testamentary Charitable Remainder Unitrust for One Life - all from the convenience of your sofa.

Join US Legal Forms now!