Nassau New York Granter Retained Income Trust with Division into Trusts for Issue after Term of Years, also known as the Nassau GREAT with Division into Trusts, is a specialized estate planning tool that allows individuals to transfer assets to their beneficiaries while minimizing estate taxes. This type of trust is commonly used in estate planning strategies to provide income for a defined number of years to the granter, after which the remaining assets are distributed to named beneficiaries. The Nassau GREAT with Division into Trusts offers several key benefits, such as reducing estate tax liability, preserving family wealth, and ensuring a steady stream of income for the granter. By utilizing this trust, individuals can effectively transfer their assets to future generations while minimizing the tax burden on their estates. This type of trust divides the assets into separate trusts for each beneficiary. By doing so, the assets can be managed and distributed according to the specific needs and circumstances of each beneficiary after the defined term of years has elapsed. This division into trusts allows for greater flexibility in managing the trust assets and ensures that each beneficiary receives their fair share. There are a few variations of the Nassau New York Granter Retained Income Trust with Division into Trusts for Issue after Term of Years, including: 1. Standard Nassau GREAT with Division into Trusts: This is the standard form of the trust that provides for the division of assets into separate trusts for each beneficiary after the specified term of years. 2. Nassau GREAT with Division into Trusts for Minors: This variation is designed to provide income and asset protection for minor beneficiaries. The trust assets are held in separate sub-trusts for each minor beneficiary until they reach a certain age or milestone, such as turning 21 or graduating from college. 3. Nassau GREAT with Division into Trusts for Special Needs Beneficiaries: This variation is tailored for beneficiaries with special needs or disabilities. The trust structure allows for the management of assets in a way that does not jeopardize the beneficiary's eligibility for government benefits. In conclusion, the Nassau New York Granter Retained Income Trust with Division into Trusts for Issue after Term of Years is a powerful estate planning tool that provides significant benefits in terms of tax planning, wealth preservation, and flexible asset distribution. By understanding the various types and their specific features, individuals can effectively utilize this trust to achieve their estate planning goals while protecting the interests of their beneficiaries.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Fideicomiso de ingresos retenidos del otorgante con división en fideicomisos para su emisión después del plazo de años - Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years

Description

How to fill out Nassau New York Fideicomiso De Ingresos Retenidos Del Otorgante Con División En Fideicomisos Para Su Emisión Después Del Plazo De Años?

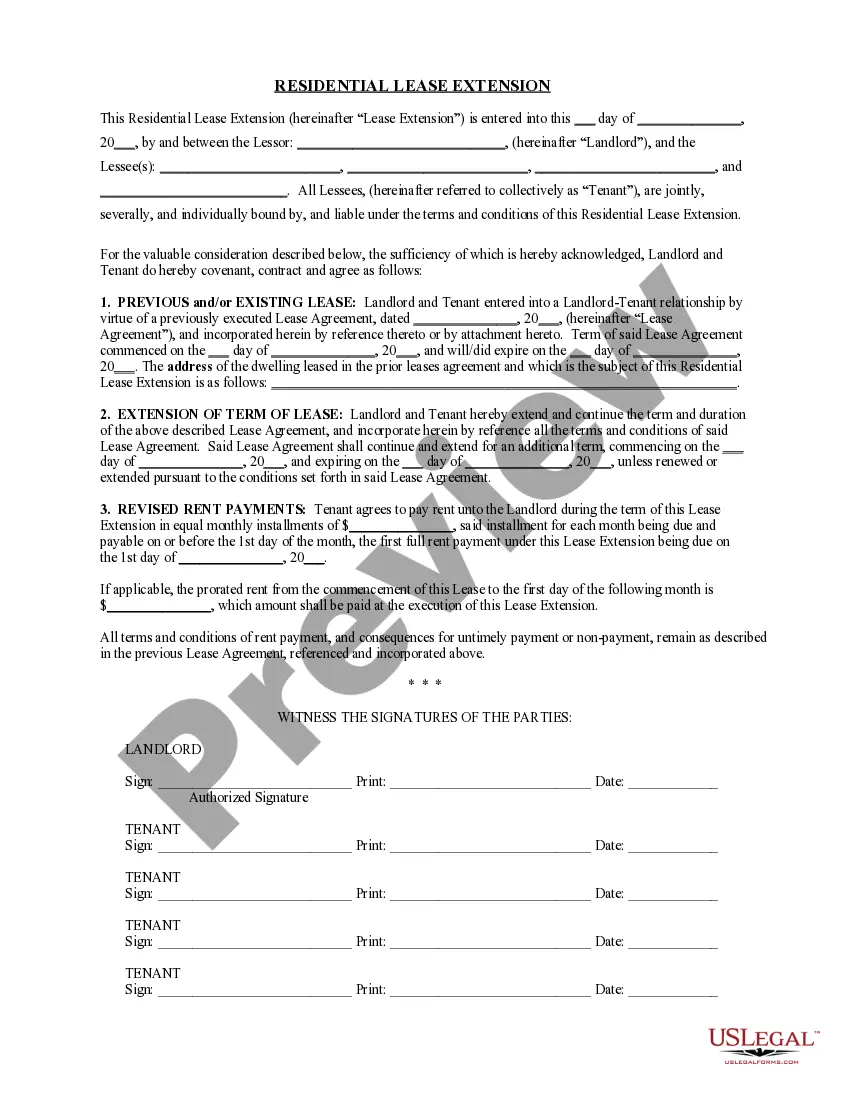

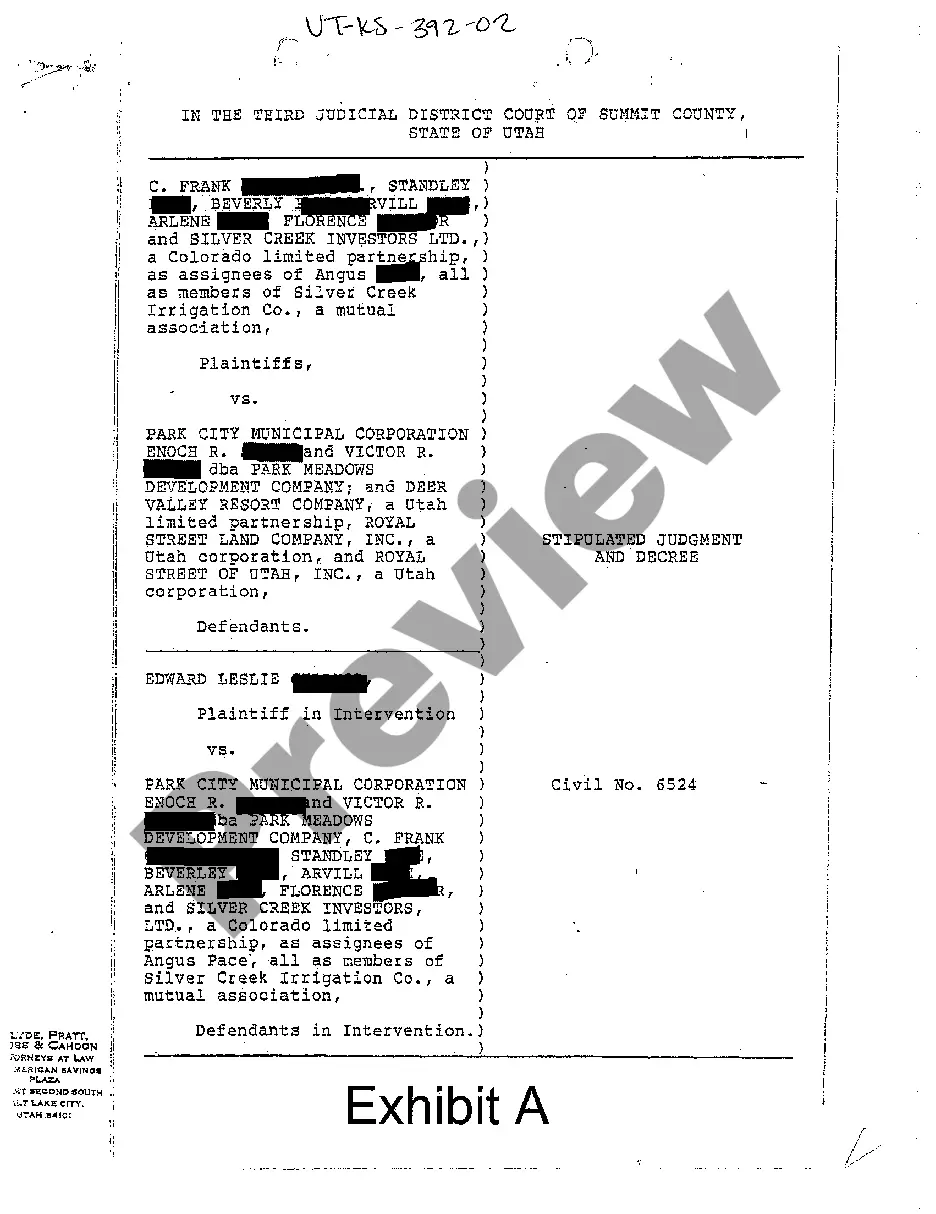

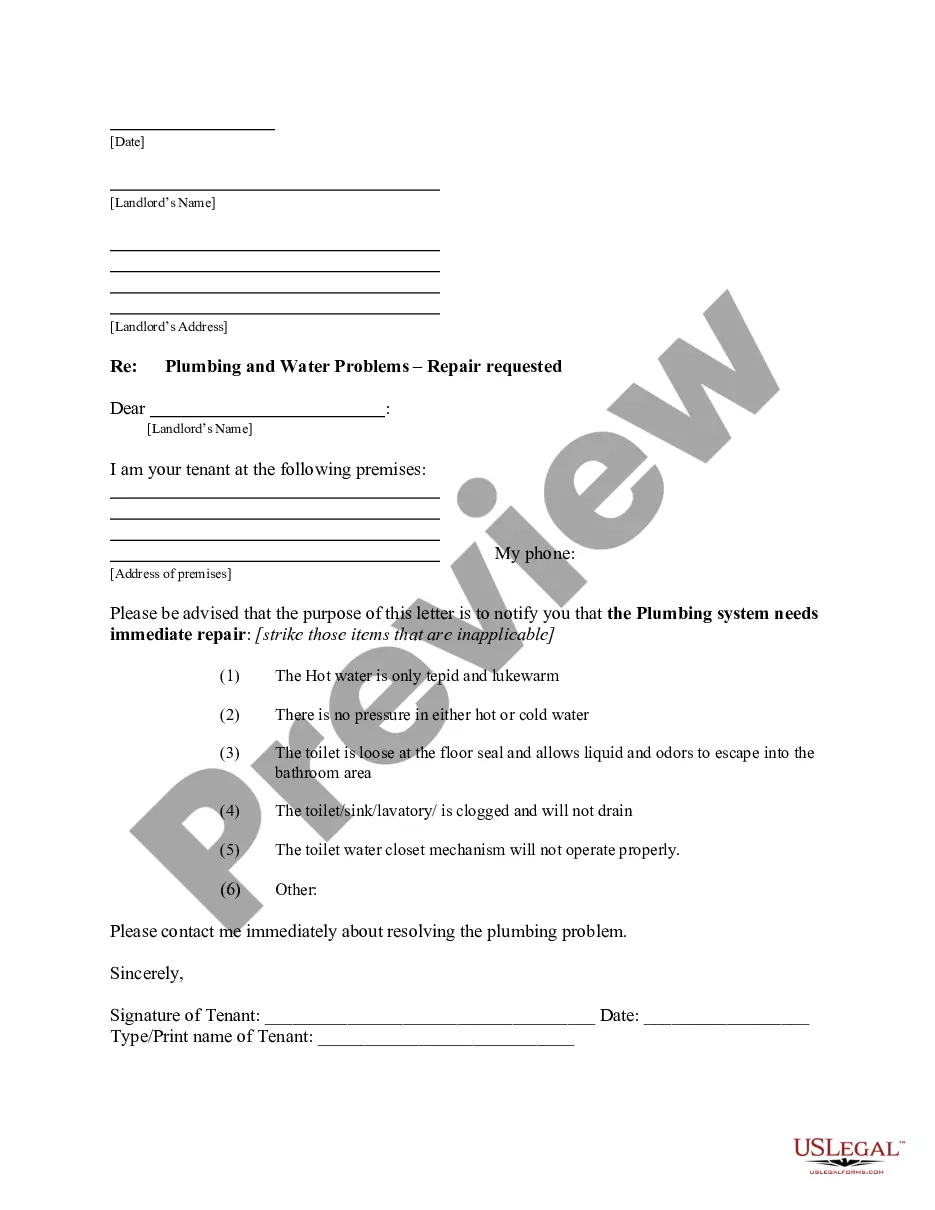

Drafting paperwork for the business or individual demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to create Nassau Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years without expert assistance.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Nassau Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years by yourself, using the US Legal Forms web library. It is the greatest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary form.

In case you still don't have a subscription, follow the step-by-step instruction below to get the Nassau Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years:

- Examine the page you've opened and verify if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that meets your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any situation with just a few clicks!

Form popularity

FAQ

El fideicomiso es sujeto pasivo del impuesto y el fiduciario es responsable por deuda ajena. En el caso de que el fideicomiso sea sujeto del impuesto a la Ganancia Minima Presunta pero no sujeto del Impuesto a las Ganancias, el pago a cuenta se terminara calculando el 35% sobre la ganancia neta gravada.

El o los fideicomisarios acumularan a los demas ingresos obtenidos en el ejercicio, la parte correspondiente al resultado fiscal de dicho ejercicio que se derive por conceptodelaactividadempresarial emprendidasporelfideicomiso,siemprey cuando dichas actividades se encuentren estipuladas en el contrato de fideicomiso,

Para la documentacion a presentar debera tenerse en cuenta el tipo de fideicomiso que se trate: · Fideicomiso no financiero: Presenta fotocopia del contrato de fideicomiso y segun sea el fiduciario persona fisica o juridica, debera acompanarse tambien la documentacion que, para cada tipo de sujeto corresponda.

Es decir que los Fideicomisos son sujetos pasivos de los Impuestos a la Renta y al Patrimonio, Impuesto al Valor Agregado, etc, como cualquier otra sociedad (con excepcion claro esta del Impuesto de Control de las Sociedades Anonimas, de aplicacion exclusiva para dicho tipo societario).

Dichos actos deben generar algun beneficio de caracter economico y estos beneficios deben ser dados a una persona a la que se conoce como fideicomisario. La persona que da los bienes es el fideicomitente y la que los recibe es la institucion fiduciaria.

El fideicomiso es la figura juridica mediante la cual una persona fisica o moral cede bienes o derechos para un fin licito y determinado, en beneficio propio o de un tercero, mediante una institucion fiduciaria.

Los fideicomisos son sujetos en el Impuesto a las Ganancias, segun lo dispuesto por el art. 73 inciso a), apartado 6 de la ley, debiendo tributar el impuesto a la tasa actual del 30%. Es decir que tienen el mismo tratamiento que los demas sujetos mencionados en el art. 73 (SA, SRL, etc.)

El valor patrimonial de los derechos fiduciarios, para los respectivos beneficiarios, es el que les corresponda de acuerdo con su participacion en el patrimonio liquido del fideicomiso al final del ejercicio o en la fecha de la declaracion.

Caracteristicas del fideicomiso Participantes: fiduciante, quien transmite los bienes; fiduciario, el que los recibe; beneficiario, aquel en cuyo favor se constituyo el fideicomiso; fideicomisario, el destinatario final de los bienes dado en fideicomiso una vez concluida la operacion.

Las partes principales que intervienen usualmente en un Fideicomiso son 3: Fideicomitente, Fiduciario y Fideicomisario, como comentamos, eventualmente en algunos Fideicomisos pueden participar partes adicionales como Fideicomitentes A, Fideicomitentes B, Fideicomitentes C, etc., Fideicomisario en Primer Lugar,