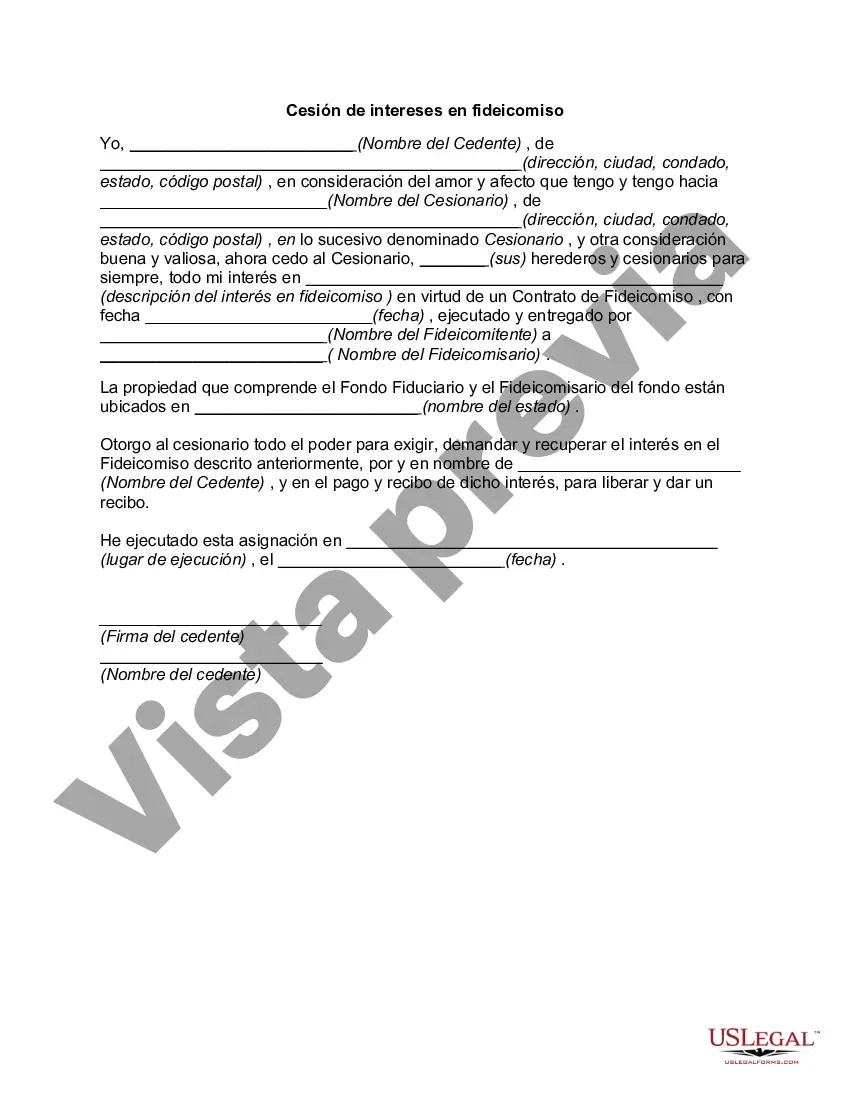

Contra Costa County, located in California, offers an Assignment of Interest in Trust which serves as a legal document allowing individuals or entities to transfer their interest in a trust to another party. This assignment effectively transfers ownership rights and responsibilities, including any associated benefits and obligations, to the assigned party. The Contra Costa California Assignment of Interest in Trust is commonly used in estate planning and fiduciary matters to facilitate the seamless transfer of trust ownership. It enables trust beneficiaries or trustees to assign their interest, whether it be a percentage share or specific assets, to another person or entity. Understanding the various types of Contra Costa California Assignment of Interest in Trust is essential for individuals involved in trust-related legal proceedings. The specific types include: 1. General Assignment of Interest in Trust: This type of assignment transfers the assignor's entire interest in the trust to the assignee. It involves a complete transfer of both legal and beneficial interests. 2. Specific Assignment of Interest in Trust: In this case, the assignor designates specific assets or a specific share of their interest in the trust to be transferred to the assignee. It allows for a more selective transfer of ownership rights and responsibilities. 3. Percentage Assignment of Interest in Trust: This type involves assigning a specific percentage or fraction of the assignor's interest in the trust to the assignee. It is often used when multiple assignees are involved and the assignor wishes to divide their interest accordingly. 4. Temporary Assignment of Interest in Trust: This assignment type allows for a temporary transfer of ownership rights and responsibilities. It may be used in situations where the assignor is unable to fulfill their duties for a period of time, such as during an illness or travel. When drafting a Contra Costa California Assignment of Interest in Trust, it is crucial to include essential information such as the names and addresses of both the assignor and assignee, the specific interest or assets being transferred, and any specific terms or conditions agreed upon between the parties. It is important to consult with a qualified attorney specializing in trust and estate law to ensure the assignment is properly executed and complies with relevant legal requirements in Contra Costa County and the state of California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Contra Costa California Cesión de intereses en fideicomiso - Assignment of Interest in Trust

Description

How to fill out Cesión De Intereses En Fideicomiso?

What is the usual duration for you to create a legal document.

Since each state has its own statutes and regulations covering all aspects of life, finding a Contra Costa Assignment of Interest in Trust that meets all local criteria can be exhausting, and hiring a professional lawyer is frequently costly.

Many online platforms provide the most frequently used state-specific documents for download, but utilizing the US Legal Forms library is the most beneficial.

Complete the payment via PayPal or using your credit card. Change the file format if necessary. Click Download to retrieve the Contra Costa Assignment of Interest in Trust. Print the document or utilize any preferred online editor to fill it out digitally. Regardless of how many times you need to access the purchased template, you can find all the files you have saved in your profile by navigating to the My documents section. Give it a try!

- US Legal Forms is the most extensive online collection of templates, categorized by states and purposes of use.

- In addition to the Contra Costa Assignment of Interest in Trust, you can discover any specific documents needed for your business or personal actions, aligning with your local regulations.

- Experts validate all templates for their relevance, ensuring you can prepare your paperwork accurately.

- Using the service is quite straightforward.

- If you already possess an account on the platform and your subscription is active, you simply need to Log In, select the required form, and download it.

- You can access the file in your profile anytime later.

- Conversely, if you are unfamiliar with the website, there are additional steps to complete before acquiring your Contra Costa Assignment of Interest in Trust.

- Review the information on the current page.

- Go through the description of the sample or preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now when you are confident in the selected file.

- Select the subscription plan that fits you best.

- Register for an account on the platform or Log In to move forward with payment options.

Form popularity

FAQ

PARA LIQUIDACION DEL FIDEICOMISO Llenar planilla de solicitud de liquidacion del Fideicomiso del respectivo banco. Copia ampliada y legible de la cedula de identidad. Copia de RIF. Copia de la resolucion del CU de la jubilacion, renuncia, recision de contrato. Estado de cuenta del Fideicomiso, emitido por el respetivo banco.

Tal como se menciono, el fideicomiso no es una persona fisica ni moral, es asi que, quienes tienen que contribuir, mediante el pago de los impuestos correspondientes, son las personas fisicas y, en su caso, las morales y no el fideicomiso.

Los efectos del contrato de fideicomiso podran ser inmediatos o diferidos a la muerte del fiduciante, y los beneficiarios del mismo podran ser el propio fiduciante y sus herederos legitimarios, simultaneamente o en forma sucesiva a partir de la muerte del primero; pero la validez del mismo despues de la muerte del

Los fideicomisos son sujetos en el Impuesto a las Ganancias, segun lo dispuesto por el art. 73 inciso a), apartado 6 de la ley, debiendo tributar el impuesto a la tasa actual del 30%. Es decir que tienen el mismo tratamiento que los demas sujetos mencionados en el art. 73 (SA, SRL, etc.)

Para establecer un fideicomiso, cualquiera de los bancos en Mexico cobrara una cuota anual por mantener el fideicomiso, un promedio de $450 a $550 USD por ano.

Un fideicomiso es una forma de titularidad de propiedad que separa la titularidad efectiva de la titularidad legal. Designa a un fideicomisario como propietario legal de los activos, al tiempo que designa a uno o varios beneficiarios que gozaran de los beneficios de los bienes depositados en el fideicomiso.

Para que el fideicomiso exista, siempre, debe haber un beneficiario que sera el que reciba el bien, una vez se haya cumplido la condicion. «El fideicomiso supone siempre la condicion expresa o tacita de existir el fideicomisario o su sustituto, a la epoca de la restitucion».

Solo pueden ser fideicomitentes las personas con capacidad para transmitir la propiedad o la titularidad de los bienes o derechos objeto del fideicomiso, segun sea el caso, asi como las autoridades judiciales o administrativas competentes para ello.

Un fideicomiso es basicamente un contrato en el que una persona transmite bienes o derechos a un tercero para que este administre o invierta dichos bienes en beneficio de el mismo o de otros.

Tecnicamente, el contrato de fideicomiso se da entre dos partes (llamadas partes stricto sensu): 'fideicomitente/fiduciante' - 'fideicomitido/fiduciario'; aunque la relacion fiduciaria se da entre cuatro sujetos: los antes mencionados mas el beneficiario (que puede o no existir) y el fideicomisario.