Lima, Arizona is a vibrant town located in Graham County, renowned for its captivating landscapes, rich history, and close-knit community. Within the realm of real estate and property transactions, the Lima Arizona Assignment of Interest in Trust holds particular significance. This legal document allows individuals to transfer their beneficial interest in a trust to another party, in order to streamline the management and administration of the trust assets. The Assignment of Interest in Trust offers a flexible mechanism for trust beneficiaries to assign their interest to a trustee or another individual, ensuring the trust's assets are effectively managed and distributed according to the benefactor's wishes. By transferring their beneficial interest, individuals can effectively delegate responsibilities associated with trust management, allowing the assigned party to make crucial decisions regarding investments, property maintenance, and distributions. The Lima Arizona Assignment of Interest in Trust encompasses several distinct types, addressing different scenarios and objectives. One such variation is the Assignment of Beneficiary Interest in a Living Trust. This type of assignment involves transferring the beneficiary's rights to the living trust, often enabling the trustee to carry out decisions on behalf of the beneficiary. With this arrangement, the trustee gains greater control over managing the trust's assets and handling matters related to income, expenses, and distributions. Another notable type is the Assignment of Beneficiary Interest in an Irrevocable Trust. This assignment allows beneficiaries to transfer their interest in an irrevocable trust, relinquishing their rights and control over the assets. Irrevocable trusts are often established for long-term asset protection, tax benefits, or Medicaid eligibility purposes. By assigning their interests in such trusts, beneficiaries can ensure the appointed trustee follows the trust's guidelines and effectively manages the assets for the intended beneficiaries' benefit. Additionally, the Assignment of Beneficiary Interest in a Testamentary Trust is another vital variation. Testamentary trusts are established through a will and come into effect after the testator's passing. With this assignment, beneficiaries can transfer their interest in the testamentary trust to a designated trustee, simplifying the trust administration process and empowering the trustee to handle asset management and distributions in accordance with the deceased's wishes. In conclusion, the Lima Arizona Assignment of Interest in Trust plays a crucial role in facilitating effective trust administration and asset management. Through various types such as the Assignment of Beneficiary Interest in a Living Trust, Assignment of Beneficiary Interest in an Irrevocable Trust, and Assignment of Beneficiary Interest in a Testamentary Trust, individuals can transfer their beneficial interests to trustees or other parties, streamlining the management, and ensuring the trust's assets are distributed as intended.

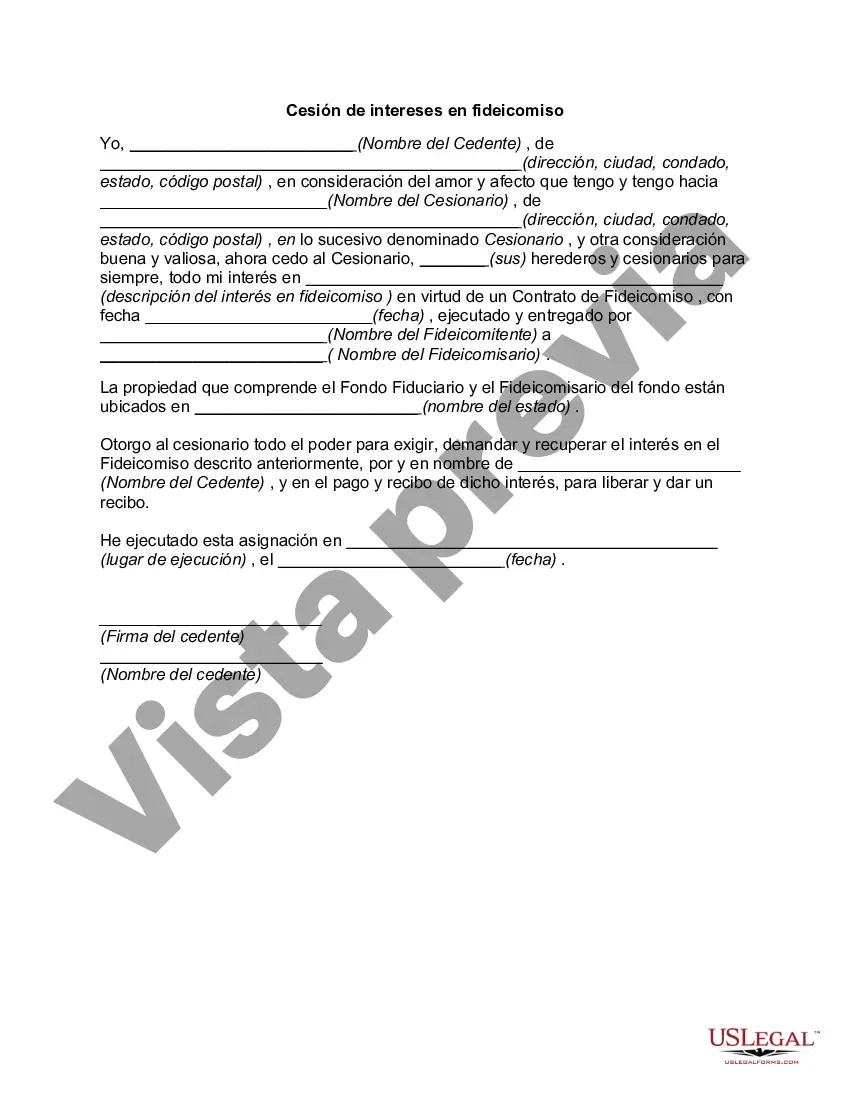

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pima Arizona Cesión de intereses en fideicomiso - Assignment of Interest in Trust

Description

How to fill out Pima Arizona Cesión De Intereses En Fideicomiso?

Drafting papers for the business or personal demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to draft Pima Assignment of Interest in Trust without professional help.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Pima Assignment of Interest in Trust on your own, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary form.

If you still don't have a subscription, follow the step-by-step guideline below to obtain the Pima Assignment of Interest in Trust:

- Look through the page you've opened and verify if it has the sample you require.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that fits your needs, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any use case with just a few clicks!