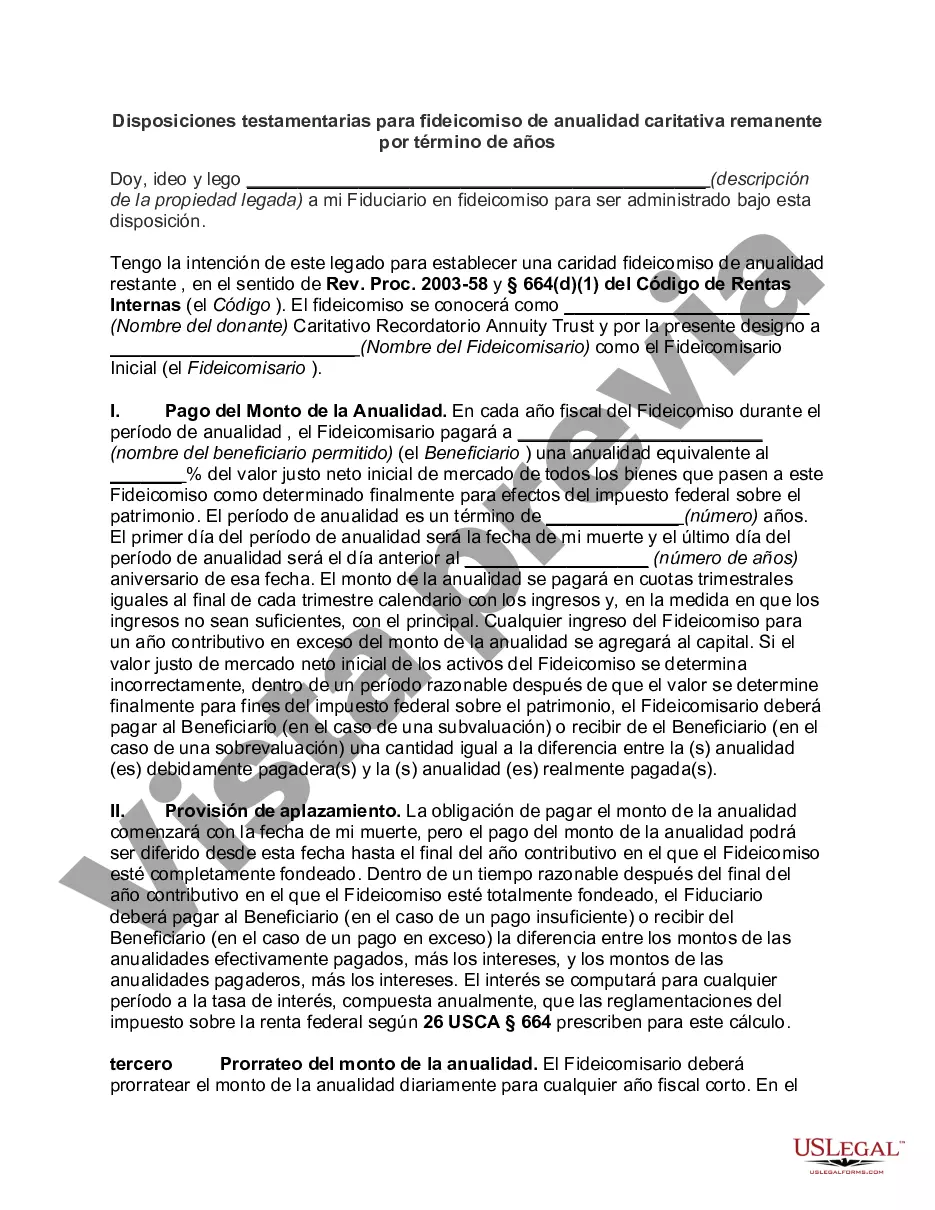

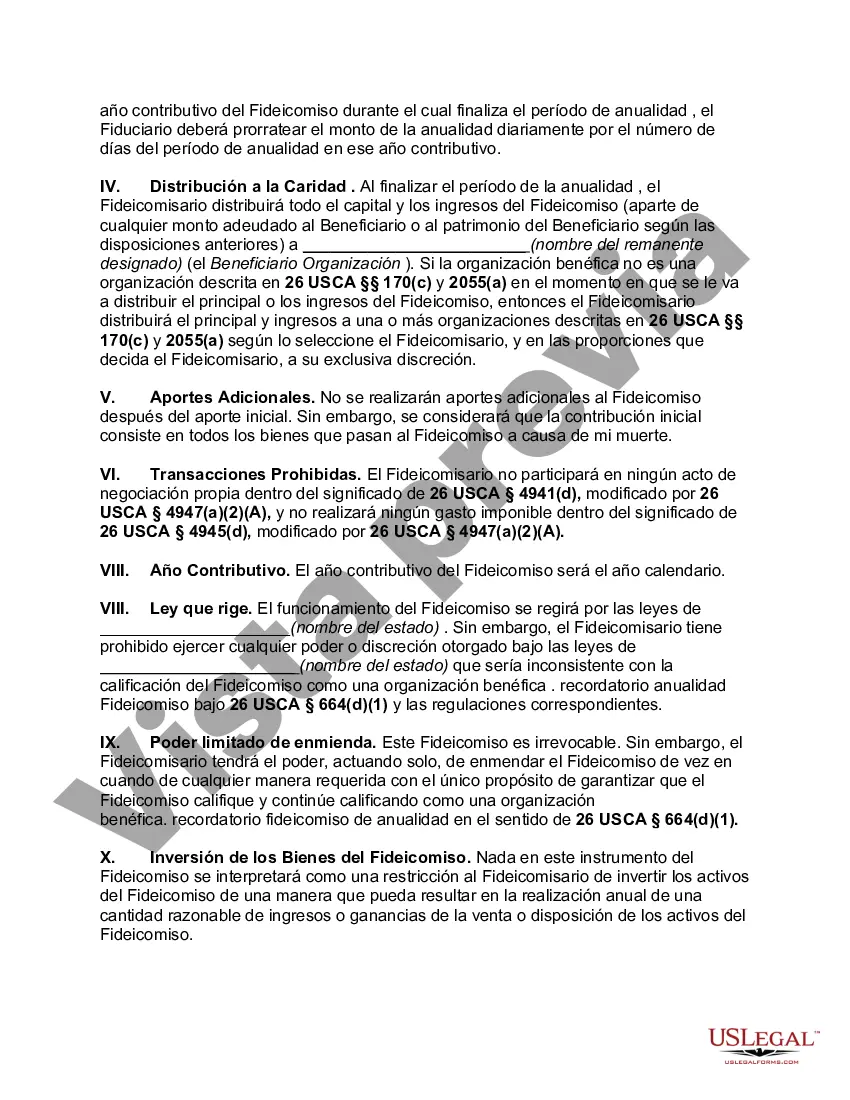

Houston Texas Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years refers to specific legal mechanisms that allow individuals to establish charitable remainder annuity trusts in their last will and testament in Houston, Texas. These provisions ensure that a portion of the estate is allocated to a charitable organization for a specified term of years, while also providing fixed annuity payments to designated beneficiaries. There are several types of Houston Texas Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years, including: 1. Charitable Remainder Annuity Trust (CAT): This type of trust guarantees a fixed annual payment to the designated beneficiaries for a specific term of years. The payment amount is determined at the creation of the trust and remains constant throughout the term, regardless of fluctuations in trust assets. 2. Charitable Remainder Unit rust (CUT): Unlike a CAT, a CUT provides beneficiaries with annual payments based on a fixed percentage of the trust's value, recalculated annually. The payment amount may vary depending on the trust's performance, ensuring beneficiaries receive a proportionate share of the trust's growth. 3. Net Income with Makeup Charitable Remainder Unit rust (TIMEOUT): This complex trust structure allows beneficiaries to receive the trust's net income, with any shortfalls being made up in future years when the trust generates higher income. Timeouts offer flexibility in income distribution, ensuring beneficiaries don't suffer from temporary low-income years. 4. Flip Charitable Remainder Unit rust (FLIPKART): A FLIPKART initially operates as a net income unit rust, but upon the occurrence of a predetermined triggering event (such as the sale of real estate), it converts to a standard CUT, paying a fixed percentage of the trust's value. This structure provides tax advantages during asset appreciation phases. When establishing Houston Texas Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years, individuals should consult with experienced estate planning attorneys familiar with Texas laws. These professionals can ensure the proper drafting and implementation of the trust, maximizing tax benefits and effectively supporting both charitable causes and beneficiaries.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Disposiciones testamentarias para fideicomiso de anualidad caritativa remanente por término de años - Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years

Description

How to fill out Houston Texas Disposiciones Testamentarias Para Fideicomiso De Anualidad Caritativa Remanente Por Término De Años?

How much time does it typically take you to draft a legal document? Since every state has its laws and regulations for every life situation, locating a Houston Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years suiting all regional requirements can be exhausting, and ordering it from a professional attorney is often expensive. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. In addition to the Houston Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years, here you can find any specific document to run your business or individual deeds, complying with your county requirements. Professionals verify all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can retain the document in your profile at any moment later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Houston Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Houston Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!