Cuyahoga Ohio Termination of Granter Retained Annuity Trust in Favor of Existing Life Insurance Trust A Cuyahoga Ohio Termination of Granter Retained Annuity Trust in Favor of Existing Life Insurance Trust refers to the legal process of terminating a granter retained annuity trust and transferring the assets to an existing life insurance trust in the Cuyahoga County, Ohio area. This specialized estate planning strategy involves the termination of a trust, specifically a granter retained annuity trust, and the subsequent transfer of the trust assets to an already established life insurance trust. In this process, the granter, who initially created the granter retained annuity trust, decides to terminate the trust before its predetermined term. Instead of continuing the annuity payments to the granter, the assets are transferred to an existing life insurance trust. The existing life insurance trust is a separate legal entity that holds and manages the assets for the benefit of named beneficiaries. The key purpose of this termination strategy is often to leverage life insurance coverage to help cover estate taxes or provide liquidity for the estate. By transferring the funds to a life insurance trust, the granter ensures that the proceeds from the life insurance policy will be excluded from the taxable estate. This can help protect the value of the estate for future generations and provide financial security. Different types of Cuyahoga Ohio Termination of Granter Retained Annuity Trust in Favor of Existing Life Insurance Trust may include: 1. Irrevocable Life Insurance Trust (IIT): This type of life insurance trust is a popular choice for individuals seeking to maximize the value of their estate and minimize estate taxes. An IIT is typically established to hold a life insurance policy outside the taxable estate. 2. Family Life Insurance Trust: A family life insurance trust allows families to create a unified plan for life insurance coverage, ensuring financial security for their loved ones. The trust assets are managed for the benefit of the family members, providing a source of financial support in the event of the granter's passing. 3. Charitable Life Insurance Trust: For individuals with philanthropic goals, a charitable life insurance trust can be established. This type of trust allows the granter to make charitable contributions while leveraging life insurance to provide funds for both charitable and family beneficiaries. In summary, a Cuyahoga Ohio Termination of Granter Retained Annuity Trust in Favor of Existing Life Insurance Trust involves terminating a granter retained annuity trust and transferring the assets to an existing life insurance trust. This strategy offers various benefits, including estate tax planning, asset protection, and provision of financial security for beneficiaries. Different types of Cuyahoga Ohio Termination may include Irrevocable Life Insurance Trusts, Family Life Insurance Trusts, and Charitable Life Insurance Trusts.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Terminación del fideicomiso de anualidad retenida por el otorgante a favor del fideicomiso de seguro de vida existente - Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust

Description

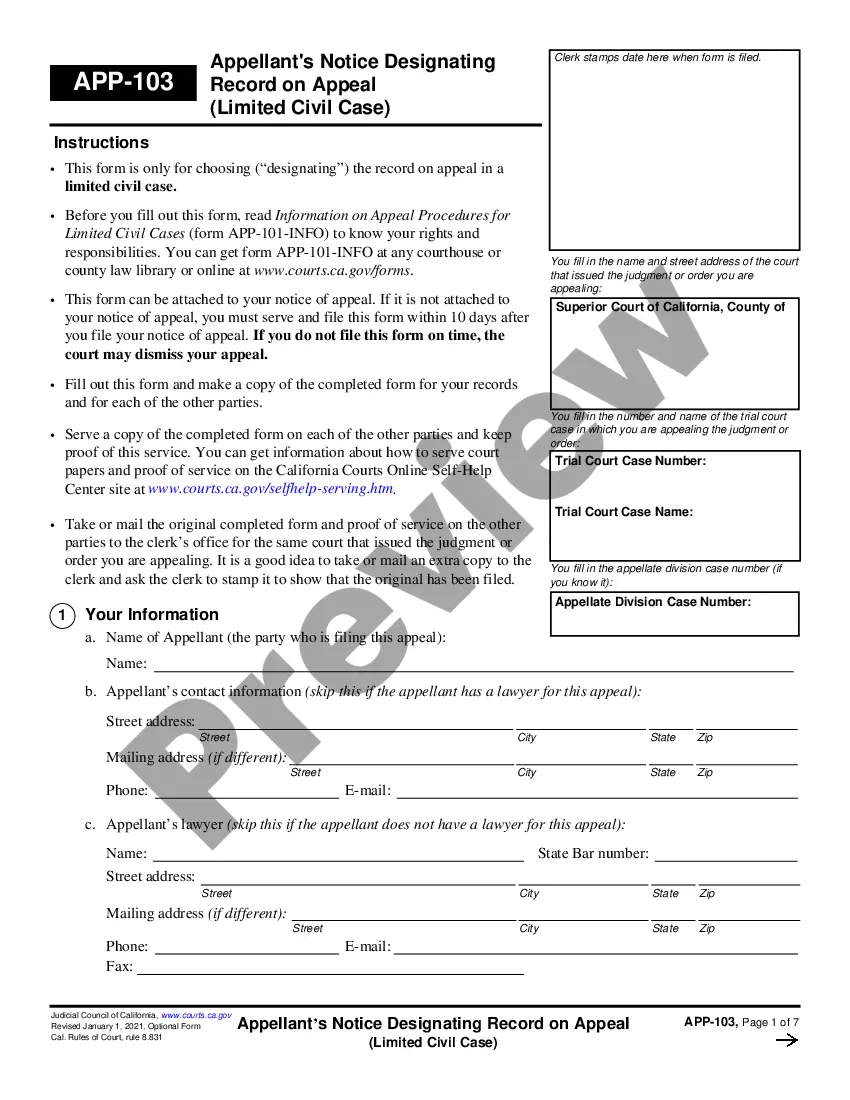

How to fill out Cuyahoga Ohio Terminación Del Fideicomiso De Anualidad Retenida Por El Otorgante A Favor Del Fideicomiso De Seguro De Vida Existente?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for qualified assistance to draft some of them from scratch, including Cuyahoga Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in various types varying from living wills to real estate paperwork to divorce documents. All forms are organized based on their valid state, making the searching experience less frustrating. You can also find detailed resources and guides on the website to make any tasks related to paperwork completion straightforward.

Here's how you can purchase and download Cuyahoga Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust.

- Go over the document's preview and outline (if available) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can affect the legality of some records.

- Check the related forms or start the search over to find the appropriate file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment gateway, and purchase Cuyahoga Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Cuyahoga Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust, log in to your account, and download it. Needless to say, our platform can’t replace a lawyer completely. If you need to deal with an exceptionally complicated case, we recommend getting an attorney to check your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Join them today and get your state-specific documents with ease!